Yasuo Nakane is an analyst from Mizhuo Securities where he looks at the display industry and was introduced by Young as a highly respected analyst in the FPD industry. If you think that Ross Young’s presentations are packed with data – think again. Nakane put out 139 slides to go with his talk and many single slides would repay significant study!

Yasuo Nakane is an analyst from Mizhuo Securities where he looks at the display industry and was introduced by Young as a highly respected analyst in the FPD industry. If you think that Ross Young’s presentations are packed with data – think again. Nakane put out 139 slides to go with his talk and many single slides would repay significant study!

He started by agreeing with Young that the equipment side of the business should see a good trend, market capitalisations are stable and equipment makers are outperforming others in terms of share prices.

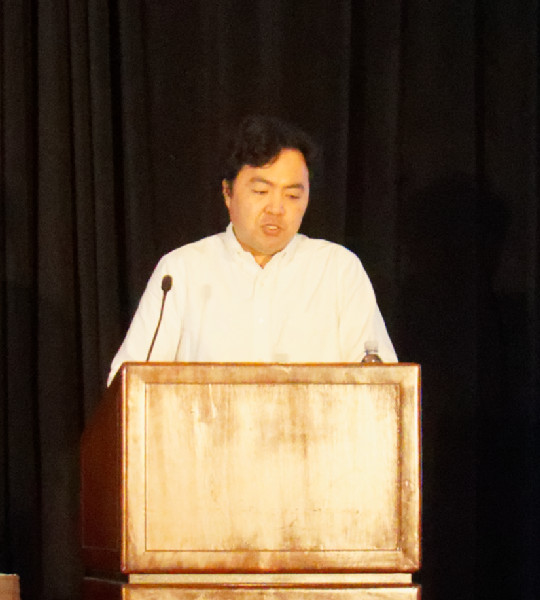

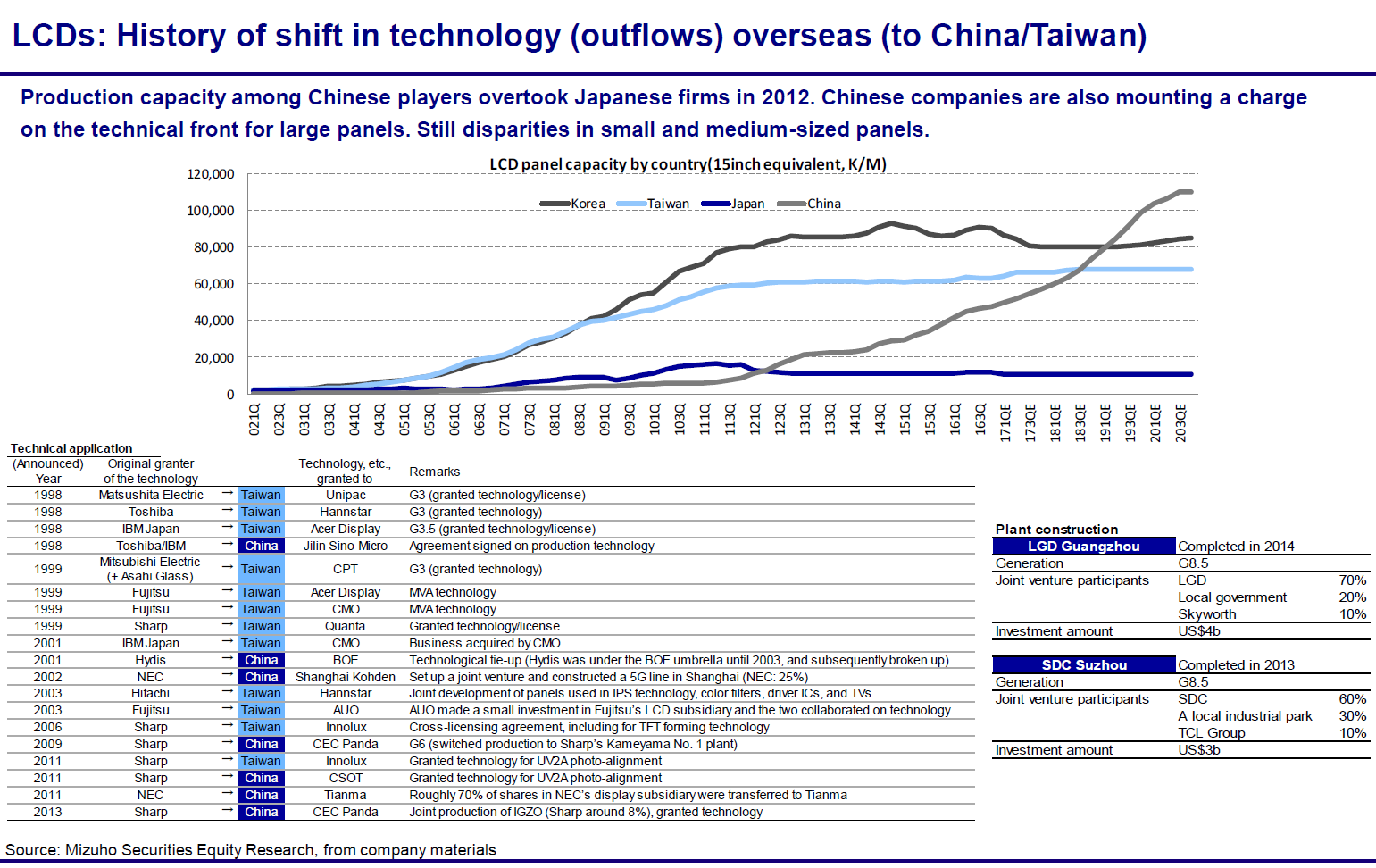

He showed interesting slides comparing the panel makers in 2006, 2011 and 2016. Sharp dropped back from having a market capitalisation of $21 billion, a quarter of Samsung’s, in 2006, dropping to $8 billion in 2011 and rising again to $21 billion in 2016, but, by then, just a ninth of the value of the Korean company and, at one point, ‘almost gone’.

On the other hand, in 2011, BOE had just started, but by 2016, the market capitalisation of BOE had risen to half of Sharp and more than LG Display..

