Automotive applications were very prominent at Display Week this year and there are good reasons for this.

In the long term, moving to driverless cars (which is taking a lot longer than many thought likely) will mean that the ‘in-vehicle experience’ will change a lot and mean that lots of displays could be desirable. Actually, I reported five years ago from the Paris motor show that the CEO of Faurecia forecast 2040 as the time that autonomous cars would arrive. Further, vehicles themselves have moved to be less analogue and more driven by digital and processor-based technology.

Electronics in Automotive is Huge

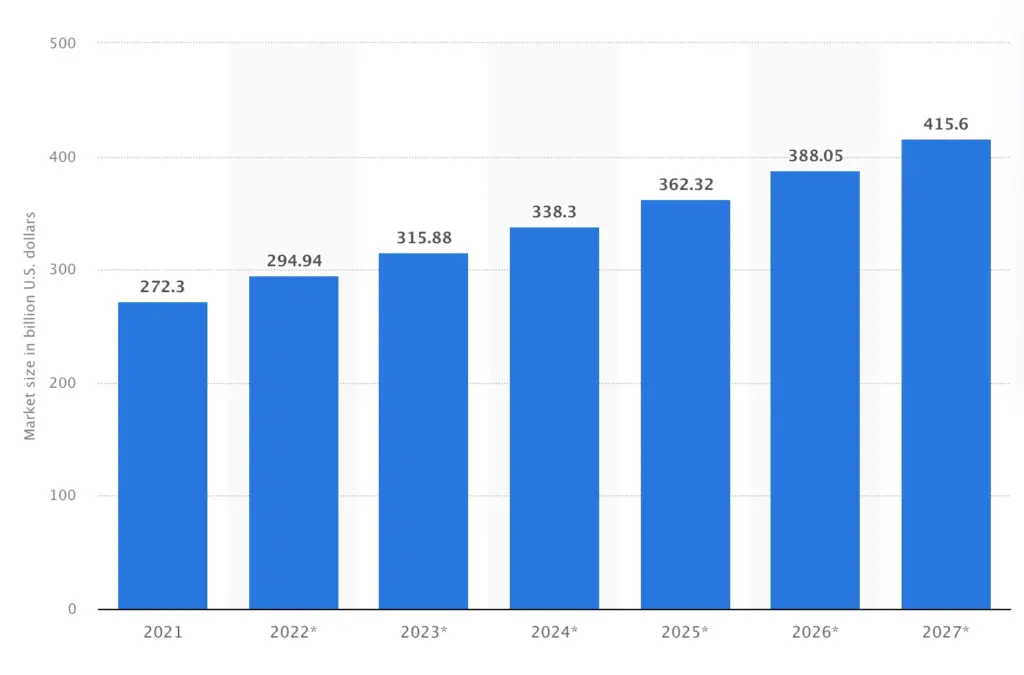

“While electronics made up only about 10 percent of a total car cost in 1980, this share reached some 35 percent in 2010. In 2030, electronics are projected to make up around 50 percent of a cost of a new car,” according to Statista. Statista values the vehicle electronics industry as worth $315 billion this year and as the processors become more sophisticated, the potential to use the data generated and present it via digital displays is growing massively.

Electronic displays were also not adopted by some makers for a long time because they could represent a ‘single point of failure.’ When you had a range of separate systems for the speedo, rev counter, fuel levels, temperature etc, there was a level of redundancy. If one system failed, the rest were OK. An LCD that failed would mean that everything could fail. However, once you have everything going through a CPU anyway, that advantage of separate analogue systems disappears and you might as well have a single display.

