As smartphone panel selling prices continue to fall, display manufacturers are focused on finding ways to reduce production costs, in order to eke out profits.

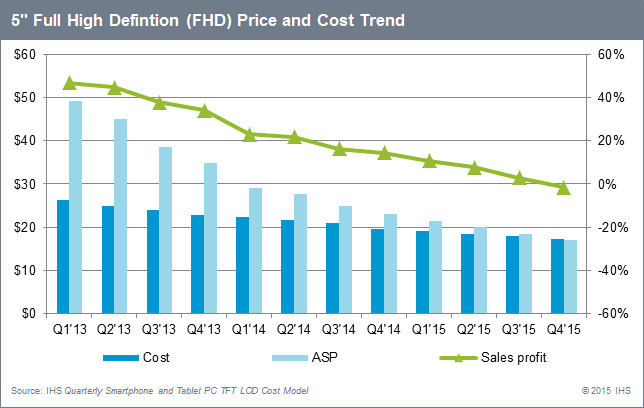

For example, five-inch full-high-definition (FHD) mobile phone panels experienced a drastic year-over-year unit-shipment decline of 34 percent last year, but manufacturing costs fell only 14 percent. If current price trends continue, manufacturing costs for five-inch FHD panels are expected to reach the break-even point by the end of this year, according to IHS Inc. (NYSE: IHS), the leading global source of critical information and insight,

“Prices for TV panels have remained relatively flat since last year, but smartphone panel prices have been continuously falling during the same period,” said Jimmy Kim, principal analyst and researcher for IHS. “Growing numbers of panel makers are increasing their production allocations; however, in the current smartphone market, only mainstream and low-end products show any demand growth at all. Manufacturers are therefore looking at cost-saving measures, in order to bolster their bottom lines.”

With smartphone panel prices falling, some panel makers are replacing low-temperature polysilicon substrates (LTPS) with oxide semiconductor substrates. Others are reducing costs, by introducing multi-chip LED packages, RAM-less driver integrated circuits (ICs), composite optical sheets and other cost-effective component solutions.

Although panels for premium smartphones are becoming saturated, some panel makers are still expected to increase their capacity allocation for smartphone panels, since demand for mainstream and low-end products shows growth. This situation will, however, add pressure to lower prices for cost-competitive products.