BOE had a higher market capitalisation than LG Display last year. (Click for higher resolutioon)

BOE had a higher market capitalisation than LG Display last year. (Click for higher resolutioon)

Samsung’s Visual Display (TV) business is still the top buyer of TV panels, and BOE and CSOT from China are already supplying Samsung, LG Electronics and Sony, the top global brands. Ten years ago, there were just 4 or 5 panel makers, but now there are a lot more.

Looking at accumulated free cash flow, JDI and Sharp are negative cash flow for now. JDI has a negative accumulated cash flow of more than $3 billion, and Sharp closer to $8 billion. LG Display, after a good year is basically at break even – it is creating creating $4 billion value per year, but having to invest it to stay in the game.

BOE has strongly negative cash flow and accumulated negative cash flow heading for $15 billion, while AUO and Innolux are finally creating cash flow, but investing less and that is a challenge for the future of the businesses.

Novatek (display drivers), Corning (glass), Nitto Denko (films), Orbotech (equipment) are all creating cash flow. Material and equipment for the FPD markets are still good places to be, financially.

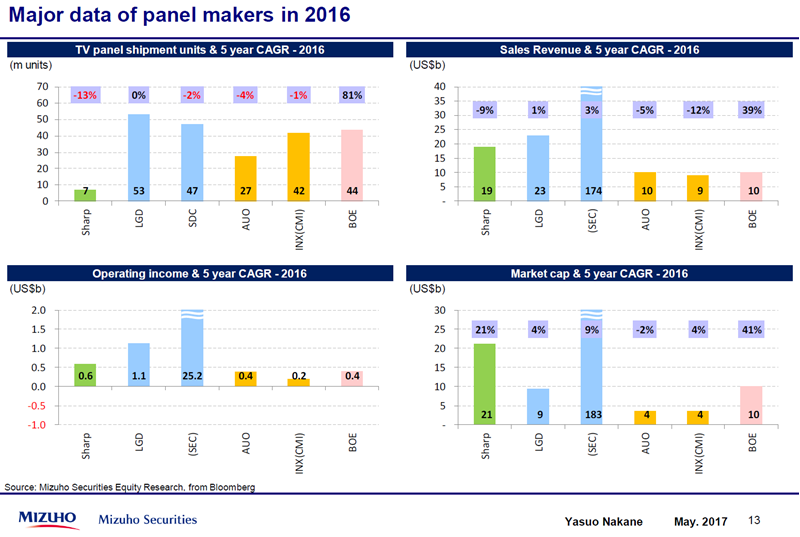

The Chinese Do it Differently

Chinese are investing differently – BOE is finding other investors, so their share of each investment is less and that makes it hard to be competitive if you have to find the capital yourself. This has led to the long term move away from Japan, then Taiwan and Korea.

