The LCD TV panel industry has a long history of making incremental improvements in performance and lowering costs. Over the last 5-years, the attention has been in two areas:

- Backlight Technology – shifting from CCFL to LEDs to LEDs with Full Array Local Dimming (FALD) and now to miniLEDs (where some also include QDs, which is increasing panel costs)

- Larger Fab Substrates – Increasing from Gen 8.5 to Gen 10.5/11, which had a major contribution to lower costs on larger panels

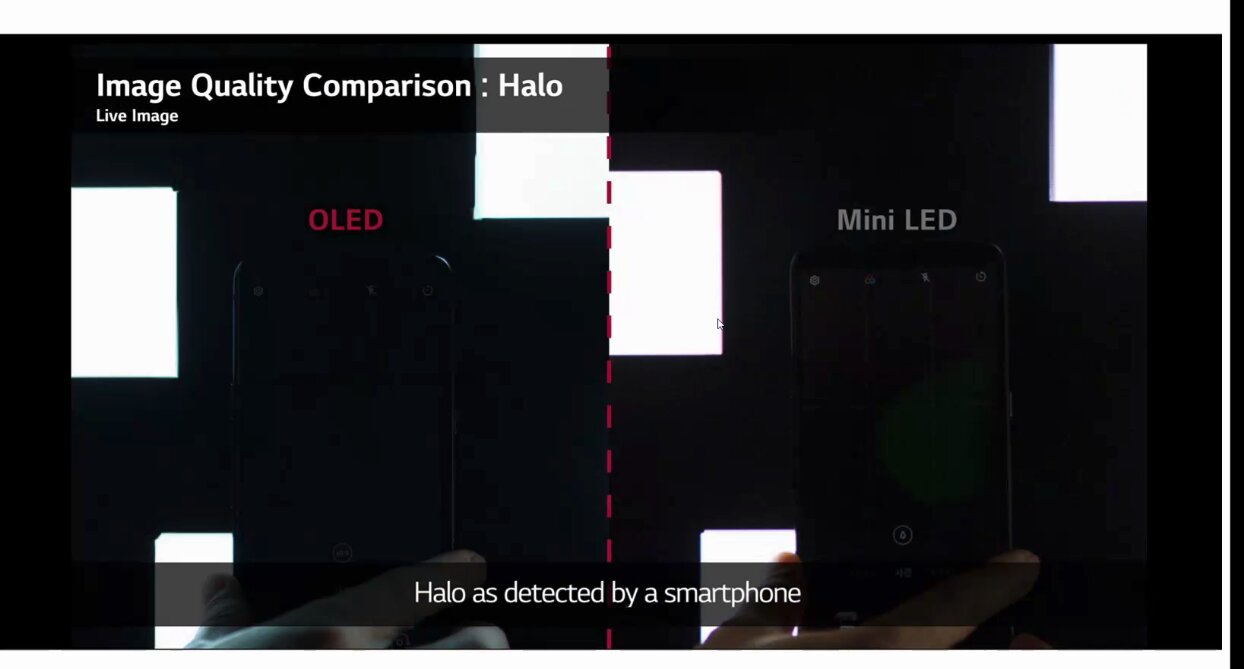

MiniLED technology closes the contrast gap with OLEDs, not 100% but substantially, depending on the image. A pure white or black is close, but there are variances in miniLED contrast ratio between the two extremes. This improvement is not attributable across the board as miniLEDs still suffer from halo effect, lower color performance, high response time, flicker and higher blue levels. MiniLEDs also introduce higher costs in the range of $100 to $250 in the Bill of Materials (BOM), depending on the number of LEDs per backlight. The revenue from the new backlight does not necessarily accrue to the panel maker, if the set maker buys the backlight separately.

After TV set makers launched miniLED TVs, TCL’s Arron Drew blogged to say how unsurprised he was that other brands were turning to the miniLED technology given that TCL introduced the technology for TVs in 2019. He went on to describe OLED as technology “that hasn’t notably changed since it was first used in TVs in the early 2010s, and still only accounts for less than three per cent of global TV sales.” Dew’s OLED-dissing comments were self-serving given that OLED TVs:

- Are much brighter than they were and getting better with the recent LG announcement of another 20% light efficiency and an additional improvemnet on the way by adopting a non-device solution.

