The AR/VR Display Forum, the virtual conference by DSCC on November 3rd and 4th focused on emerging display trends that are shaping the market. There is a surge of interest in AR (Augmented Reality)/VR (Virtual Realty) market due to the recent focus on the Metaverse by industry leaders such as Meta (the new name for Facebook), Microsoft and others.

Metaverse incorporates AR/VR, holographic avatar, video and other means of communications. Some see AR/VR as the next generation communication platform. To make it a reality, there is a need for many technological developments and multiple challenges need to be resolved. Emerging display technologies are an integral part of AR/VR market development.

Battle of Display Technologies for the AR/VR market

According to Guillaume Chansin, Director of Display Research at DSCC, Meta (Facebook) is betting on AR/VR with a $10 billion investment in 2021. Its Oculus Quest 2 is the fastest selling headset, and the company is planning a ‘project Cambria’ (high-end VR headset, with pancake optics in 2022) and ‘project Nazare’ (thin and light see-through AR glasses). Apple is expected to launch a high-end VR headset in 2022 (with dual smicroOLED CMOS Si+ one other OLED displays and Sony will be bringing in its second Gen VR headset for PlayStation 5. Companies such as Magic Leap, Snap, ByteDance (Tiktok), Nreal and others are all investing in AR/VR this year.

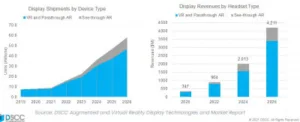

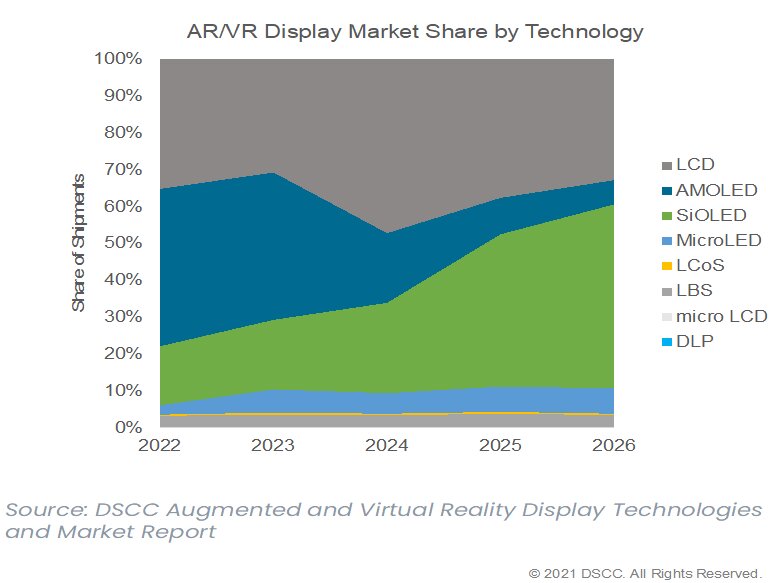

Technology developments, product introductions and higher investment will drive AR/VR growth in the next few years. DSCC’s forecast shows that revenue for AR/VR displays will grow at a CAGR of 51.6%, from $0.3 billion in 2020 to $4.2 billion in 2026. VR (including pass-through AR) will be a much bigger market segment for display suppliers, generating 4.2x more revenue than see-through AR by 2026.

According to the presentation, the display requirements are different for VR (and pass-through AR) and see-through AR.

For VR (and pass-through AR) most displays are based on TFT LCD and AMOLED. VR needs high pixel density to reduce or eliminate the screen door effect, as optical lenses magnify the image. Also it requires high refresh rates and a short duty cycle to reduce motion sickness. There is a need for smaller lighter headsets.

