The CTA held the opening event which followed the traditional format with Shawn Dubravac and Steve Koenig of the organisation giving, first, a view on technology and then a report on global markets.

The CTA held the opening event which followed the traditional format with Shawn Dubravac and Steve Koenig of the organisation giving, first, a view on technology and then a report on global markets.

Dubravac started by saying that this year’s event is the 50th edition of the CES show. There are more than a thousand more media representatives than were present at the Olympics. New companies at this year’s event were five times more numerous than all the exhibitors at the first event in 1967 (we were impressed that there was one reporter that has attended all fifty!).

Dubravac basically covered the same content that he talked about in the preview of CES in New York. See this article (CTA Forecasts for Christmas and Beyond) to read Matt’s report.

For those that don’t want to go through it in detail, in summary, Dubravac said that there is an inflexion point, with voice taking over from GUIs as the primary interface for many computer and device interactions. A point he mentioned in Las Vegas is that voice recognition will become important for security and is already being used by financial institutions to identify users. Dubravac said that as many as 500 additional apps for the Alexa from Amazon are likely to be announced at the show, an increase of around 50% in the number available.

Lenovo has a connected speaker and there is a new watch with Alexa support at CES. TVs will be shown at CES that use Alexa (earlier voice control for TVs was pretty weak – Man. Ed.). The CTA thinks that five million voice-based devices have sold up to now and the same number will be sold in 2017.

An innovation at this year’s event was the ‘C Space’ which was in the Aria for content companies and there will be representation from content companies – lots of work going on to widen recognition of CES among content companies. Other new attendees included the first cruise line exhibiting at the event, Carnival.

There’s a dishwasher that automatically tracks the usage of detergent and can be programmed to automatically re-order detergent before it runs out.

AI can now be put into small objects and at low cost and that’s a big change. Ten years ago, intelligent objects were too expensive, Dubravac said. Now intelligences is into the premium devices, but will get to the mainstream.

Fluid conversation is important for voice devices and the value of recommendations havs to be good – in both cases, AI infused adjustments are important – ‘things’ that the user interacts with have to learn and in the end there has to be a ‘depth of change’ from AI technology.

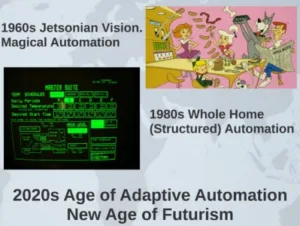

Dubravac looked at how ideas about the Smart Home from the Jetsons in the ’50s and ’60s to very structured concepts in the 80s, but migrating now to adaptive and flexible use.

Dubravac said that there have been changes in AI to become flexible and adaptive

Dubravac said that there have been changes in AI to become flexible and adaptive

Wearables also getting very specific – for example has developed a device for those that care about jumping – for example, basketball players or athletes and counts the number of jumps, height etc. Fitbit has developed devices that can work out what you are doing.

Sleep technology is a growing segment, Dubravac said that there are nine companies with sleep-related technology at CES. Health is a big trend – with devices for tracking skin, breathing, and even a ring to track different data. NeOse has a system that is said to recognise smells. (we looked it up and were not sure that it’s really for CES – it’s aimed at industrial applications and costs $10,000 or more)

TV is still the star of the CE world – 98% of households have them and on average families in the US have three. Smartphones and tablet penetration is up in the 70 to 75%, but few products can be as widely adopted as TV.

New Car Companies at CES

Honda and Nissan are new to CES this year. The automotive section covers 200K sq ft (18.5K m²) and has grown again. Dubravac reminded the press that when Darpa set its challenge to get a car from LA to Las Vegas, in the first year, 2004, the best result was 11 minutes into the 150 miles. In the next year, 2005, only one team didn’t finish. Now they are at CES with products that will be available in a few years.

Honda and Nissan are new to CES this year. The automotive section covers 200K sq ft (18.5K m²) and has grown again. Dubravac reminded the press that when Darpa set its challenge to get a car from LA to Las Vegas, in the first year, 2004, the best result was 11 minutes into the 150 miles. In the next year, 2005, only one team didn’t finish. Now they are at CES with products that will be available in a few years.

The CTA expect the sale of drones to go up 40% in 2017. Dubravac described a security system that automatically deploys a drone in ‘unusual’ circumstances.

VR/AR and mixed reality are still really, really new. The 2016 sales result was realistic for a new technology, Dubravac believes although PCs for VR need to get below $1000. New use cases are being developed for the technology.