- Delivered some sensational ultra-thin designs

- Enabled a new rollable form factor

- Are highly sought after by gamers thanks to their ahead-of-the-curve next-gen gaming support

- Are being developed by TCL, which is trying to catch up but are still 3-5-years behind LG Display (LGD)

TCL hopes that miniLED technology will be a clear and present challenge to OLED’s self-emissive attraction. But the miniLED TCL models released don’t compare with OLED’s pixel-level light control and the brightness at full APL is the same or even less. MiniLEDs, being at an early stage of development, do not even offer an advantage in terms of cost.

- A 55″ OLED, the LG OLED55BX, currently only costs around £1,100/$1,400.

- The new A1 OLED series LG announced at CES, are designed to be ‘stripped back’ models versus LG’s usual OLED series – but stripped back doesn’t automatically mean bad. The main areas of compromise for the A1s are a shift to a 60Hz panel rather than the usual 120Hz panel, and the swapping of multiple HDMI 2.1 connections for cheaper HDMI 2.0 ports. The A1 series will be focused on movie and TV fans at the expense of the next-gen gaming fans catered for by LG’s other 2021 OLED models.

- The cheapest BX series in 2020 hitting such low prices, you’ve got to think that the A1 series could see OLED dropping comfortably and consistently below £1,000/$1200 for the first time. At that point, it will be price competitive with mid-price LCD’s .

Manufacturing costs for miniLED BLUs for 65″ TVs with a local dimming zone of 10,000 or less are in the $250-$1,100 range, and TV prices range from $1500 to $6000, depending on size and local dimming division levels.

Zones Count

According to UBI, high end LCDs use FALD (full array local dimming) BLU, with 300 to 500 dimming zones. However, the number of local dimming zones are being increased to 1,000 to 2,500 using miniLED, to increase the contrast ratio and reduce the halo effect. UBI says to close the gap with OLEDs, 10,000 dimming zones and an active matrix are required to drive the backlight, putting the manufacturing cost of the panel (including modules) similar to OLEDs. But miniLEDs will introduce a number of weaknesses including:

