DSCC has released a new report on OLED equipment and both the supply and demand sides of the market. The firm said that the input capacity for OLED supply is expected to rise at a 52% CAGR from 7.5M m² in 2016 to 40.4M m² in 2021, with mobile displays expected to account for 71% of the input capacity over that period.

Smartphones

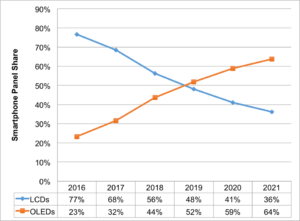

DSCC expects Apple to take as much as 20% to 35% of the industry capacity from 2017 for use in the iPhone and flexible OLEDs will see a big increase, overtaking rigid OLEDs for mobile applications by the end of 2017 on an input basis, and Q1 2018 on an output basis.

Rigid vs. Flexible Mobile OLED Output Capacity (Area Basis)

Rigid vs. Flexible Mobile OLED Output Capacity (Area Basis)

Source: DSCC Quarterly OLED Supply/Demand and Capital Spending Report.

Click for higher resolution

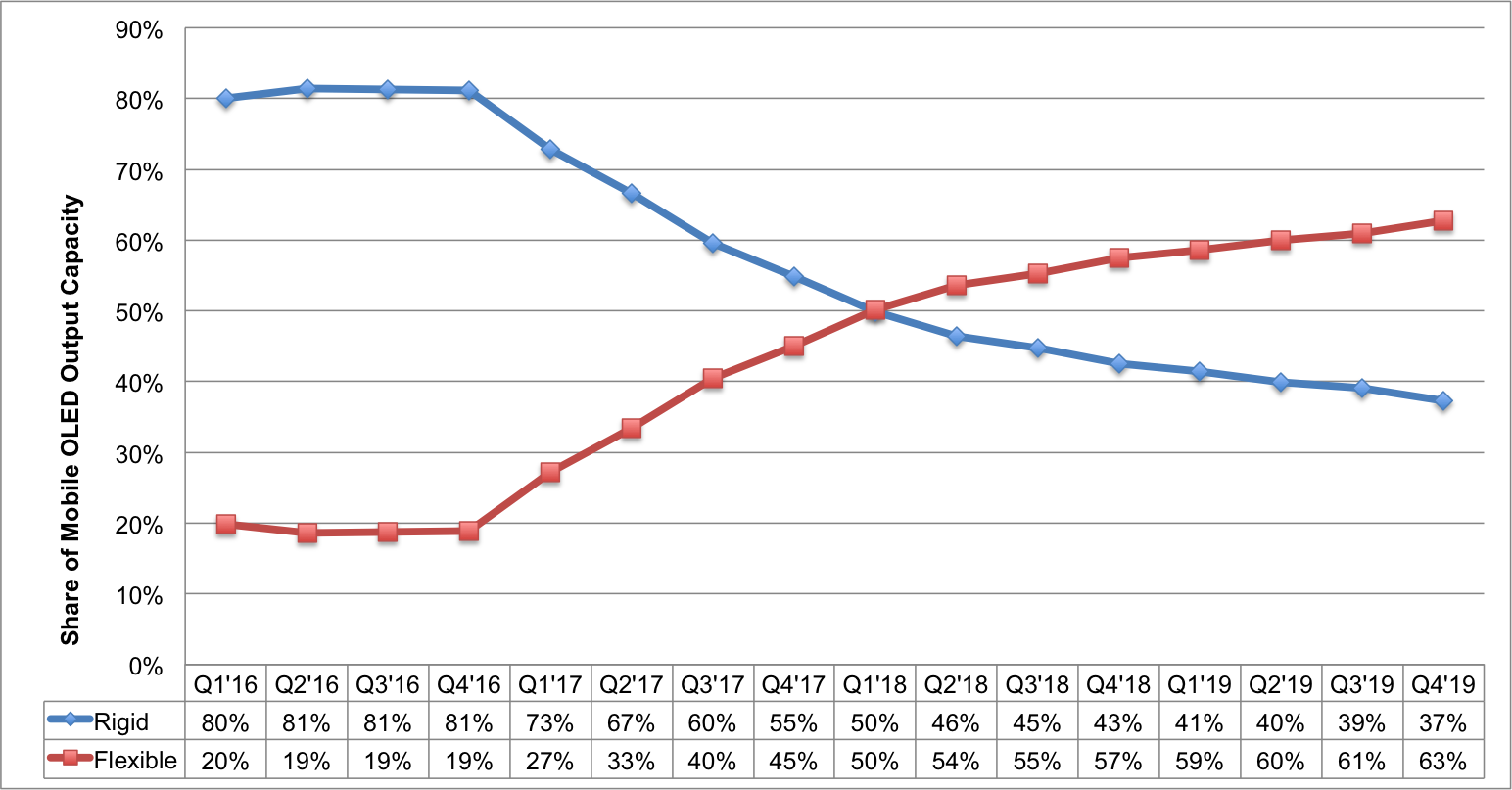

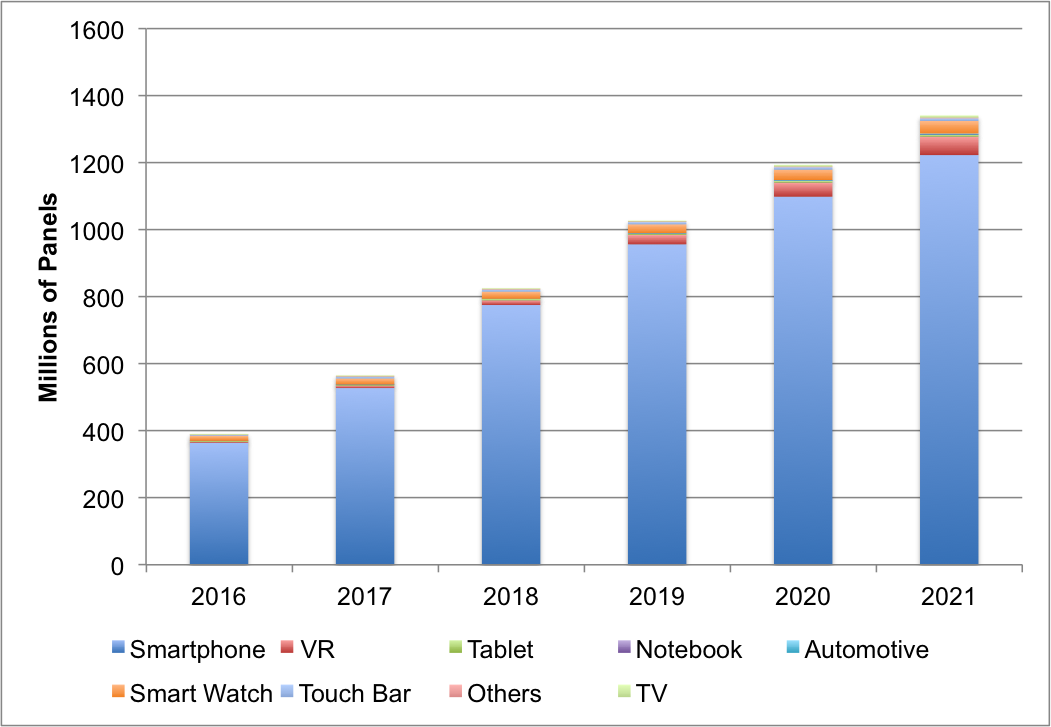

Mobile applications will dominate with 99% of the market which will rise from 389 million in 2016 to 1.34 billion by 2021. VR and smartwatches will be the #2 and #3 applications by volume. OLED will overtake LCD in 2019 in smartphones. As part of this trend, the analysts expect LCD smartphones to fall at an 11% CAGR from 1.2B units in 2016 to under 750M in 2021.

LCD vs. OLED Smartphone Panel Share

Source: DSCC Quarterly OLED Supply/Demand and Capital Spending Report.

Click for higher resolution

OLED TV

OLED TV will see demand rising to nearly 7 million units in 2021 (CAGR of 66%), with production reaching the equivalent of 8.4 million 55″ panels in 2021 on an output basis (52% CAGR).