Koenig Covers Global Forecasts

Steve Koenig then went through his global forecasts for technology which the CTA works on with GfK. There are ‘dozens’ of categories, he said. The forecast is divided between developed regions (NA/ Europe/ Developed APAC) and Emerging regions (C/ EE/ LatAm etc)

The US dollar is very strong and that has affected the forecasts, reducing the value of some other markets as they will have to spend more local currency to buy products that are sold in dollars. Uncertainty is also a big factor – there are difficult political and other factors in a number of regions. The CTA believes that instability will influence spending by consumers negatively. Global growth should be 3.4% in 2017 and the CTA believes that North America will still the biggest region. Sentiment is improving in emerging regions.

China is moving from a manufacturing-based economy to one that is dominated by services and consumption and that will have an impact on the global market, because of the scale of China.

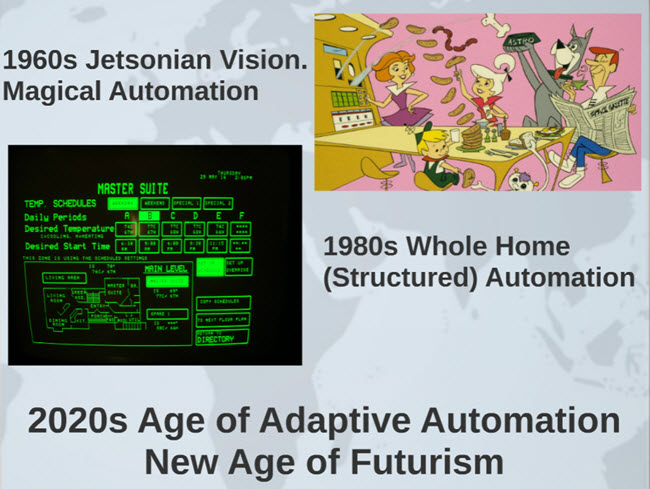

The CTA’s Magnificent Seven will see smartwatches displace feature phones in 2017

The CTA’s Magnificent Seven will see smartwatches displace feature phones in 2017

Koenig has previously talked about the “Magnificent Seven” of consumer products – TVs, smartphones, tablets, notebooks, feature phones, PCs and digital still cameras. Now, the value of smartwatches means that the category is pushing out featurephones from last year’s list.

Smartphone is central and will represent 47% of the value of the market in 2017. Consumers in emerging markets have limited money for technology and it nearly all goes into smartphones. There’s a whole system of services etc around the device to further absorb spending. However, smartphone volumes and revenue growth is flattening – ASPs are flattening and as a result all technology spending will flatten.

US is important, but it’s a numbers game and China is therefore massive. Splitting between mobile and static devices – add in tablets and notebooks and you get to 63% OF ALL SPENINg in 2017. 586 billion dollars.

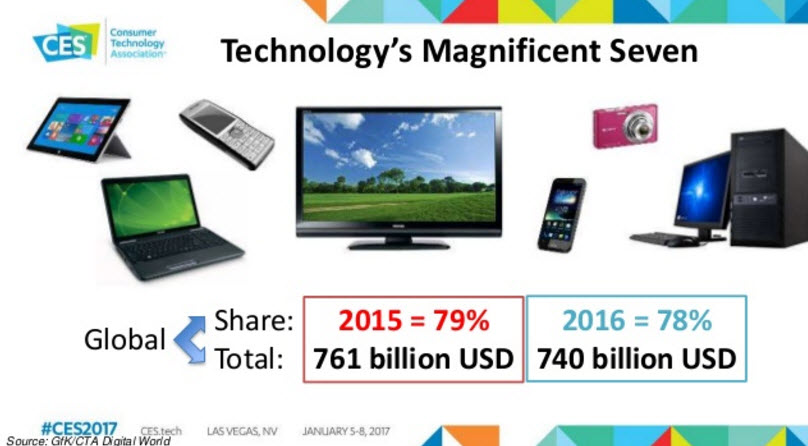

Tablets is a ‘rise and fall’ story, Koenig said. Tablets filled a gap between smartphones and notebooks, but now the segment is getting squeezed between those two devices. Penetration of tablets is already 66% in US, so now its about the density of use. We’re now past “peak computing”.

