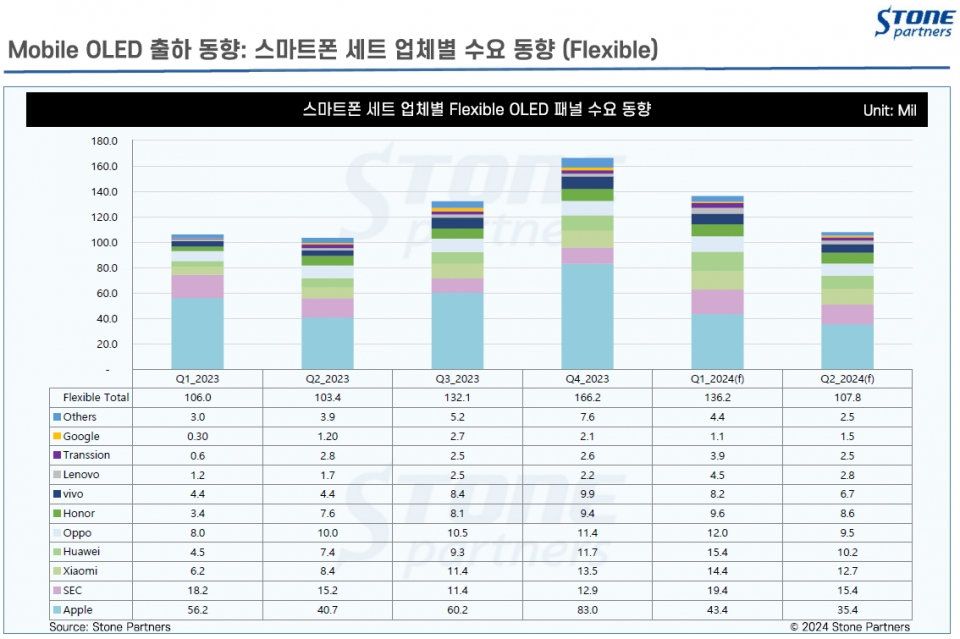

In a significant shift in the smartphone industry’s OLED panel demand, Apple has experienced a 19% decrease in its orders for the first half of 2024, compared to the same period last year. According to a report by market research firm Stone Partners via The Elec, the tech giant’s requirement dropped to an estimated 78.8 million units, down from the previous year’s 96.9 million units.

| Company | Q1’23 | Q2’23 | Q3’23 | Q4’23 | Q1’24(f) | Q2’24(f) |

|---|---|---|---|---|---|---|

| Flexible Total (in millions) | 106.0 | 103.4 | 132.1 | 166.2 | 136.2 | 107.8 |

| 3.0 | 3.9 | 5.2 | 7.6 | 4.4 | 2.5 | |

| Transsion | 0.3 | 1.2 | 2.7 | 2.1 | 1.1 | 1.5 |

| Lenovo | 0.6 | 2.8 | 2.5 | 2.6 | 3.9 | 2.5 |

| vivo | 4.4 | 4.4 | 8.4 | 9.9 | 8.2 | 6.7 |

| Honor | 3.4 | 7.6 | 8.1 | 9.4 | 9.6 | 8.6 |

| Oppo | 8.0 | 10.0 | 10.5 | 11.4 | 12.0 | 9.5 |

| Huawei | 4.5 | 7.4 | 9.3 | 11.7 | 15.4 | 10.2 |

| Xiaomi | 6.2 | 8.4 | 11.4 | 13.5 | 14.4 | 12.7 |

| Samsung | 18.2 | 15.2 | 11.4 | 12.9 | 19.4 | 15.4 |

| Apple | 56.2 | 40.7 | 60.2 | 83.0 | 43.4 | 35.4 |

While Apple’s demand wanes, competitors Samsung, Huawei, and Xiaomi are on an upward trajectory, indicating a changing landscape in high-end smartphone preferences. Samsung’s demand for flexible OLED panels saw a modest increase of 4%, attributed largely to the successful launch of its Galaxy S24 series.

Huawei, on the other hand, witnessed an unprecedented surge in demand, with a 115% increase in orders for flexible OLED screens, reaching 25.6 million units. Xiaomi also reported significant growth, with an 86% rise in demand, amounting to 27.1 million units. These figures not only highlight Huawei and Xiaomi’s expanding market presence but also suggest a shift towards high-end smartphones in key markets like China.

Overall demand for flexible OLED screens from smartphone companies worldwide is expected to hit 244 million units in the first half of the year, marking a 17% increase from the previous period. The emergence of low-cost flexible OLED panels, under $20, is a key factor driving this trend, with many smartphone models transitioning away from traditional LTPS LCD and rigid OLED screens.