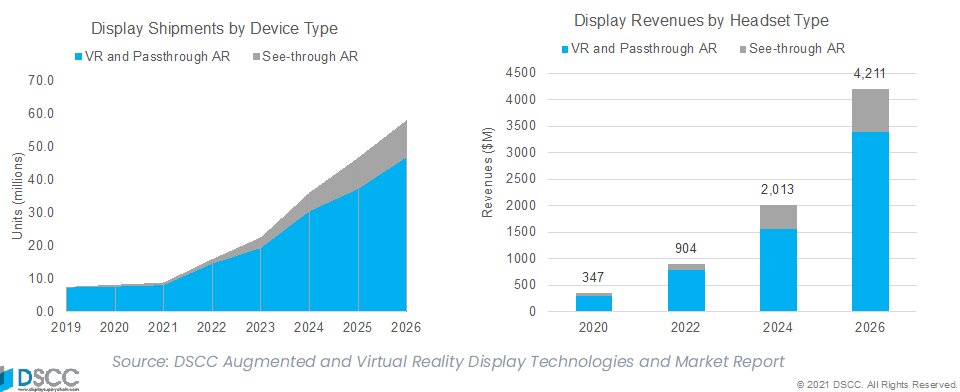

For see-through AR, all headsets are currently based on microdisplays (DLP, Micro-LCD, LCoS, Micro OLED) or laser beam scanner (LBS). They need very high brightness displays to match the ambient light; display needs to be small and power efficient to make headsets thinner and light-weight. DSCC forecasts that OLED on Silicon will capture the largest share of shipments from 2025 for AR/VR display market with LCD in second place. AMOLED will lose share due to limitations of pixel density. MicroLED with higher potential brightness will have an advantage for see-through AR but will be less important for VR.

LCD: Strong presence through high pixel density, global blinking and MiniLED

According to a JDI presentation, LCD is leading the VR market with technology advancements such as high PPI.

The company announced its latest high PPI LCD for VR at the forum. It’s a 2.88-inch 1201PPI LTPS TFT-LCD (120Hz refresh rates, global blinking backlight). JDI used advanced LTPS (LTPS+Oxide backplane) to produce the display and it contributed to a higher aperture ratio (30% higher than before) which is essential for VR. The use of local dimming technology achieved higher contrast and lower power consumption.

An impulse display is also realized by applying a global blinking backlight and by shortening the display “on” time and minimizing “ghosting” to provide a clearer image. The company uses SLC-IPS technology for fast response LC (3msec B/W). By combining the backlight blinking (impulse display) and fast response LC, it can achieve ‘no blur’ and ‘no ghost image’. According to the presentation by JDI, LCD is the best technology for 2-3-inch size displays for VR-HMD as it provides a wide field of view (HFV), which is a critical factor for an immersive VR-HMD. For future VR LCDs, JDI is planning a 4Kx4K 2.x-inch display with 1700-2000PPI, 1000 cd/m², contrast ratio of >100,000, color gamut of >DCI-P3 95% with local dimming. JDI has also developed a prototype HMD using a laser backlit LCD of 2.89-inch diagonal, with 1058 PPI. The lasers proved for a wider color gamut of BT 2020 (97%).

Companies are also starting to use miniLEDs backlight for LCD for higher contrast and lower power consumption. A DSCC presentation showed two products – the Varjo Aero($1900) with two miniLED LCDs (Varjo Gets Aero) and the Pimax Reality (12K QLED) ($2399) with two miniLED LCD panels (200Hz refresh rates and QD layer for high color gamut, 6K per eye resolution with 1200PPI) (Pimax’s New Headset Boasts ’12K’ & MiniLED – WBS subscription required).

Lynx announced a $500 headset with full color pass-through AR which is versatile and covers mixed reality. In its presentation, Stan Larroque, CEO of Lynx said their product is using JDI’s LCD display due to low BOM costs and high refresh rates. They are considering other displays for future products also.

Micro OLED: Poised for dominance with very high resolution & high luminance

OLED micro-displays (microOLED) are viewed through an optical system and generally have higher pixel densities than AMOLEDs. OLED on silicon is the most common technology used to implement microOLED. It can be used both for VR and see-through AR.

MicroOLED displays can be generally categorized into RGB OLED and White OLED (WOLED) classes. However high resolution RGB OLED microdisplays still face challenges due to a shadow effect during the deposition process using a FMM (Fine Metal Mask). White OLED uses a color filter to generate the image and can achieve high PPI (4000PPI). However the color filter absorbs a very high percentage of the emitted light that limits maximum brightness for microOLED.

Sony has been using a microLens to increases peak brightness of its OLED micro-display. Kopin has developed a trio stack architecture to increase brightness. According to the presentation of Andrew Sculley, CEO of eMagin, there are four major challenges for the AR/VR market: Displays, Optics, Content and Price.

- Display: high resolution, high brightness, high contrast, low power, no screen door effect, high fill factor

- Optics: large FOV (Field of View), no distortion, high efficiency, light weight, small form factor

- Content: games, movies, live events, etc and graphics processing speed

- Price: has to be right

The human eye’s resolution capability is 60 Pixels/degree (PPD). eMagin’s OLED microdisplay demo has 40PPD compared to the Oculus Quest 2’s PPD of 20. For microOLED, its higher PPD, high luminance (to eliminate motion artifacts), high resolution (to eliminates screen door effects), high fill factor, higher efficiency and longer life time capabilities result in increased demand for the VR applicatrion.