- Color Distortion

- Flicker

- Slow Response time

- Blue Light Emission

- Reduced Viewing Angles

- Halo Effect

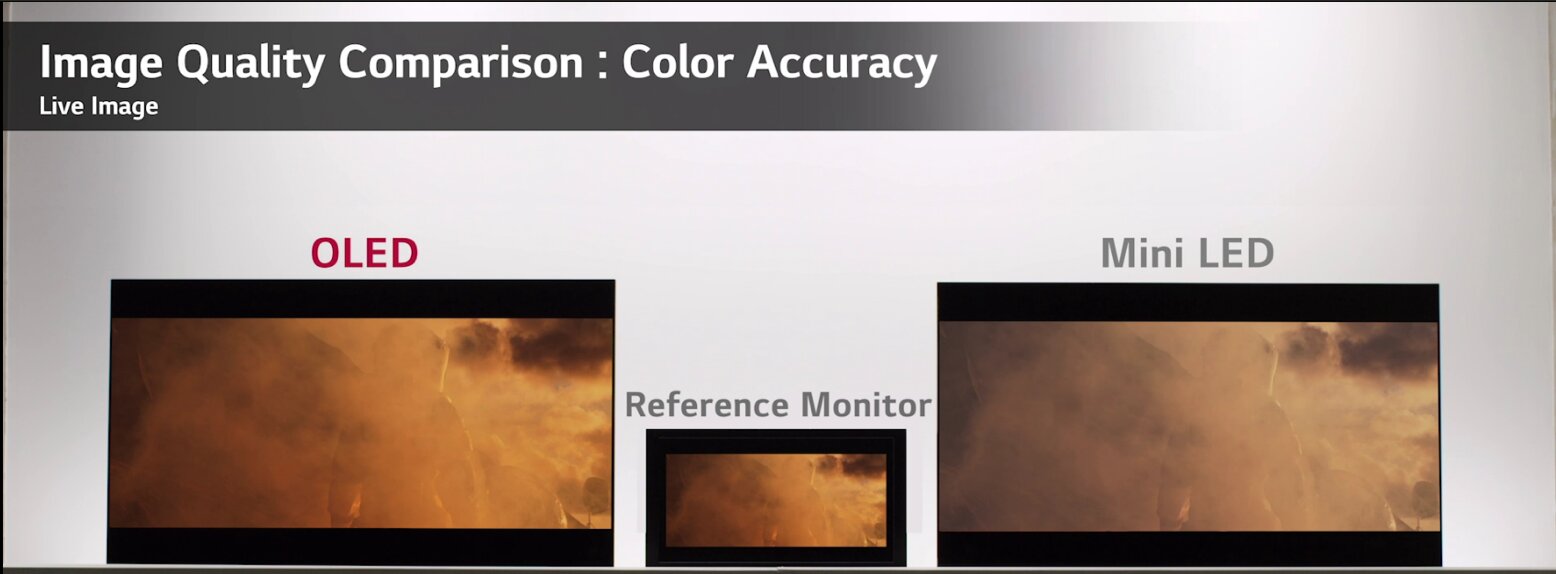

LGD has shown that miniLED lowers the slower LCD response time central for moving pictures, and critical for gaming. The local dimming algorithms also reduce the accuracy of the color presentation. In the following figure, an image appearing on a standard reference monitor is compared with an OLED and a MiniLED. The OLED display reproduces the image accurately depicting the colors , while the miniLEDs cause the image to be significantly lighter. The difference is caused by the local dimming algorithms.

Consider that a 65” TV has an area of 1805 sq.in. (11600 cm²) and the best MiniLEDs have 2500 dimming zones. The area of each dimming zone is 0.72 sq. in. (4.65 cm²) such that with UltraHD resolution, each dimming zone controls 3300 pixels covering a range of colors, which are then averaged to reduce the leakage caused by the LC that can’t filter out all the light. As a result, the actual colors produced by the MiniLED are different from the colors created by the camera as the figure shows.

OLED vs. MiniLED Color Accuracy Comparison – Source:OLED-A – Click for higher resolution

OLED vs. MiniLED Color Accuracy Comparison – Source:OLED-A – Click for higher resolution

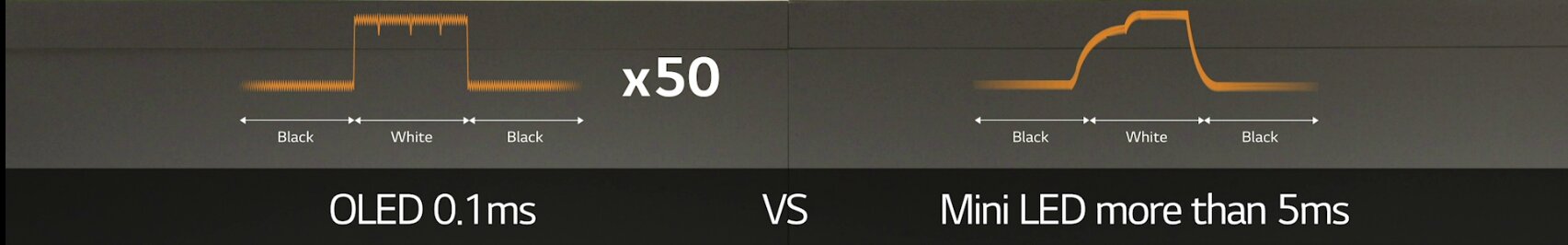

Gaming now represents at least 10% of OLED shipments and the difference between the response time OLED and LCDs is shown below.

OLED vs. MiniLED Response Time Comparison. Source: OLED-A. Click for higher resolution

OLED vs. MiniLED Response Time Comparison. Source: OLED-A. Click for higher resolution

While the static images don’t reveal the effect of the 50X response time difference, consider the following:

- The underlying attraction of most games is to shoot a fast moving target, but with slower response times, if the response time is too slow, the target many not really be where the gamer is aiming

- In watching fast moving sports such as hockey or soccer (football everywhere except the US), the puck or ball will become misshapen or even disappear for short periods of time. The phenomena were clear to LCD TV watchers at the last World Cup, when the football was almost unrecognizable during certain goal kicks and the miniLED LCDs are even slower than the traditional LCDs.

