It was the 19th century Habsburg era diplomat Prince Klemens von Metternich who once said, “When France sneezes, Europe catches a cold”. Well, it’s a different viral strain, but that’s pretty much what seems to be going on since China caught the virus and we move deep into the first quarter of 2020. Both in the smartphone, and just about every other market, the effects of China’s malaise hits world markets hard and we may begin to question all things “made in China”.

Things were humming along smoothly in the smartphone market back in 3Q-19, as worldwide vendors hit a total of 358.3 million units in the quarter, boosting YoY growth by almost 1 point (0.8%) over the 2018 number (332.7 M units.) Perhaps most importantly, this growth reversed the seven quarters, (yep, 21 months) of decline for the global smartphone market. 4Q-19 also saw an uptick of almost 3 points (2.9%) over 3Q with real unit volume shipments to 368.8 million units, according to IDC quarterly mobile phone tracker cyphering.

In January, 2020 the IDC vendor data overview said:

Worldwide smartphone shipments decreased 1.1% year over year in the fourth quarter of 2019 (4Q19), according to preliminary data from the IDC Worldwide Quarterly Mobile Phone Tracker. While the past several years have delivered flat growth, 2019 volumes dropped to levels below annual shipment levels between 2015 and 2018. From a geographic standpoint, almost all the market showed (a) positive trend when compared to the last quarter. China witnessed a slight QoQ increase in the period suggesting some recovery is underway in the world’s largest single market.

Apple had a strong fourth quarter, worldwide. as the company pushed past rivals to top the charts in the heavily gifting Christmas buying season period. The company shipped 73.8 million iPhones and grew YoY almost 8% on the back of iPhone 11 sales and the “value” option, the iPhone XR, as the company got creative with both trade-in’s and financing options to take the sting out of its higher prices.

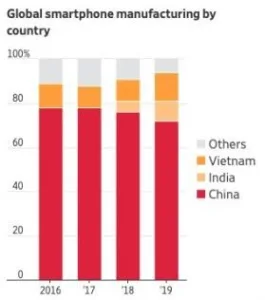

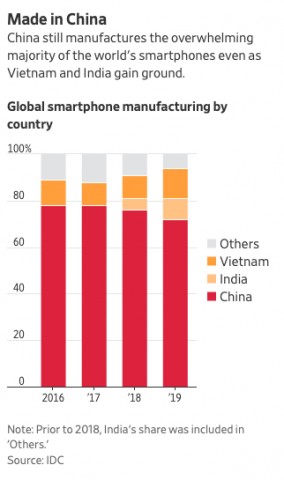

But Apple seems particularly vulnerable to the flu outbreak, as it’s reliance on China as the vortex of most all its manufacturing, and the greater China region hit $44 billion in sales last year, (includes HK and Taiwan) representing a whopping one-in-five (20%) of total revenue for Apple, according to the WSJ.

The company said its own iPhone (and other product) revenue predictions (between $63B and $67B) will suffer this quarter, with the double punch of both limited iPhone production impacting world-wide sales and reduced domestic Chinese demand for its products. Ouch. Apple stock shed $100B by March 2nd.

Also in 3Q19, we saw further industry consolidation in smartphone devices with the top five vendors including Samsung, Huawei, Apple, Xiaomi, and China’s Guangdong-based Oppo, represented a whopping 71% of the total market volume, and the top 10 vendors collecting almost 20% more (for 90% in total), according to the late January IDC report.

Also in 3Q19, we saw further industry consolidation in smartphone devices with the top five vendors including Samsung, Huawei, Apple, Xiaomi, and China’s Guangdong-based Oppo, represented a whopping 71% of the total market volume, and the top 10 vendors collecting almost 20% more (for 90% in total), according to the late January IDC report.

So, the recent viral outbreak is significantly influencing worldwide markets, with companies that bet big on China (i.e. Apple) facing the ripple effects. Positive outcomes include having the world re-assess, question and begin to shift from an all things “made in China” policy, as our worldwide dependence on a nation, not so transparent (OK. fiscally and politically opaque) and certainly not as forthcoming as a “world trade partner/supplier” needs to be. My take is buy Apple stock while the prices are down (OK lower) as this too shall pass, and we look to other geographies long term. – Stephen Sechrist

Coronavirus Disrupts Display Panel Production in China, Spurring Supply Shortfalls and Rising Prices

China’s Smartphone Market Narrowed its Decline to -3.6% in Q3 2019, IDC Reports

Strategy Analytics: Apple Becomes World’s No.1 Smartphone Vendor in Q4 201