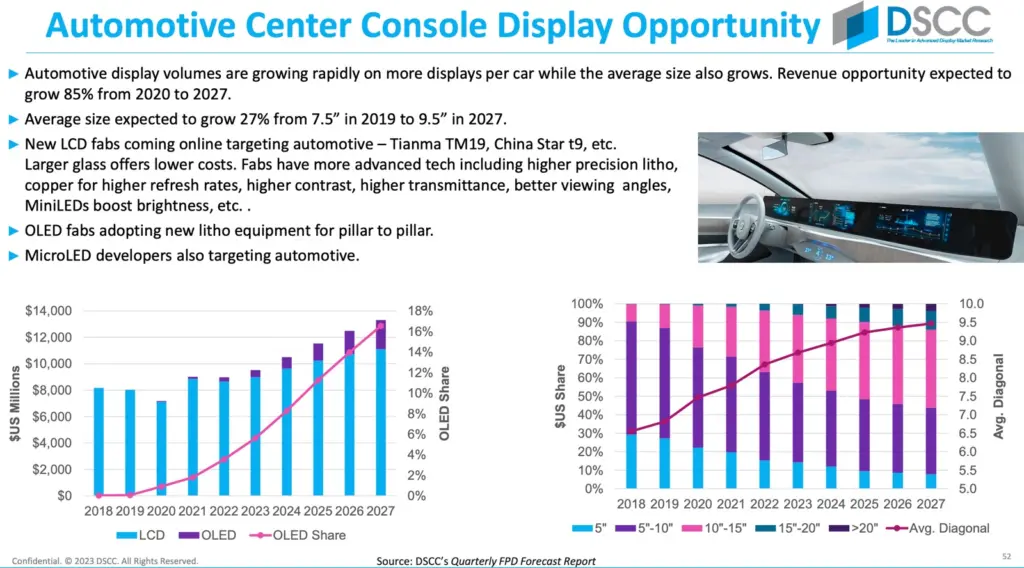

The other big factor is the state of the display industry itself. All the applications that have driven growth and development over the last couple of decades – notebooks, monitors, TVs, tablets and smartphones – have all got fairly depressing growth forecasts. Add to that the problems for the Taiwanese makers, in particular, that have been squeezed by bigger Chinese players in TV but have not been able to develop significant OLED businesses and you can see why automotive looks like a good place to go.

The reality, given my experience as a supplier to the automotive industry both in raw materials and displays (decades ago but ‘a leopard doesn’t change its spots’), was that they are really really hard to please, but at the same time they make tough technical demands while paying as little as possible and wanting the maximum supply chain flexibility and longevity. It’s not easy, and the challenges of enabling great display performance in the huge range of different automotive environments is still a long way from being completely solved.

Although it’s a difficult market, if you are a committed and a long term supplier, there is business to be done and the market does have the capacity to grow.

At the SID/DSCC Business Conference at Display Week 2023, Ross Young presented this overview of the opportunity which showed (gasp!) revenue growth!

As the song (nearly) says ‘the very things that make you rich, make you poor.’ The difficult technical demands of the auto makers have helped to drive the technology development of suitable displays.

The vehicle designers also want to get away from the flat and rectangular shapes that the display industry likes to make. So a number of technology developments have helped the integration of electronic displays.

LCD Challenged

LCD was initially challenged in terms of the speed of the displays and the temperature range that the displays could support. A liquid crystal is somewhere between a liquid and a solid so it’s not, perhaps, surprising that temperature should be critical. At high temperatures, often seen in car interiors, you can have problems losing contrast as the material changes its properties (reaching its clearing point), while at low temperatures LCDs tend to react very slowly – not ideal if you are barreling down the highway!

Temperature issues have been improved by better materials and by the ‘brute force’ approach of using heaters to raise the temperature in very cold conditions.

Other challenges for LCD are in achieving the level of flexibility in shape that designers might like. Making curved LCDs, even with a curve in just one plane, is not trivial and in two planes is really difficult. Although you can make ‘free form’ LCDs of different shapes, that can be expensive and auto makers have tended to stick to simple rectangles. The makers would like to hide that choice. If the panel doesn’t have a low enough black level, the rectangular shape can become apparent because of a glow from the backlight, so there have been developments to use miniLED backlights or even dual panel LCDs to give extreme contrast, allowing the edges of the display to be effectively hidden when the display is behind a dark cover glass.

OLEDs Appear

OLEDs have had different challenges. They can (relatively) easily be curved and have the deep blacks that makers would like, but struggled with enough output in high ambient light and also from ‘burn-in’ like most emissive technologies (especially with the high output and at high temperature).

OLEDs in vehicles are not new. In 2000, I bought a Toyota Celica that had an OLED fuel gauge and I fitted a Pioneer radio that used a color passive OLED. The fuel gauge was noticeably much dimmer by the time I moved on from the car around 2014 and the radio was also dimmer.

The solution to this problem was ‘tandem OLEDs’ that used double stacks that have the advantage of stressing the materials less, extending the lifetime, and also boosting the output. That adds cost, but LG Display developed the technology and managed to get it qualified for automotive use, albeit in the luxury segment only because of the high cost. All the expected boosts to OLED performance in the next few years will make a big difference to outputs and lifetimes.