Local dimming also adds to the halo effect that affects some LCD images as shown below.

OLED vs. MiniLED Response Time Comparison Image:OLED-A Click for higher resolution

OLED vs. MiniLED Response Time Comparison Image:OLED-A Click for higher resolution

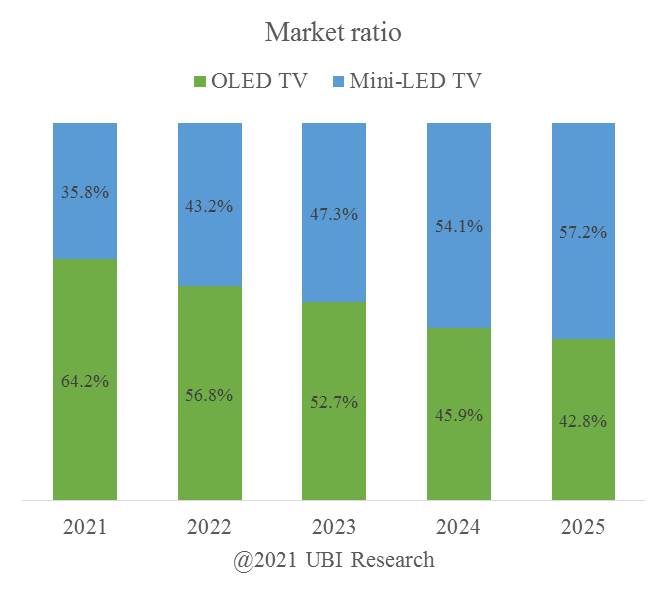

UBI projected that miniLED TVs are expected to dominate the market share with OLED TVs from 2023. Comparing only miniLEDs and OLED TVs, UBI projects miniLEDs to grow from a 35.8% share in 2021 to a 57.2% share by 2025.

