As the biggest buyer of mobile displays, Apple’s recent decision to halt production of the M2 series chipsets for MacBooks should have been a big red flag. According to Korean media, the production was stopped in January and February this year, and while it has partially restarted, levels remain low. Add to this the fact that despite the trend of other suppliers committing to OLED displays for laptops, Apple has not yet committed its MacBooks. This is in contrast to several other laptop brands, including Lenovo, HP, Dell, Asus, and Huawei who have already adopted OLED displays for their high-end or flagship laptops in the consumer gaming and high-end business segments.

Then, there’s the smartphone end of the business. Apple is the dominant brand in the market. However, it has not been immune to macroeconomics, and it says were down, just like everyone else.

| Company | 4Q22 shipment volumes* | 4Q22 market share* | 4Q21 shipment volumes | 4Q21 market share | Year-over-year change* |

| 1. Apple | 72.3 | 24.1% | 85.0 | 23.1% | -14.9% |

| 2. Samsung | 58.2 | 19.4% | 69.0 | 18.8% | -15.6% |

| 3. Xiaomi | 33.2 | 11.0% | 45.0 | 12.2% | -26.3% |

| 4. Oppo | 25.3 | 8.4% | 30.1 | 8.2% | -15.9% |

| 5. vivo | 22.9 | 7.6% | 28.3 | 7.7% | -18.9% |

| Others | 88.3 | 29.4% | 110.2 | 30.0% | -19.8% |

| Total | 300.3 | 100.0% | 367.6 | 100.0% | -18.3% |

But that’s only because the Android phone market is so fragmented. The actual market for iOS devices is lagging in growth behind Android.

| OS | 2023 shipments | 2023/2022 growth | 2026 shipments | 2026/2025 growth | 5-Year CAGR |

| Android | 1036.9 | 3.1% | 1145.7 | 2.5% | 0.4% |

| iOS | 233.5 | 1.3% | 247.5 | 1.9% | 1.0% |

| Total | 1270.3 | 2.8% | 1393.2 | 2.3% | 0.5% |

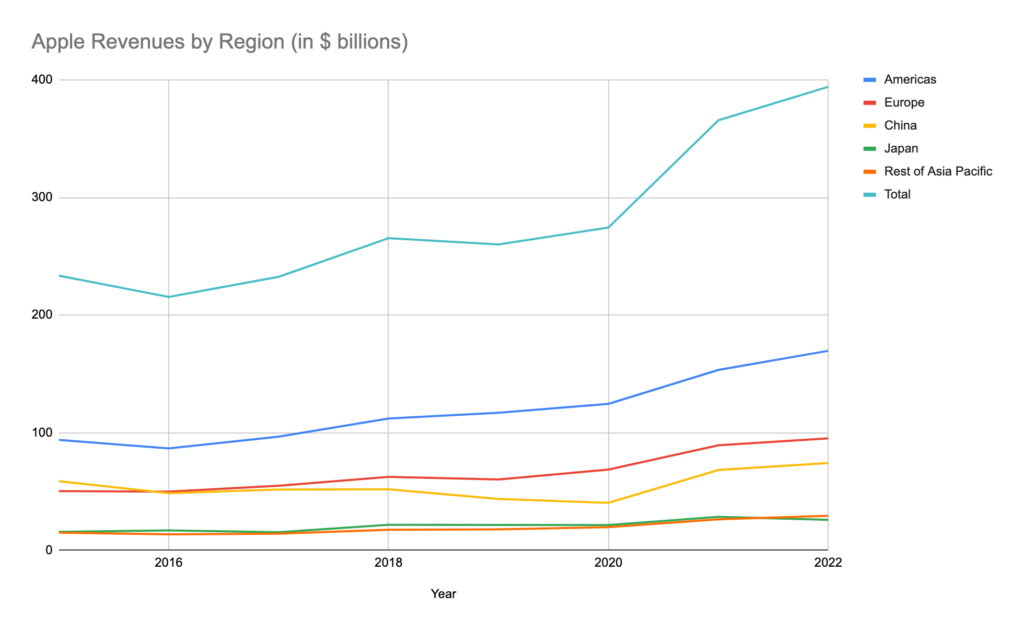

It’s also safe to say that Apple is mostly reliant on the generosity of more affluent customers, mostly in the US and Europe, and that’s where the company experiences its biggest growth rates. It doesn’t negate other regions, but with half of Apple’s business, and a market that is highly localized and fickle, the US makes it own demands on Apple’s future plans, and is the dominant influence. Apple’s the new Coke, a worldwide brand that is a sort of flagship for America. Even though that can sometimes be a detriment to growth, as I am sure it is in Asia, for instance, where the mystique of Apple doesn’t necessarily hold as much sway as it does in America and Europe.

The great downturn hits Apple like everyone Else

So, Apple is taking a hit just like every other company, but it is buoyed up by an incredibly well-organized, well-managed, and profitable supply chain. In the middle of this downturn Apple is also looking at making significant changes—a mixed reality headset, a transition to OLEDs for all mobile devices, and most importantly, the enormous task of reorganizing its hitherto years-in-the-making-supply-chains to remove reliance on supplies from China.

It is probably prudent for Apple to shift timelines and back-off any grand schemes or significant changes to its products, even at the expense of losing some of the luster on new product launches in 2023. It’s the confluence of events—market downturn, taking decades of supply-chain build up and distributing them across the globe rapidly, and the need to maintain the glow of invincibility by maintaining profits and margins—that means Apple can shift its focus to 2024–25 to do things that it may have done in 2023. That would have meant OLED MacBooks. That could mean some sort of foldable or flexible mobile product, or an upgrade to Apple displays, a product line that is woefully inadequate by comparison to other product lines.

Apple could, by virtue of its buying power, accelerate manufacturing and pricing parameters for OLEDs. It may not want to because it doesn’t need to. It doesn’t want to necessarily be reliant on Samsung, and to some extents LG, for its supplies. It has to drag its Chinese suppliers into Vietnam, and now Thailand, apparently, and navigate the geopolitics of the US–China relationship on technology. Apple is still the single most important buyer of displays, and as such, it can shift the timelines of the whole industry, as well as whole factories. I tend to be phlegmatic on Apple’s headset but it is also a good time for the company to float one out there and see what happens. It’s not a volume product, by Apple standards. It doesn’t impact the need of the company to address its core product revenue streams, and maintain its market position, and it keeps Apple in the headlines, and distracts everyone from the fact that Apple isn’t really doing much that is revelatory this year. Or, maybe, this is just the new normal for the company.

What Apple is going to miss out on is OLED laptops. Apple is going to miss out on the emergence of foldables. It may not care, and the technologies involved may not live up to its standards. That’s not going to be the way the rest of the industry is going to see it. It may be that an iPhone beater will emerge during this transitionary period, and it will only take one decent smartphone with a flexible display to create a new fashion for what is, in essence, a stylish accessory as much as it is a smartphone.