Wei Chen, Apple VP display products, announced that Apple would use its own microLED display in the Apple Watch and that in the future it would extend to smartphones tablets and even MacBooks. This week, Ross Young of DSCC chimed in to confirm LG Display will begin production of microLED displays starting in the second half of 2024, giving it enough time to produce panels for Apple to release a microLED Apple Watch in 2025, not the 2024 window that had previously been suggested. Apple rarely adopts new technology earlier than rivals, possibly to reduce the risks. It was a latecomer when it comes to OLED, so to be the first to adopt microLEDs is totally out of character and appears to be a way to test the market acceptance before a wholesale adoption of the technology.

Industry sources report that Apple could be working with a Malaysian company it has invested. The Malaysian company could produce the LED chips while the backplane and module production would be provided by LGD. Both Samsung Display and LG Display declined to comment on their possible partnership with Apple on microLED production, as well as the client’s possible discontinuation in using their OLED panels. The microLED display is expected to be introduced in the high end Ultra model or Apple could possibly create a new price point with an Ultra Pro model, given that a microLED could be 3to 4x the cost of an OLED.

The 2.1” OLED used on the Ultra, which according to Counterpoint’s BOM analysis costs ~$17.50. A recent report from the MicroLED Association expects the display to be populated by 10×10 µm2 LEDs, with 5 µm spacing producing a pixel pitch of 30 µm x 45 µm

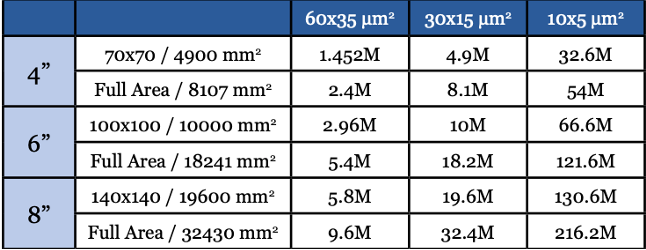

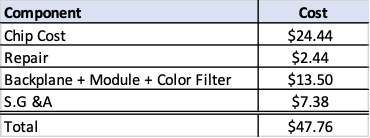

Apple’s Watch Series 8 has a resolution of 448×368 pixels, or 494,592 LED chips. The MicroLED Association assumed the use of 6” wafers with a blue LED epiwafer LED stack that complete with chip processing, costs about $2,500. A single 6” wafer with a usable area of around 16,000 mm2 will produce 61.8 million LEDs with the area of each chip (plus the spacing) about 0.0002353 mm2 or 235.3 um2. A 10×10 um2 chip is an attainable size with today’s technology, although it requires very fine chip handling and other related technologies. Assuming today’s MicroLED yield of ~90% and 10% redundancy, a comparable Apple Ultra would require 604,501 chips, each costing $0.04043/thousand or $24.44 per panel. In addition the process would have to absorb the transfer costs, the repair and or the replacement of chips failing during the transfer, estimated at ~10% or $2.44. The backplane and the module accounts for ~$10.00 so the total cost of the display is estimated to be $47.76 or about 2.7x the cost of a comparable OLED, as shown in the next table.

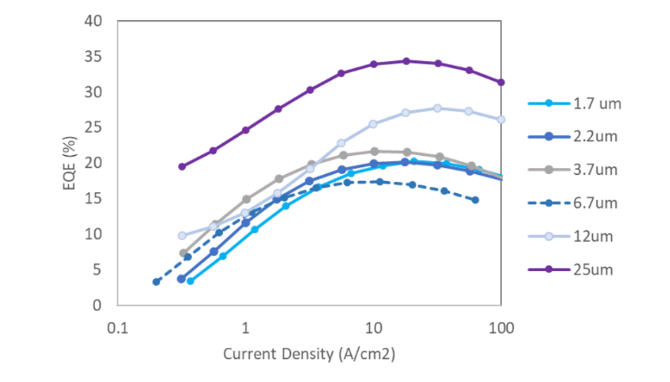

The promise of the microLED is both increased brightness, which could be beneficial to customers using the watch outdoors and increased time between charging. However, the average EQE for RGB OLEDs is ~30%, while a 10×10 µm2 blue microLED has an EQE of 20% at a current density of 5 A/cm2. Adding the loss from a color filter would reduce the EQE for the microLED to around 10%.

The benefit of using microLEDs would be higher contrast, the ability to achieve a higher luminance in bright ambient conditions, but the power consumption will likely be higher than OLEDs at most luminance levels.

Apple isn’t the only company taking a look at microLED technology for its wearables. A new report has Samsung Display considering building a microLED fab for Samsung watches and in China, BOE, CSoT, Tianma and Visionox are all reportedly building microLED fabs.

There are alternative approaches to fabricating a full color microLED, including

- Blue LEDs that are converted to white using phosphor of QD film (similar to miniLED displays,) augmented by a color filter. The LEDs are mass transferred using a stamping technique as provided by X-Display. We chose to use this concept in developing the display costs.

- Growing RGB LEDs, on separate wafers and then transferring (stamping) them unto an interim wafer to create the RGB pattern, and then mass transferring the pattern unto the substrate. The positives for this approach are the elimination of the color filter and its 50% luminance loss. The down sides are 1) the two-step mass transfer and the accompanying lower yield and higher repair cost, 2) the lower EQE for red and green, which offsets the benefits of no color filter and 3) a more comprehensive design for redundancy

- Blue LEDs that are transferred (stamped) to a substrate, converted to red and green using QD’s, while a blue sub-pixel allows the blue light to flow thru, similar to the way Samsung’s QD-OLEDs are constructed. Since SDC is the only company with the technology, this approach is unlikely to be used by LGD.

Wei Chen mentioned the extension of microLEDs to smartphones, for which the iPhone 14 Pro Max has a resolution of 2796×1290, or ~11m sub-pixels. Using 10×10 µm2 LED chips that would cost $4,374 if grown on 6” wafers. Clearly, this is not feasible, but using a smaller die, 1×1 or 3×3µm2 and an 8” wafer would significantly reduce the LED cost.