OLED TV vs. Mini-LED TV Market Share by UBI Source:UBI Research

OLED TV vs. Mini-LED TV Market Share by UBI Source:UBI Research

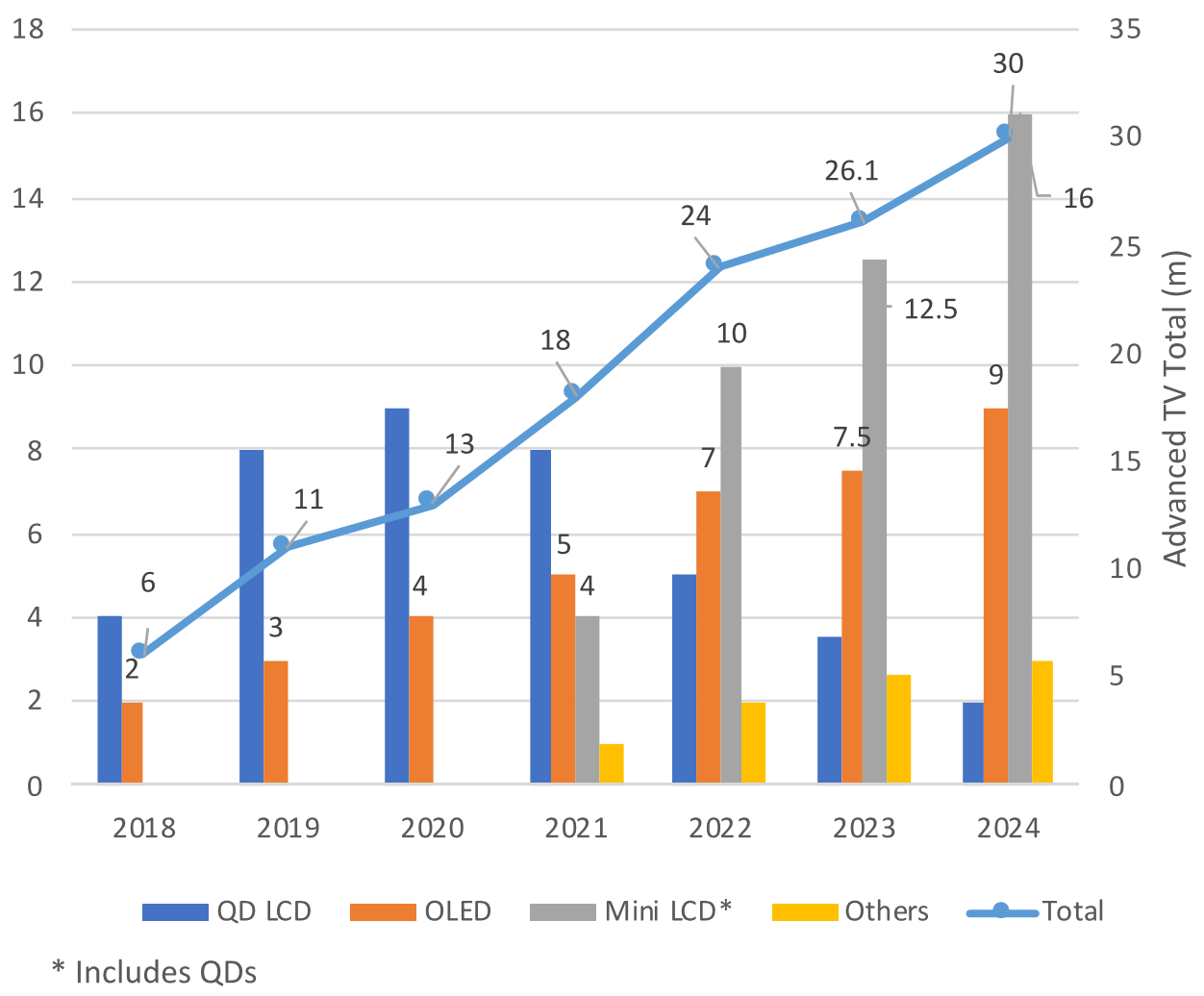

The chart unfortunately is incomplete because it does not reflect all of the Advanced TV shipments, which represent ~$1000 and up. DSCC provided a more complete categorization of Advanced TVs as shown in the next two charts. Total Advanced TVs are expected to grow from 18m in 2021 to 30m by 2024. Clearly, OLEDs growth is slower than miniLEDs, which don’t enter the market until 2021. But the miniLED growth is not at the expense of OLEDs, it is stealing from LCDs and QD LCDs (without miniLED). In addition, the forecast may not include the change in product mix. LGD is adding smaller panels 32”, 33”, 40” and 48” that will increase the shipment count by 10% to 20% and still remain in the advanced display category.

Figure 5. Advanced TV Shipments by Technology Source:DSCC/OLED-A

Figure 5. Advanced TV Shipments by Technology Source:DSCC/OLED-A

(Note that Mini LCD sets also typically use QDs so sets QD continue to grow overall)

