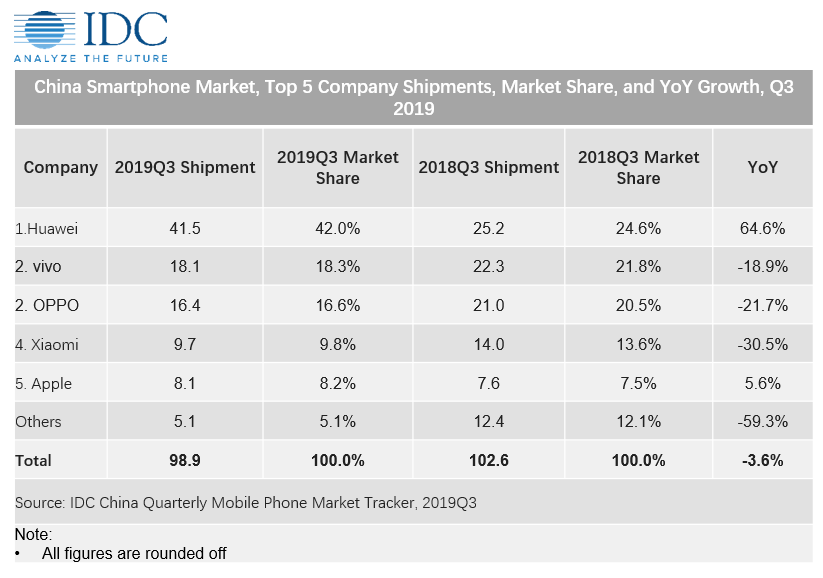

According to IDC’s Quarterly Mobile Phone Tracker, smartphone shipments in China stood at 98.9 million units in the third quarter of 2019, down 3.6% year-on-year. This marked a narrower decline than the first half of the year, in part due to Huawei’s strong performance.

“Huawei gained share at the expense of almost all other market players,” says Will Wong, Research Manager for Client Devices at IDC Asia/Pacific. Wong adds, “Still, Apple was able to buck the trend with its competitive pricing strategy and brand name – in spite of US-China trade tensions and the lack of a 5G model.”

• Huawei’s market share reached a record high of 42.0% with its increased brand appeal and strong channel partnerships. While the Changxiang and nova series were the volume drivers, the high-margin Mate and P series provided attractive channel margins. This strategy played a crucial role in sustaining Huawei’s performance in China.

• vivo continued to focus on the US$150-200 and US$200-400 segments with its Y and Z series. The iQOO series also fueled the vendor’s performance by targeting tech-savvy users, while its competitively priced 5G model successfully garnered attention in the market.

• OPPO was still in the process of refining the positioning of its new Reno series during the quarter. As such, its A series continued to be the vendor’s main driver – particularly in the low-end segment. The vendor focused on 4G smartphone demand, but also implemented inventory controls to prepare for the expected 5G boom in 2020.

• Xiaomi declined significantly during the quarter, as the vendor continued to face challenges around internal organizational changes, offline channel management, and brand differentiation between Mi and Redmi.

• Apple achieved a 5.6% year-on-year growth by offering competitive pricing and notable improvements in camera and battery life for its new iPhone 11 series. In addition, the new entry-level model shipped one quarter earlier this year, thus also supporting the year-on-year growth rate.

“4G inventory began to build in China as consumer attention was increasingly diverted toward 5G devices instead. However, consumers are also waiting for 5G smartphones to reach mid-range and mainstream prices, which means that replacement cycles are lengthening,” says Xi Wang, Research Manager for Client System Research at IDC China. Wang adds, “Managing 4G channel inventory will be crucial while transitioning towards the 5G era.”