One of Nakane-san’s charts shows technology shifts in LCD – click for higher resolution

One of Nakane-san’s charts shows technology shifts in LCD – click for higher resolution

Small Medium depends on Smartphones

Area demand in the small/medium sectors are closely related, so display and smartphone demand depend on each other. The key for success in the market is to supply the top five brands for smartphones.

Apple will have a new OLED-based phone and that will mean buying 80-90 million panels from Samsung. Next year, Apple is likely to be all OLED (except, perhaps, the SE). There may also be bigger models in the range than there are currently.

Apple will have to depend on Samsung for OLED supply for two to three years and is ready for another supplier which will probably be LG Display then JDI. JDI/Sharp haven’t decided whether to invest in OLED or LCD fabs yet, but if JDI chooses OLED, Nakane believes that it will probably have to give up its flexible LCD concepts.

Samsung’s S8 and Note 8 will use flexible OLEDs when they are launched and, next year, even the A series is expected to move to flexible OLED. As the #1 smartphone maker and #1 flexible OLED maker, Samsung will be in a very strong market position.

Chinese makers. Huawei, Oppo and Vivo will switch more to OLED as they can get supply.

LCD & OLED have Different Cost Structures

For LCD material cost is high – but for OLED depreciation is bigger – so that means scale really matters. (see the Display Daily Why LCDs are Not Just Big Chips for more on this) The OLED model is closer to the semiconductor cost structure. OLED can get cheaper than LCDs in three to five years. Samsung Displays rigid OLED fabs will be depreciated and so in the future can be very aggressive on pricing.

