Recent data from Cinno Research shows a softening in the Chinese smartphone market, with sales predicted to dip by 2% in 2023, amounting to 250 million units. This decline reflects a range of factors from a weak economic recovery, a prolonged consumer demand slump, and extended replacement cycles.

With tepid consumer demand, premium smartphones have emerged as the only bright spot for smartphone manufacturers. Sales of high-end smartphones priced above 5,000 yuan ($684) were 23% of the market in the first half of 2023. Apple has been a dominant player in this segment, capturing 75% of this high-end market. To provide some historical perspective, in 2020, post the US restrictions on Huawei and subsequent challenges faced by the Chinese tech giant, these premium phones represented only 11% of the market, with Apple holding 48% of that slice.

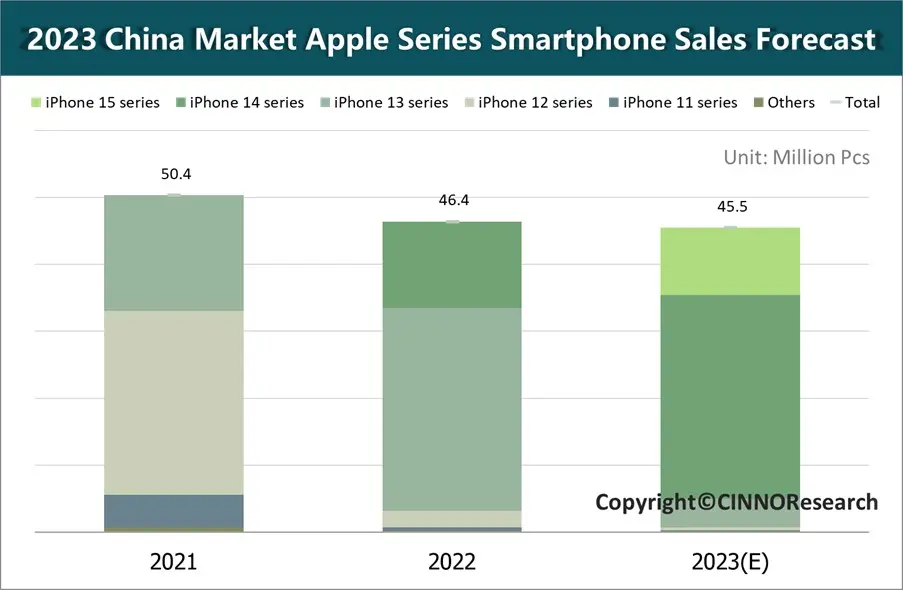

Apple’s four new models – iPhone 15, 15 Plus, 15 Pro, and 15 Pro Max – reportedly lack substantial upgrades from the previous generation, and Cinno is predicting challenges ahead for Apple in China, particularly with home team, Huawei, jumping into the market with its own Mate 60 Pro. Apple’s 2023 sales in the Chinese market might hover around 45.5 million units, marking a 2% year-on-year decrease. Cinno is predicting the iPhone 15 series to sell approximately 10 million units in 2023, a 22% decline, or a drop of roughly 2.9 million units, compared to the iPhone 14 series.