Yong-Seog Kim, the President of the SID, opened the Business Conference, which took place on the day before the main exhibition and Symposium, by saying that the industry is in a great period of rapid change, with forecasts that in 10 year’s time more than half the display business will be in China.

Ross Young is the founder and President of Display Supply Chain Consultants (DSCC) said most that this is a most exciting time – companies are making money, market valuations are high, there are lots of new products and there might even be an LCD fab in the US for the first time. He introduced his company, DSCC, a start-up that he founded at SID last year, although 20 years ago he founded DisplaySearch at SID. He wondered what he would be doing at SID in 2037!

Ross Young is the founder and President of Display Supply Chain Consultants (DSCC) said most that this is a most exciting time – companies are making money, market valuations are high, there are lots of new products and there might even be an LCD fab in the US for the first time. He introduced his company, DSCC, a start-up that he founded at SID last year, although 20 years ago he founded DisplaySearch at SID. He wondered what he would be doing at SID in 2037!

Young started in his inimitable style with a ‘machine-gun’ powerpoint presentation that we struggled to keep up with in note taking, but delivered a very good overview on the state of the industry.

LCDs Remain Dominant

At last year’s event, although LCDs were dominant, the outlook did not good, with prices too low, too much supply, limited opportunities for growth and a big drop in equipment sales. As it turned out, the result was very different – if you had bought display stocks “you could have retired!”, Young said. In reality, it has become a very positive market in many ways.

In the past, in the LCD industry and there have been periods of +20% margin for four consecutive quarters – and this could happen again. In the past, the problem for the industry has often been that there is not enough cash generated, although free cash flow is still negative because of the capex needed to stay in the business. (for more on this, see the later talk from Nakane-san at Mizhuo BC05 Mizhou Looks at Finance and Supply)

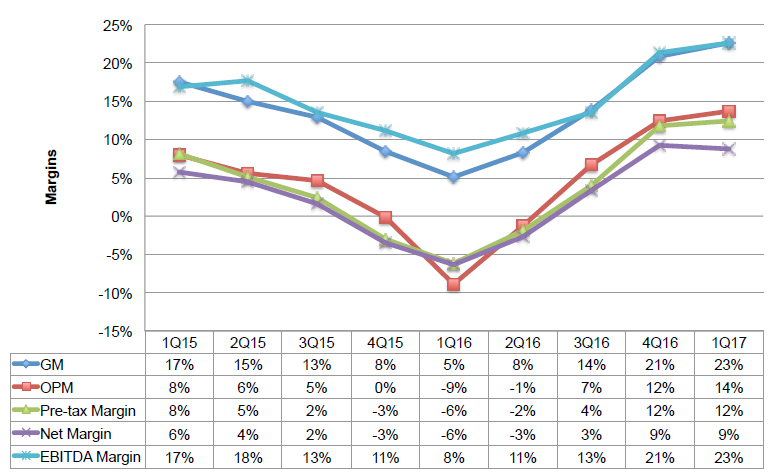

Young said that LCD Margins could be over 20% for four quarters. Data:DSCC

Young said that LCD Margins could be over 20% for four quarters. Data:DSCC

The Small/Medium panel market has done best and that has driven up stock valuations for suppliers that were strong in this segment. Prices are up for panels. Equipment revenues are up 89% YOY. Glass margins are high and other material margins are all up. That has meant that material and equipment stocks are up. “How did this happen?”, Young asked. The main reason is that there were more fab closures than anybody expected – and he said that he expects that closures of older fabs will continue.

The next reason is that after the Foxconn takeover, Foxconn moved Sharp’s LCD supply to its own brand which created a shortage (we noted some data from IHS last year that showed that the majority of Sharp’s output at the end of Q3 was going to Samsung’s TV business, so this was a big deal – Man. Ed.) This also reduced supply because of lower glass efficiency as Samsung has had to buy panels from fabs that were less optimised for 65″ and 75″ than Sharp’s G10.

The third factor in reducing the potential oversupply was the trend to larger sizes – a trend that was made stronger as TV brands tried to maintain their margins in $ terms, although they were down in percentage terms.

Apple has booked capacity from Samsung for flexible OLEDs of 105K of 6G substrates, which has meant a big change in the OLED supply outlook..

A Tidal Wave of Capex

Young said that the effect of the shortage, valuations and pricing, is a ‘tidal wave of capex’ for OLEDs, large TV panels and enabled by “cheap money”.

Why are people going for flexible OLEDs? Young expects smartphone displays to move to 7″/8″/9″ and 10″ exploiting flexible and foldable OLEDs. In turn, this will generate higher ASPs, Young believes. That will be a huge opportunity for Apple & Samsung and he thinks that ASPs at the premium end of the phone market could even get to $1,500+

OLEDs will completely replace LCD in smartphones, although supply will remain constrained until OLED is the only smartphone display. DSCC sees foldable technologies as a big opportunity and Young is ‘very bullish’. There are more and more rollable prototypes being shown and the ‘some day’ of rollables is ‘right around the corner’. Notebooks will also use flexible displays.