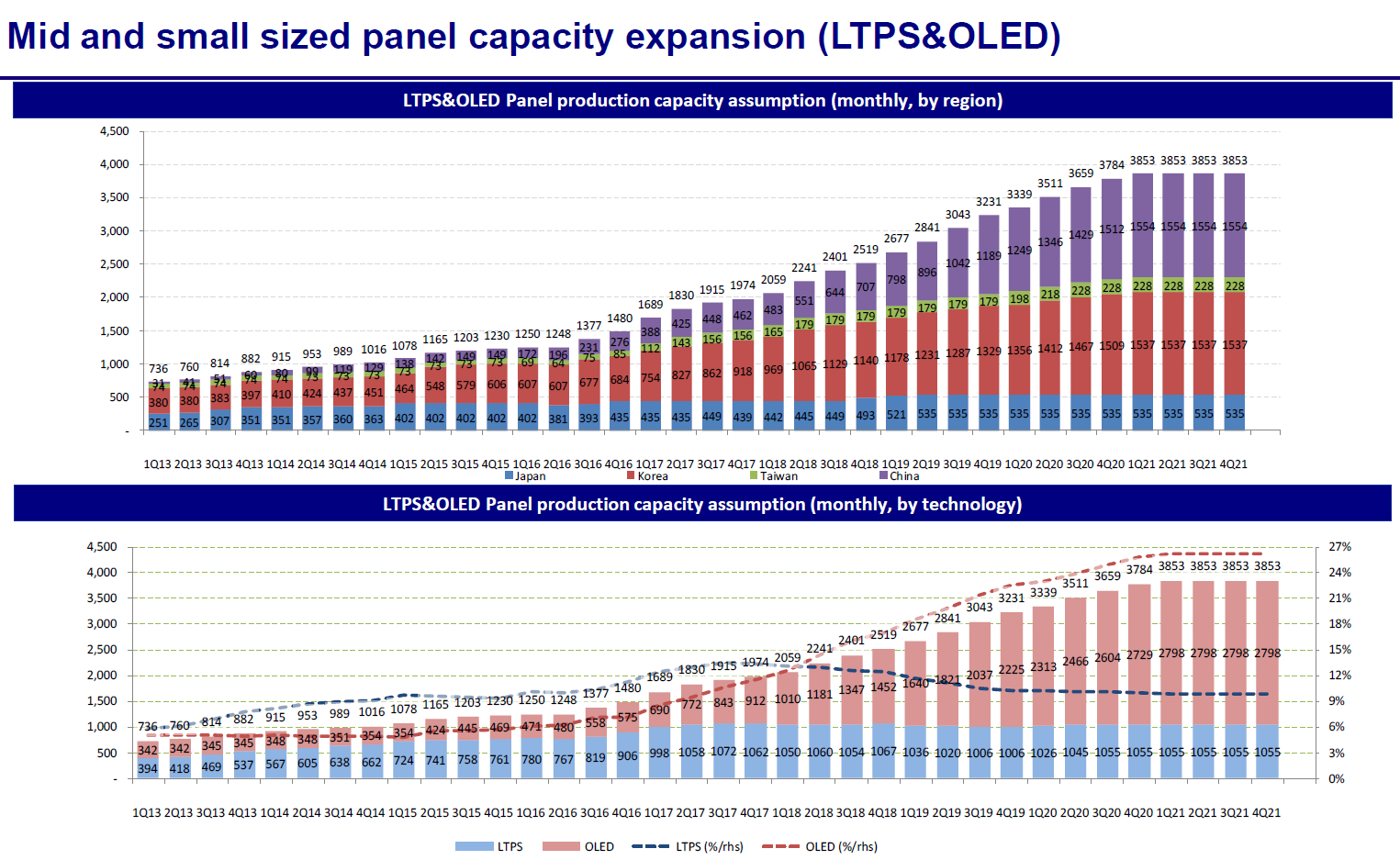

OLED volumes go past small/medium LCDs in terms of volume by Q2 2018, and the share of LTPS LCD is probably peaking around now. Nakane thinks that Samsung can stay ahead if it can keep its lead in capacity and technology – it will be hard for the others to catch the firm. The other, potentially disruptive, issue could be microLED. In the future, a big question is when Apple leaves Samsung. They probably will because they are rivals, Nakane said.

In Small/Medium capacity, LTPS is peaking and OLED goes past LCD in Q2 2018. Click for higher resolution.

In Small/Medium capacity, LTPS is peaking and OLED goes past LCD in Q2 2018. Click for higher resolution.

TV Dominates Large Sizes

Moving to large sizes, 80% of the area of panel is TV and 55″/65″ are both in tight supply. Panel makers are making money, but their share prices are not going up. TV demand is expected to be flattish over the next five years with, perhaps, 5% to 7% area growth based on size changes. Panel prices are high so demand won’t grow as much as it might and it could take 1.5 years to match supply and demand.

There will be growth in larger size fabs and Nakane sees a chance for four G10 fabs – but more are planned (as said elsewhere, there could be up to nine! BC02 Applied Materials Says Industry to Move from Components to Processes). Nikon can only make 12 photo steppers per year so in his forecast, only 54 are made, but 60 are needed by top four makers with G10 plants.

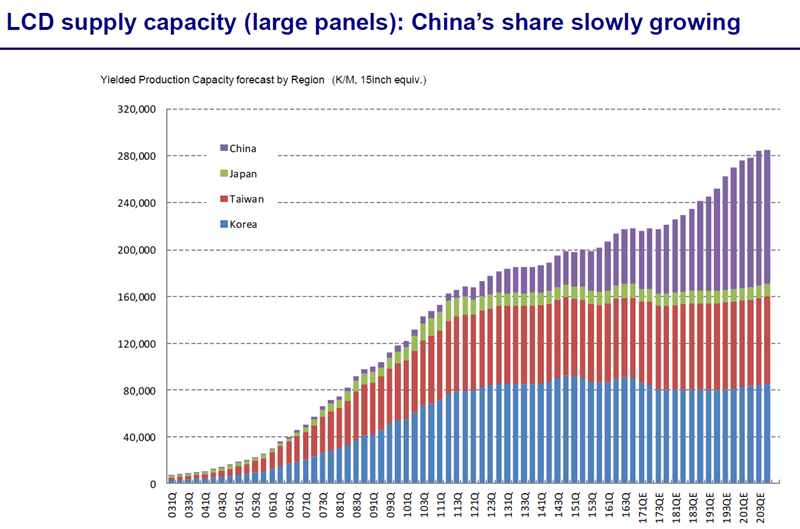

All the growth in large panels is in China.

All the growth in large panels is in China.

Samsung Display and LG Display are trying to expand their OLED capacities. The G10.5s in 2019 will use oxide transistors, which might mean that they can be re-purposed for OLED. Can the industry shift to inkjet OLED? Maybe in 2021/2022, Nakane believes.

Samsung Display and LG Display will stay top the two panel suppliers, unless the Chinese start to merge – which is unlikely in his view. That gives a chance for non-Chinese panel makers. LGD will focus on OLED in the future.

Samsung Display is losing momentum in large panels. Will they invest in QLED in G10? That’s a big question!