Regional Trends

Korea is expected to account for the highest share of capacity through the forecast, but its share will falli from 92% in 2016 to 63% in 2021. China’s OLED capacity is expected to rise at a 135% CAGR with its share rising from 6% in 2016 to 32% in 2021.

OLED Panel Demand (Millions)

OLED Panel Demand (Millions)

Source: DSCC Quarterly OLED Supply/Demand and Capital Spending Report.

Click for higher resolution

Overall, the firm sees the OLED supply situation remaining tight through 2019 as both Apple and Samsung are likely to move completely to OLEDs for their smartphones. Even in 2020, the surplus is still likely to be only 6% to 12%

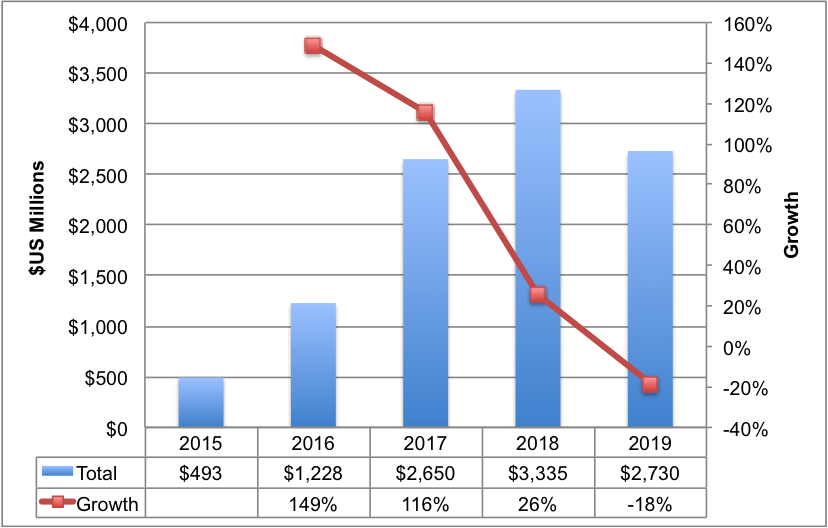

As well as the overall market data, DSCC said it has done a lot of work to analyse the OLED deposition market, which allows a good understanding of overall capacities and capabilities. The next step is to add detail for the encapsulation market. On a revenue basis, the OLED deposition market is expected to rise 140% in 2016 to $1.2B and more than double in 2017 to $2.65B, peak in 2018 at $3.3B before falling 18% in 2019 to $2.7B. Q2’18 is projected to be the first $1B quarter for OLED deposition. Half-sized 6G systems are expected to be the dominant OLED motherglass size, rising from 0% of 2015 shipments to 89% of 2019 shipments.

Tokki is expected to head the OLED deposition market each year on a unit basis with its share increasing from 40% in 2015 to 57% in 2016 and 65% in 2017. With SDC ramping, Tokki is also expected to lead each quarter from Q3’16 – Q4’17. Tokki’s share is lower on a revenue basis due to panel manufacturers’ choosing different source suppliers.

Annual OLED Deposition Revenues and Growth

Annual OLED Deposition Revenues and Growth

Source: DSCC Quarterly OLED Supply/Demand and Capital Spending Report.

Click for higher resolution

According to DSCC CEO and Founder Ross Young, “We heard from a number of equipment and materials suppliers that the display industry needed a more accurate way of tracking the OLED equipment market. Rather than estimate OLED spending based on TFT backplane investments, we have taken a bottoms up approach to tracking OLED equipment spending. With the first issue, we quantified the size of the OLED deposition market (IJP and VTE) by determining the number of systems installed at each fab phase while also identifying the supplier of both the system and the evaporation source as in many cases they are different. This allowed us to determine quarterly VTE system, VTE source and the total OLED deposition market share on a unit and revenue basis. Our next step is to track the encapsulation equipment market by type by fab.”

Analyst Comment

These numbers back up the comments I made in my editorial last week. (The Year of OLED, Perhaps…) BR