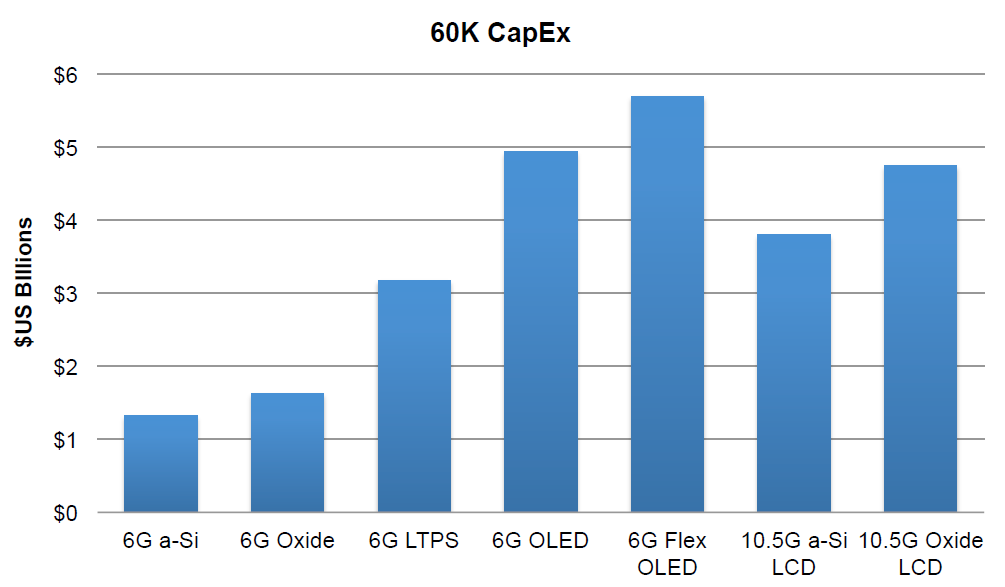

However, there are many requirements and tech challenges still to be met in flexible OLED. Equipment gets more difficult to develop and more equipment is needed, so capex is higher and Young said that for flexible OLEDs, the extra cost of adding capacity for 30K substrates a month at 6G size is $250 million.

The capex needs for flexible OLED are much more – good news for equipment makers! Source:DSCC

The capex needs for flexible OLED are much more – good news for equipment makers! Source:DSCC

Capex is rising rapidly as a result and a flexible OLED 6G fab is more expensive than a 10G LCD fab.

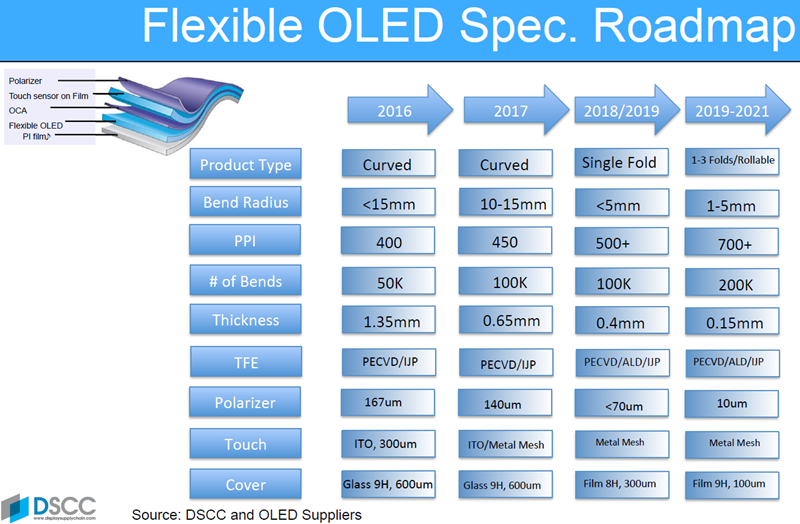

There are tech challenges moving to flexible products with a single fold being the main configuration in the near future and later with multiple folds. Lots of things need to change including making the displays even thinner so that they are easier to bend. Atomic Layer Deposition rather than PVCD is likely to be the preferred manufacturing process. The polariser also has to get thinner – coatable polarisers will start to be the norm.

Touch has to be made flexible and the expected solution is metal mesh on glass and on film. There are many challenges to overcome to turn flexible OLEDs into a good business.

Young showed this roadmap for flexible OLED. Source:DSCC

Young showed this roadmap for flexible OLED. Source:DSCC

Young said that Samsung sold 17m smartphones using flexible displays in Q1 2017, representing 18% of its Q1 2017 output. Margins are now higher for OLEDs than LCD operating margins for Samsung.

Samsung is spending a huge amount of money – more than the rest of the industry – and DSCC sees its capex at $3.6 billion in Q1 2017 – up 143% on 2016. Total capex for the industry was $8.8 billion in Q1 2017.

Last year, the forecast from IHS was that 600m OLEDs would be sold in 2019, with less than 200 million flexible, but the forecast from DSCC now is for 900M OLEDs with more than 480 million being flexible. Simply, OLEDs will take over the phone business.