MicroLED on the Horizon

Automotive is one of the technically ideal applications for MicroLED. The technology is potentially very robust, with a long life and great performance and output. It can also be made on transparent, flexible and even stretchable substrates. What’s not to like? Well, sadly, the cost is a big challenge. However, AUO, LGD and others are trying very hard to get the market for automotive MicroLED displays started.

MicroLEDs have the advantage that it should be possible to build them on a ‘sparse matrix’ i.e. with only a very small part of the display area actually devoted to the LED itself. The space between the LEDs can be used for a range of different sensors, for example, under display cameras for driver monitoring.

It seems almost inevitable that one day in the medium term future MicroLED will be the display of choice for all the better cars on the market, although cost will remain a barrier for anything but the luxury segment for a long time, I suspect.

3D Finally Finds a Use

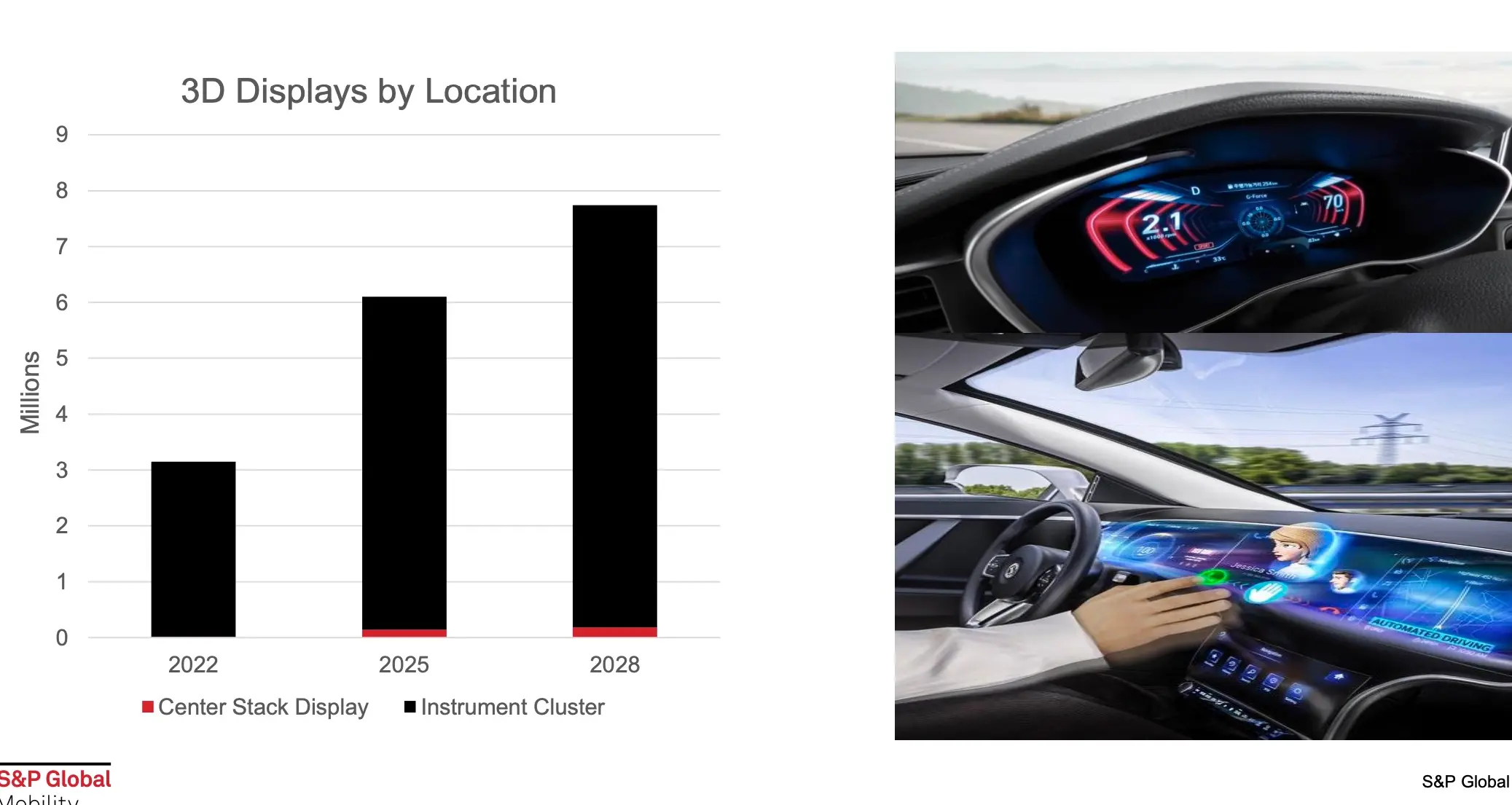

S&P highlighted that 3D displays will see wide adoption in coming years. Finally, after so many false starts, the idea might have found an application where it adds real value. Image depth is a key part of what humans see, so in a vehicle where you want the maximum information in the shortest possible time, its use and adoption seems logical to me.

