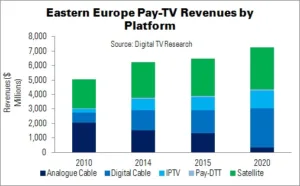

Pay-TV revenues in Eastern Europe will climb 45% from 2010 ($5 million) to 2020 ($7.3 million), according to a forecast by Digital TV Research. However, most of that increase has already taken place and revenues will only climb 17% from 2014 to 2020 (although that is still more than $1 billion).

Digital pay-TV revenues will rise $4 billion over the 10-year forecast, and $2.2 billion between 2014 and 2020 (47%). Digital cable will more than double in the seven-year period, while IPTV will rise 56% and pay-DTT by 53%. However, satellite (the main revenue generator) will only climb 17%.

Digital pay-TV subscribers will increase from 25.8 million )20.7% of households) in 2010 to 51 million (40%) in 2014, and 76.7 million (59.%) in 2020.

Total cable subscriptions will fall by 8.9 million between 2010 and 2020; analogue will fall from 36.8 million to 4.9 million, but digital homes will rise from 4.6 million to 27.6 million. Overall cable penetration will fall from 33% to 25%. Revenues will be mostly flat between 2014 and 2020, despite more homes taking expensive digital packages. Digital cable revenues will more than double (to $2.7 billion), but analogue will fall from $1.5 billion to $0.3 billion.

63.2% of homes in Eastern Europe will pay for TV by 2020, up from 50.1% in 2010: an increase of 19 million. About 12 million will come from Russia. Penetration will range from 89% in Estonia to just 25% in Ukraine.

31% of pay-TV revenues ($2.3 billion) will come from Russia in 2020, overtaken Poland this year. Russia will be responsible for almost 66% of Eastern Europe’s $1 billion pay-TV revenue increase between 2014 and 2020. Bosnia, Hungary, Latvia, Lithuania, Poland, Romania and Slovakia will grow by less than 5%, while Estonia and Slovenia will experience falling revenues.