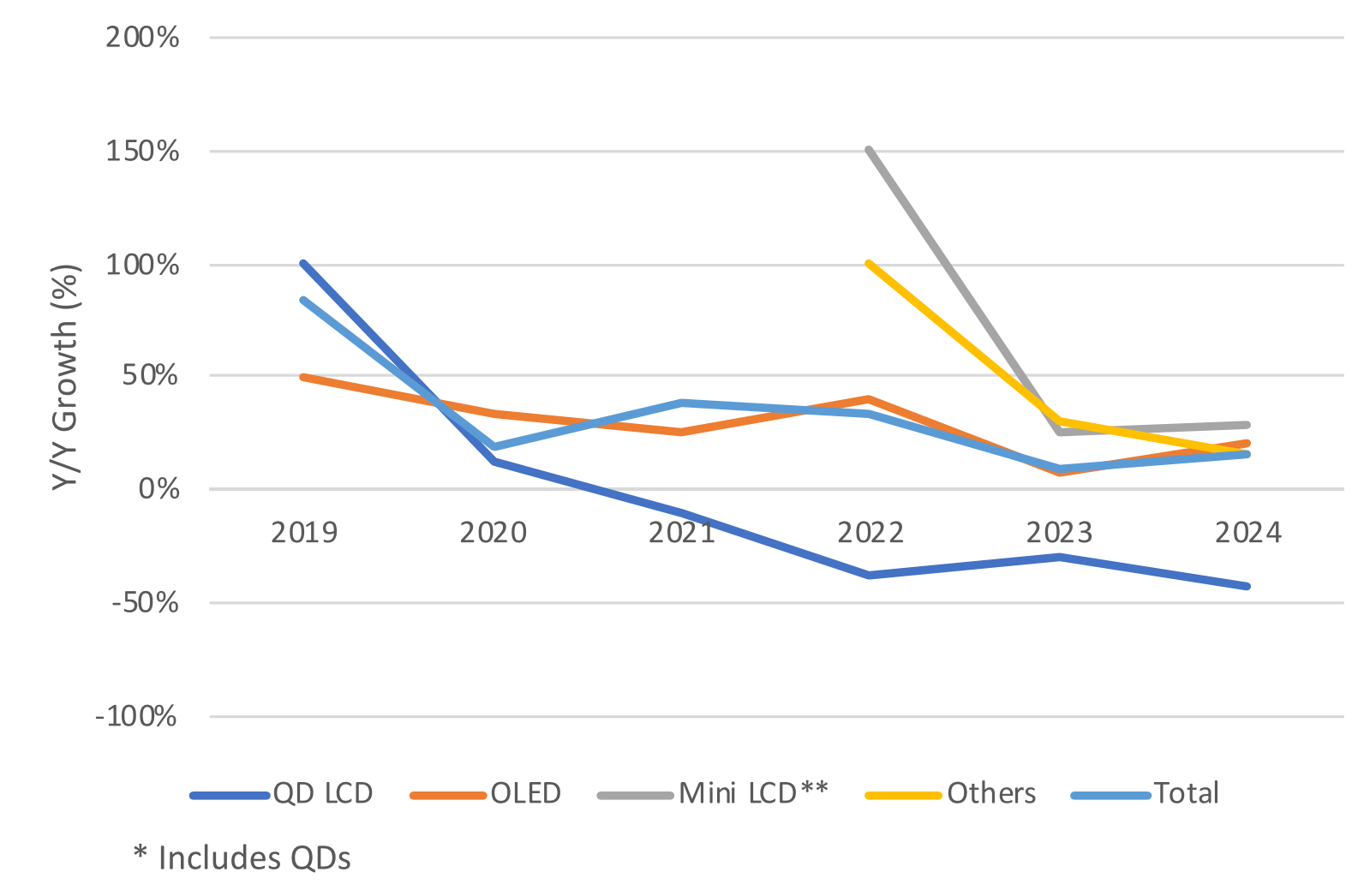

The next chart shows the Y/Y growth rates for each technology:

- MiniLEDs (which include QD as well) are forecast to grow by 150%, 25% and 28%, from 2022 thru 2024 respectively

- OLED growth is 40%, 7% and 20%

- QD LED (non-miniLED) LCD growth is -38%, -30%, -43%

Figure 6: Advanced TV Shipment Growth by Technology Source: DSCC/OLED-A

Figure 6: Advanced TV Shipment Growth by Technology Source: DSCC/OLED-A

(Note that Mini LCD sets also typically use QDs so sets QD continue to grow overall)

The introduction of MiniLED LCD TVs viewed as a plus for the LCD industry, not because it increases the share of LCD’s panel revenue but because it raises the purchases price which accrues to the panel maker if they provide the backlight, typically purchased by the set maker. The rise of miniLEDs will not in the immediate future affect sales of OLED TVs, although LGD will have to make improvements to OLED performance to maintain or increase the performance difference. For example, DSCC recently reported that LG is raising the luminance by 20% initially and then will increase it by another 30% by developing non-device solutions. (BY)

Barry Young is the CEO of the OLED Association

Note after publication slight changes were made to the captions and legends of Figures 5 & 6 to clarify the categories.