Every year the end of the Holiday Season marks a new start for the electronics world with the CES in the first week of January. For a good reason this marks a new beginning for the consumer electronics world. There are new products all over and if you thought that the new gadget you just bought a few weeks ago is really state of the art, think again.

It is actually state of the art for last year. Of course many of the products you can see at CES won’t be available until later this year, just in time for the next holiday shopping season. That is life.

What we sometimes forget is to reflect a little more on last year’s sales results and the consumer trends that this data may reveal. Here in the US, pretty good indicators are actually the reports from CTA published at the end of December and covering sales and expectations for the USA in the coming year. Often they get overlooked, not a big surprise with all the hype of CES just around the corner.

The 2016 holiday season presented a little bit of a surprise, with 4K TVs being a strong contender during the Black Friday sales frenzy, but other devices being highlighted during the following holiday season. If you were betting on smartphones and tablets being mentioned as drivers for consumer electronics, think again. The CTA mentions VR/AR, smart home, and digital assistant devices together with 4K TVs, drones and wearables as the segments with the highest growth numbers. Keep in mind that this list is driven by sales growth and not actual total sales numbers or revenue.

For the display industry, the interest in digital assistant devices is not a return to the Palm, but actually a standalone version of Siri and its colleagues. From a product development standpoint I really would like to know if under Steve Jobs, Amazon and Google would have been able to capitalize on this new market segment without even an Apple product being available. With Siri, Apple was certainly a leader in the voice control arena early on but didn’t even show or announce a home device that would act as a voice control hub for all Apple devices. Now the CTA says that this segment will grow over 50% in 2017, even though the market itself will only reach 4.5 million units. Anyway 4.5 million units in 2017 is about one quarter of the yearly Mac sales, Apple are you reading this?

For the display industry, the interest in digital assistant devices is not a return to the Palm, but actually a standalone version of Siri and its colleagues. From a product development standpoint I really would like to know if under Steve Jobs, Amazon and Google would have been able to capitalize on this new market segment without even an Apple product being available. With Siri, Apple was certainly a leader in the voice control arena early on but didn’t even show or announce a home device that would act as a voice control hub for all Apple devices. Now the CTA says that this segment will grow over 50% in 2017, even though the market itself will only reach 4.5 million units. Anyway 4.5 million units in 2017 is about one quarter of the yearly Mac sales, Apple are you reading this?

Now, drones are more of a toy for most consumers, nevertheless they are predicted to reach sales of 3.4 million units in 2017 at a value of about $1 billion.

Wearables, including smartwatches, fitness bands, and other types will reach combined sales of 48 millions with a value of $5.5 billion. This represents a unit increase of 14%, but only 3% measured by sales value. These numbers are somewhat low and may indicate a slower growth going forward suggesting some form of market saturation. This is certainly not so great news for the smartwatch makers in the high end of this market sub-segment.

VR/AR Has Potential

VR/AR is certainly a segment that has all analysts singing high praise for its future potential, but also mentioning a relatively slow start. The numbers that the CTA is forecasting for 2017 is around 2.5 million units, a whopping 79% increase, which would put 2016 sales at around 1.4 million units in the US, more than I would have suspected. They forecast that revenues will reach $660 million, which translates into an average sales price of $264. This indicates a strong lead by Gear VR-type smartphone-based devices over headsets like the Oculus Rift or the HTC Vive, unless the sales prices for the stand-alone headsets are due to come down significantly in 2017.

Smart home devices seem to resonate well with consumers, being forecast to reach 29 million units (63% increase) and $3.5 billion in revenue. Interestingly, this is another new strong growth sector where Apple is, perhaps surprisingly, absent.

Of course, 4K TVs are not a brand new market segment, but still managed to grow significantly and are forecast to reach 15.6 million units and $14.6 billion in 2017. That’s much stronger growth than we saw when HDTV was launched. From a business perspective, 4K TVs will create roughly the same revenue as all the other high growth gadgets put together. This shows the importance of the TV set in today’s world, even after many analysts have said that the use of a large display is being replaced by the second and third screens in homes.

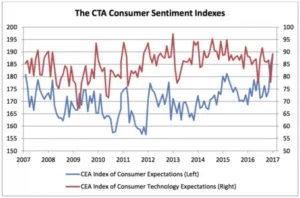

Source: CTA Indices 12/2016

In addition to these high growth areas, CTA is looking at overall consumer technology expectations as well as the consumer expectations in the USA. According to their surveys, both indices have been rising and are both higher month over month as well year over year. Especially the index of consumer expectations is at an over 10 year high level, a good sign that US consumers hope for a better future under the new government. However, the index for the consumer technology expectations is more or less flat or even slightly decreasing over the last three years.

Of course, these are only forecasts and we will have to wait until after the 2017 holiday season to see how true they actually were. Unfortunately, will all be busy looking at all the new gadgets at CES 2018! I guess this is the circle of our life. – Norbert Hildebrand