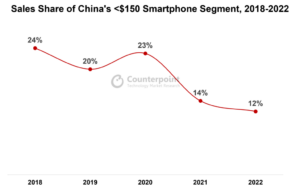

China’s smartphone market experienced a 5% year-on-year (YoY) decrease in the first quarter of 2023, but sales within the entry-level sector (<$150 wholesale price) grew by 22%, according to the China Quarterly Smartphone Report by Counterpoint.

This surge was previously seen in 2020, amid the first wave of the COVID-19 pandemic when smartphone use grew due to government promotion of non-contact services and the requirement of health code scanning in public spaces.

The smartphone market did take a hit in 2021 due to the global chip shortage which significantly raised manufacturing costs, causing difficulties in major updates for entry-level smartphones. The focus then shifted to high-end segments that typically yield higher profit margins.

However, recent reductions in manufacturing costs over the past quarters have allowed OEMs to introduce upgraded specifications in the entry-level segment, including the addition of 5G features. This has brought a variety of options to consumers in this price band.

The smartphone replacement cycle in China now exceeds 40 months, reflecting this trend. However, it’s unlikely that most consumers will switch to cheaper smartphones under $150, given the current economic climate, and will probably just retain their existing phones longer until their circumstances change.

The average selling price of smartphones is projected to rise again by the end of 2023, driven by Android OEMs’ continuing premiumization strategy and increasing shipments of foldable smartphones.

Despite these trends, demand in the entry-level segment is expected to remain. Groups such as teenagers and senior citizens are anticipated to continue preferring these affordable devices, providing a stable customer base for this market segment.