Apple and Samsung have over a third of the phone market (according to IDC), but they are expected to dominate the capacity for OLEDs, taking over half of all the capacity of the industry until 2021, when the rest, combined, will go past 50%.

OLED capacity for the industry is expected to have a 40% CAGR while flexible OLED capacity will grow twice as fast, at 80%. OLED is likely to overtake LTPS LCD in volume very soon – perhaps by late 2018.

LG is expected to catch Samsung in OLED capacity 2021 but Samsung will stay ahead for a long time. The two Koreans are expected to have two thirds of the OLED industry capacity at that time, by area. Samsung will still have more than 40% of the flexible capacity, based on current information.

OLED & LCD Capacity to Continue to Grow

DSCC believes there is a long term trend to significantly increase capacity – more than 50 lines will be needed to fully saturate the smartphone market, which will happen around 2026. Further capex will still need to be at around $63 billion from 2022 – 2026 to meet the demand, based on an expectation of 9% of the market being foldable. If it’s more than 9%, then even more capex will be needed.

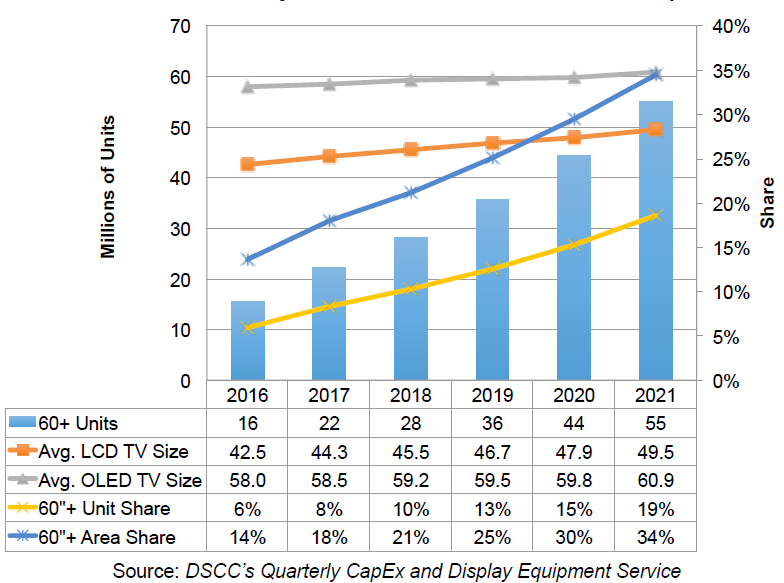

In TV there is a big demand at 65″ and 75″ for panels for UltraHD TVs – 10.5G is a sweet spot in manufacturing. Area share of 60″ sets will grow a lot (to 34% by 2021) and will continue to increase in volume terms. There are likely to be up to 7(.5?) fabs to meet this demand on top of Sharp’s existing G10 fab. There are five G10 or G10.5 fabs announced or that seem clear to DSCC. However, Applied Materials, the equipment maker, is tracking nine potential new fabs at G10.5.

The G10 generation of fabs is ramping more slowly than it might because of a limit on the production of Nikon photolithography tools, Nikon being the only company able to make the equipment and which has limited capacity for the machines.

Another enabler of the strong capital investment is ‘easy money’ in China. Chinese suppliers have lots of additional subsidies – including income and asset grants – and that means much higher market valuations for Chinese companies than for Taiwanese companies. At the moment, it’s easy to raise money – and while it’s easy they will continue to invest. (At the event I heard from BOE that just 10% of its investments are being financed by the firm itself, with the rest coming from sources including the government. Mizhuo’s data later in the day confirmed the 10% figure for some of BOE’s fabs – Man. Ed. )

There has been 50% in growth in 2017 for capex in equipment and there will be more going forward.

LCD Stays Dominant

LCD will still be dominant by 2021 in terms of area production and it will take that long for OLED to go over 10% of the supply chain by area. BOE will be the biggest supplier from next year in LCD, but later for the combination of LCD and OLED (and will be the overall biggest FPD maker from 2020 at 17% of the global capacity).

Looking at the supply/demand balance there will be a surplus of capacity if there are no shutdowns, Young said, but if shutdowns continue then the industry will stay in balance as DSCC expects 6% demand growth on an area basis until 2021.

Looking at investment opportunities (an area that DSCC wants to focus on) Samsung and Apple will dominate the smartphone market and benefit from the expected higher ASPs for foldable OLEDs.

Taiwanese panel makers are valued low by the market. There is a lot of risk in switching from LCD to flexible OLED; there are exclusive materials used and special equipment. For example, Samsung makes its own depostion targets and that makes it difficult to compete with the company using vapour deposition.

Young said that mask makers will do well out of the move to G10.5 and some material suppliers will also do well. There is lots of competition in evaporation and encapsulation – “many are called, but few chosen”. Korean companies that have developed equipment for Samsung and LG may find export markets, especially in China. However, the equipment market will be competitive.