The developed world is dominant in the notebook and PC markets. Global TV is moderating because of the shift in viewing from TVs to mobile devices. UHD is growng and HDR will be a big factor in developing the TV market. The value of the market is heading to be flat and may go down

Wearables are growing well and Koenig highligted the “Spartan boxer briefs“! (they are claimed to ‘protect your [intimate] health from Wi-Fi and cellphone radiation’) Volumes and value are both rising, with lots of innovation.

Regions Differ

Latin America has been hit economically and the strong dollar is not helping. The region is ‘in need of economic redemption’, Koenig said and there are dim economic prospects – for example there are big problems with Venezuelan inflation and Argentina’s economy is weak, while Brazil is in a tough recession.

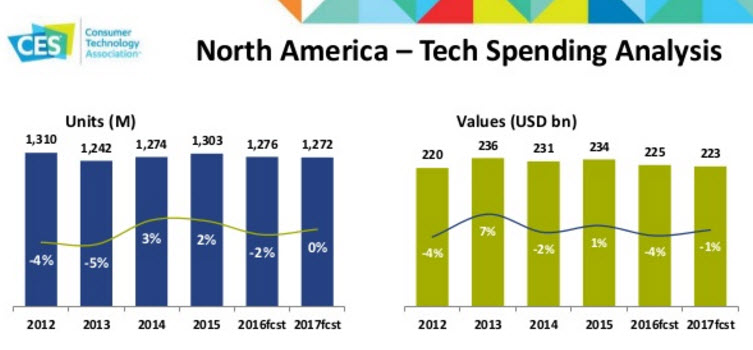

US Tech is spending ‘doing OK’ in volumes and values (see chart) although there is little growth.

“Will the US, Canada and Mexico remain the ‘three amigos’?”, Koenig asked. Consumer confidence is at the highest level since 2001 in the US, but Mexico is struggling with crime and corruption. Canada has seen weak oil prices impact its economy. Western Europe is like the US in terms of volume, that is to say ‘pretty flat’ and value will also be flattish.

‘Mind the gap’, said Koenig, Brexit is a potential issue that could negatively impact economics in Europe. There are a number of other potential issues that could impact the economic prospects, but consumers still like technology and services may grow better than devices in that region.

The CEE region has dropped, but is probably now flat in volume and value, the CTA believes, but there may be opportunites for growth. Ukraine & Russia still potentially have problems, but consumers across the region are hungry for technology. Replacement cycles are speeding up for technology products.

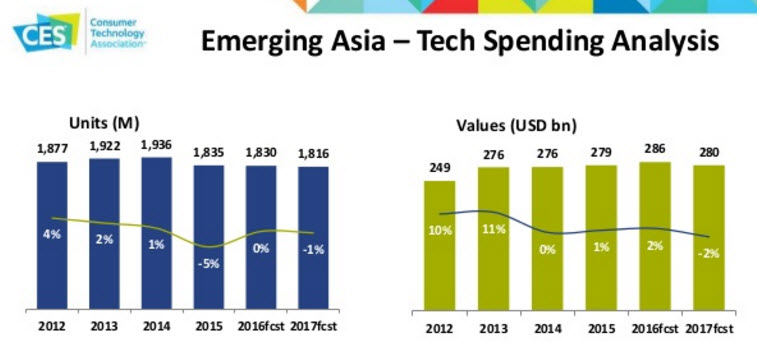

Emerging Asia is really China & India, Koenig explained. China is probably now a fully developed technology market in terms of channels, products and buyers, but there are still lots of growth prospects.

Malaysia/Vietnam is ‘in the middle’ in terms of market development, but Indonesia and Philipines have still a lot of first time technology buyers. That can slow down development because consumers may have to travel to buy technology products. In Malaysia and Vietnam, buyers are looking to get productivity and clear benefits from technology purchases.

Chinese consumers are now buying for entertainment. India is ‘the next China’ with 7.5% growth through 2020, the CTA forecasts. Connectivity and infrastructure is arriving and enabling growth.

Developed Asia is struggling and the weak yen has hit the region. In Japan, and South Korea, there could be lots of interest in wearables for ‘active seniors’, Koenig said.

Finally, MEA has a big area of geography, but has low impact on the market. Conflicts are an issue in the region. There is still a lot of opportunity for first time buyers and new brands that can supply low cost products. Around 60% of spending in MEA is in smartphones.

Emerging Asia is the biggest region. Spending is flat or slightly down and volumes are also flat.

As Dubravac had said there are opportunities in drones etc.

The presentations from the talks are available for download.