See-through AR also requires very high brightness, very high resolutions and very high contrast. These requirements make OLED microdisplays more applicable for both AR and VR. eMagin has achieved 10,000 nits brightness in a 1920 X 1200 4K OLED microdisplay, made by direct patterning (eliminating the color filter) of red, green, and blue (RGB) sub-pixel emitters on the backplane. The red and green emitters were made from phosphorescent materials and the blue from fluorescent material. This has enabled a significant improvement in efficiency and lifetime. eMagin has a roadmap to develop 30,000 nits full color peak luminance.

Chinese Developments

A DSCC presentation by Chase Li about microOLED capacity development in China showed that nine companies have plans for constructions including BOE, Lakeside, SeeYa, Sidtek, Jicui. Most of them will adopt a white OLED+ colour filter approach. By 2025, 81% of the capacity will be from OLED microdisplays made in 12-inch (300mm) fabs. BOE is expected to ramp up production in next two to three years. According to DSCC’s Chansin, BOE’s 0.71inch displays are in a Qualcomm reference design for Smart Viewer glasses. SeeYa’s 1.03-inch display is being used in the Arpara VR headset in 2021. LG display from Korea has demonstrated a 0.42″ micro OLED display (3500PPI) at SID Display Week 2021.

MicroLED: Emerging presence with ultra high brightness, high reliability and small form factor

MicroLED’s very high brightness, high reliability (inorganic LED display) and ability to create ultra compact form factors will have major advantages for the see-through AR market. As presented by DSCC, many companies including Vuzix, Snap, Xiomi, TCL and Meta are introducing microLED display based AR/VR headsets. Vuzix’s next gen smart glass uses Jade Bird Display’s (JBD) microLED. Waveoptics (Snap) announced a developmental kit and projector using a JBD display and Kopin has announced collaboration with JBD to develop monochrome microLED displays. Xiaomi and TCL both introduced microLED-based smartglass prototypes in 2021.

Applied Material’s presentation by Nag Patibandla showed that they have demonstrated microLED direct view display using single wavelength UV-A microLED and CD free Quantum Dot technology in an innovative pixel architecture (reducing and simplifying mass transfer and repair). They have achieved higher efficiency, higher resolution (high EQE uvMicroLED + Quantum Dot technology) (inkjet printing + self aligned curing) and higher yield (one time mass transfer). The company has demoed two displays: one with microLED, 433PPI, 1000nits, the second one with microLED, 318PPI, 10,000 nits. The company’s near-eye AR displays road map show of 1588 PPI and 3396PPI with uvMicroLED. (Applied Materials Overcomes Some Challenges in MicroLED for VR)

A presentation from JBD’s Leon Baruah showed that JBD is focusing on commercialization of microLED-based microdisplays. It is boosting its current pilot fab capacity in Shanghai and will start its Hefei fab in 2022 (operation will start in Q1 2023). JBD microLED microdisplays have achieved high brightness (up to 4.5million nits), power efficiency (6mW for 10K nits), small form factor (pixel pitch from 2.5micron to 5micron) and more than 100,000:1 contrast, deep black and 125Hz refresh rate. The company has introduced a very small (0.35cc in volume) monochrome microLED projector and a polychrome projector (1.35cc in volume).

A Mojo Vision presentation from Naamah Argaman showed that they have created a smart contact lens with built-in microLED (nanoLED) display (with1.8 micron pixel pitch, monochrome green, 14,000 PPI) that gives information to users without interrupting their focus. They are building prototypes. They are also working on Quantum Dot color conversion from blue to get brighter pixels. MicroLED displays have great potential in AR/VR due to their high brightness and high contrast. (Mojo Vision Developing NanoLEDs)

Companies such as CEA-Leti, MICLEDI, and Coherent LaserSystems participated and presented in the AR/VR forum’s microLED manufacturing session.

Technology developments, product introductions and higher investments will drive AR/VR growth in the next few years. Display technology developments will be an the integral part of AR/VR market growth. (SD)

Sweta Dash, President, Dash-Insights

Sweta Dash is the founding president of Dash-Insights, a market research and consulting company specializing in the display industry. For more information, contact [email protected] or visit www.dash-insights.com