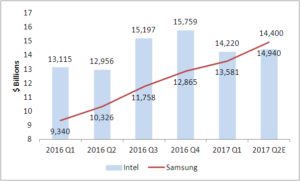

This week, IC Insights forecast that because of the current high pricing regime for memory, Samsung might go past Intel in the value of its semiconductor sales in Q2 of this year, the first time that Intel has not been top for nearly 25 years. Clearly, Samsung understands how to operate in the chip business.

Intel vs Samsung Chips Samsung Could go past Intel. Chart:Meko from IC Insights data

Over the last 25 years, I have watched the dynamics of the flat panel business and it occurred to me several years ago that the LCD business had developed differently from the chip business. That was slightly surprising, as flat panels are, after all, based on semiconductor substrates. It seemed to me the different development path wasn’t what had been expected by the Korean LCD companies, in particular.

The Chip Business Favours Dominant Suppliers

The chip business has an interesting dynamic that there are very heavy fixed costs to create new chips in design and manufacture. Get the scale right and your costs go down and you can beat the competition. It seemed to me (and I make no claim to be any kind of expert in semiconductors) that chip markets typically see quite a lot of competitors in new markets, but at one point, one or more companies get an advantage (either in cost or technology). That gives them volume, which drives down the unit costs and boosts margins, meaning good profits to invest in the next chip. At a certain tipping point, the number of viable competitors goes down to a very small number.

A classic example of this was the 3D graphics chip business. At one point, my friend, Dr. Jon Peddie reckoned there were around 75 companies developing 3D graphics*, but a couple of years later, it was down to a handful and is now down to, basically, three – Nvidia, AMD and Intel – and Intel probably wouldn’t be in it if it didn’t dominate PC CPUs. Of course, in PCs, Intel is totally dominant.

LCDs are not The Same as Chips

It seemed to me that the early efforts of LG and Samsung to dominate the market for LCD was based on the expectation that the LCD market would go the same way. Many years, at an event in Korea, I remember being amazed when a speaker from the Korean government said that Korea would take more than 50% of the market – it seemed unlikely at the time, but it is what happened. I think that the government and Korean companies expected that the same would happen in LCD as happened in semiconductors – just a very small number of companies would dominate the market and then control it to make good margins and growth.

It didn’t turn out that way. One reason was that the costs of LCD are too dominated by materials and components, which made it hard to get a big advantage from economies of scale. Making more meant buying more. The second factor is a the result of a feature of the industry that economists call “fungibility” – a term that I was introduced to by David Barnes, whose different point of view I miss now that he has retired from the business. The idea of fungibility is that if a product or factor is more fungible, it is more capable of substitution. LCD fabs turn out to be pretty fungible, most fabs can make most product types.

The implication of this is that if one maker decides to dominate a particular segment, the other makers can also make that product. If, for example, Samsung pushed very strongly on notebook panels, and dominated that segment, it might hope to control the market and push up prices. However, in a market of fungible suppliers, if Samsung decides to try to push up the price of notebook panels, the others would quickly rush in and supply them, pulling the pricing and profit down again.

The big question for the next few years is whether the OLED business will be as fungible as the LCD business. Samsung is widely reported to have done a lot to try to stop technology getting into the hands of competitors in OLED and that will certainly slow down the ability of them to catch up. – Bob

* I remember being at an event more than ten years ago where Jon was giving one of his talks. When he said that the market would dramatically consolidate from 75 to three companies, I noted that his demeanour changed. Afterwards (probably over a glass of good red wine), I asked him about the change in tone. “I just realised, that’s my market disappearing!”, he said! However, he remains in the business of advising and researching on graphics.