Hiding the Display

Auto makers like the idea of hiding the display when it’s not in use and Display Daily has been reporting on this for a while. Continental has used the name Shytech for the concept and at Display Week, I spotted other makers using this as a generic term for the idea, which may not please the firm’s marketing department! Makers like the idea that the surface looks like wood or leather when the display is not being used. There were a number of approaches at Display Week responding to this desire.

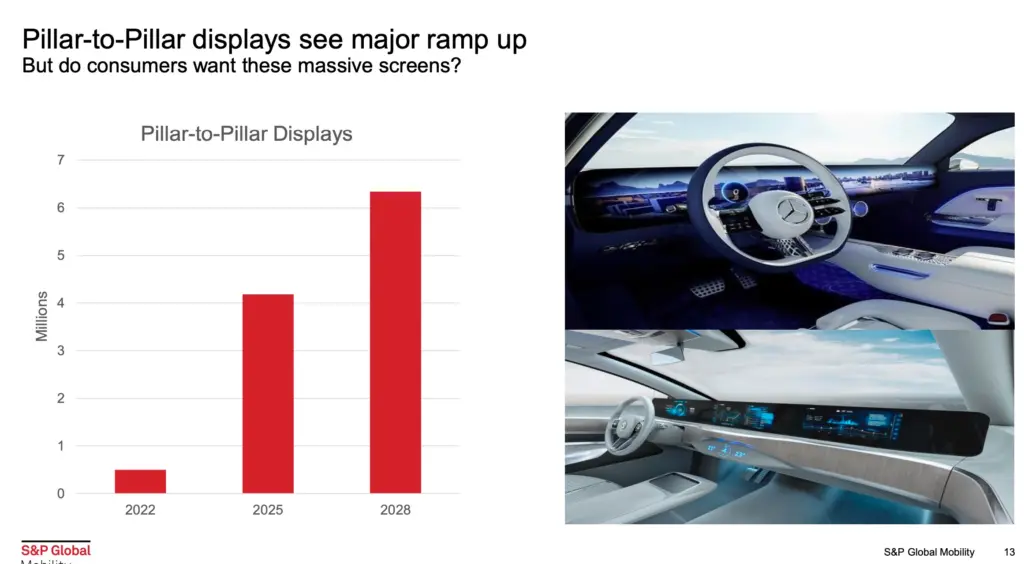

Combining Displays

If you can make one big continuous ‘pillar-to-pillar’ display, that’s ideal, but if you can’t (and it’s not easy), it’s possible to mount a number of displays behind a single cover glass and supply it as a single part to a car maker – a popular option for makers according to S&P at the Business Conference as it reduces the maker’s assembly costs. The idea also allows different technologies to be mixed inside what appears to be a single display. For example, you might use an OLED for the instruments while using an LCD with privacy functions in front of the passenger.

Blocking the Images

In some regions of the world, you cannot allow a driver to see video content, for example, when the car is moving. Different approaches either separate the views for the driver and passenger all the time or allow disabling of the image from the driver’s set when the car is moving. There are a number of different approaches to this challenge and several were on display at Display Week.

HUDs

I remember talking to a General Motors executive who told me, several years ago, that his firm was convinced that once you have used a good HUD system in a vehicle, you don’t want to go back and S&P confirmed that trend during the Business Conference. He was convinced that, eventually, nobody would need the instrument cluster any more, but the challenge was to persuade buyers that they really didn’t need one. It might only ever have been used in the showroom.

AR HUDs that also add road condition information to the readout from instruments are going to be the big growth area for the next few years, starting from now, S&P believes.

And all of that is without looking at the opportunities in rear seat displays – a full topic on its own!

Display Week 2023 and Automotive Displays

I had intended to be covering the displays shown at Display Week 2023, but my introduction ran away with me. I’ll be back with Part II – An Explosion in Creative Design where I will look at what was shown.

Bob Raikes is semi-retired from the display industry, but still edits the 8K Association newsletter and contributes to Display Daily. He attended Display Week 2023 for Display Daily and others.