A couple of weeks ago, Ross Young of DSCC ran a webinar that summarised the impact of the Coronavirus on the display industry, and he subsequently published a detailed blog, but he kindly sent me his full deck and I thought this was a good chance to highlight some of the key points and lead into the second part of my Display Daily.

You can see his full blog here.

Ross has a unique perspective on the display industry and was an analyst during previous crashes, so he started by looking at lessons from previous industry crashes, in 2000/2001 and in 2008/9. In 2001, the crisis caused consolidation, with Acer Display and Unipac combining to form AUO, Chi Mei acquiring IDTech and BOE taking over Hyundai Display.

However, in 2008/9, the main effect was a dramatic fall in panel prices, which acted as a stimulus to the market and drove demand for TV panels to the extent that, by 2010, there was a shortage of panels and prices recovered. Again there was some consolidation with Foxconn acquiring Chi Mei and Toppoly to create Innolux. Tianma acquired NEC’s fab in Japan and SVA in China.

In both of these crises, premium products dropped in price the most, and older technologies were displaced more rapidly.

This Crisis

This time, the crisis has arrived when the market is already struggling with prices at or around cash cost for TV panels and large losses in large LCD, while the mobile OLED industry is suffering poor utilization. Companies are downsizing (with the Samsung plans to close its LCD business the most notable) and before the crisis, there was an expectation of just 1% growth in flat panel revenues this year.

Although TV panel prices had started to rise in Q1 2020, TV demand has plummeted because of the disease, so are back on the decline for Q2 2020. As David Hsieh of Omdia/IHS Markit said to me in a discussion on this “impact to the display industry has been shifting from the supply side (February-March) to the demand side (April-May)”.

Young looked at the state of Covid – but that was a couple of weeks ago and the situation is changing fast. He highlighted that, unluckily, Wuhan was an emerging hub for display making with BOE, CSOT and Tianma all building fabs and having ordered more equipment for this year. However, the virus has slowed down equipment installation by four to six months. Wuhan is boosting capacity from around 2.5 million sq. metres in 2019 to 18.6 million by 2022, with slower growth after that.

Wuhan LCD Production. Data & Forecast:DSCC

Wuhan LCD Production. Data & Forecast:DSCC

Wuhan LCD Production – Data & Forecast:DSCC (chart:Meko)

Final device markets are down and Q1 2020 was a weak quarter in the TV, notebook and monitor markets – the major segments for LCD volume and area. Smartphone demand was down 25%, too.

By the beginning of Q2, China was starting to recover with fabs and factories fully staffed again, but by now, demand has been seriously hit because of lockdowns around the world. That is having a huge impact on economic activity and the drop is likely to be between around 19% of GDP in China, up to nearly 30% in Spain and Germany. The US is likely to be down 25%. The long term danger will be dependent on the length of the lockdowns around the world.

Forecasts

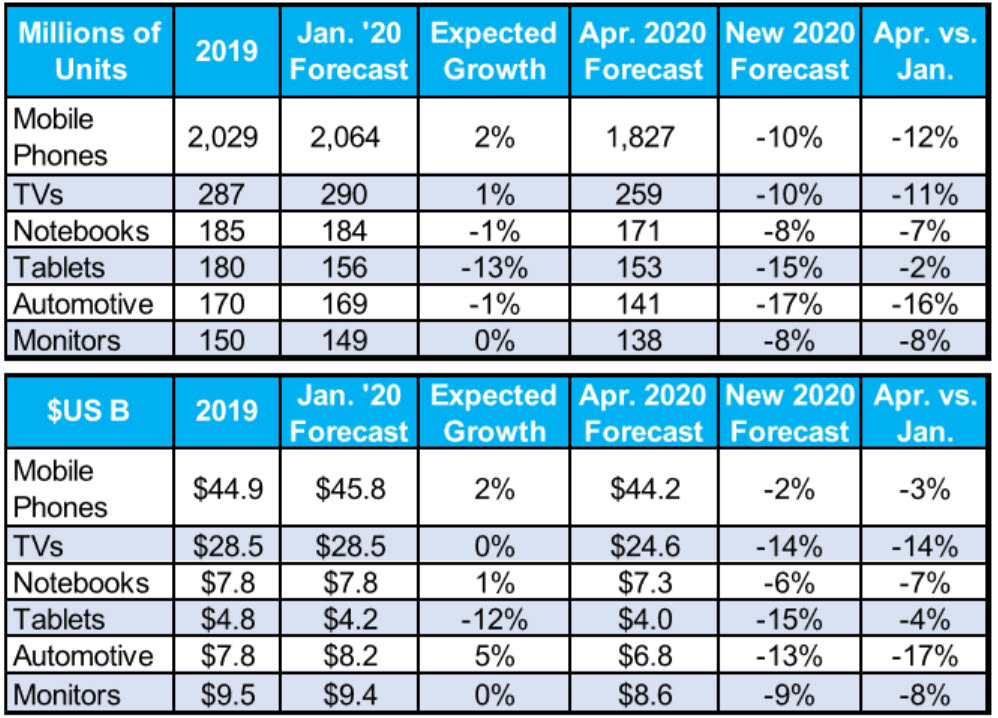

Looking ahead, Young highlighted the drop in units by just 2% for tablets, but 11% for the TV market and 16% for automotive. Revenues will be down by 3% to 17% with TVs down 14%. Overall, 2020 will be 9% down compared to previous forecasts, but there should be recovery in 2021. OLED will do better than LCD in keeping prices firm and will increase its revenue penetration from 34% to 36%.

Flexible OLEDs are also expected to increase in share and OLED is expected to take 63% of smartphone display revenues this year.

In TV, both OLED and LCD are likely to be down. By 2025, DSCC expects OLED to be taking 22.3% of TV panel revenues by 2024, although unit share will be just 4.7%.

The movement of the Olympics to 2021 will impact the growth of 8K as broadcasts are postponed. However, ‘Advanced TVs’ (QDEF/OLED/QD-OLED, 8K LCD, miniLED and Dual Cell) will go from just over 10 million units this year to 35 million by 2025.

Consolidation

As in previous crises, more consolidation is expected with Apple aquiring JDI’s Hakusan fab, Samsung Display probably selling fabs to TCL (which already has a 10% share of the fab in Suzhou). LG Display is getting out of TV LCD panel making in Korea and some suppliers will struggle in China. That’s the topic I’ll address in my next Display Daily.

The LCD industry, then, will see a likely decrease in area capacity of around 2% and even that could be optimistic. Watch out for the second part of this article. Covid-19 Forces Sanity on the LCD Industry (Covid Brings Harsh Reality to Display Industry Part 2) (BR)