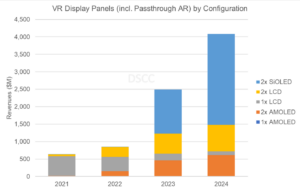

Revenues for AR/VR displays will total $942M in 2022, according to the latest issue of the Biannual Augmented and Virtual Reality Display Technologies and Market Report. Despite the current global economic downturn, the long-term outlook for AR/VR displays remains positive, with revenues expected to grow at a compound annual growth rate (CAGR) of 50.7% and reaching $7.3B by 2027.

2022 has been a challenging year for AR/VR device makers, with Meta lowering its sales target and Sony pushing the release of the PlayStation VR2 until February next year. Total device shipments for headsets and smart glasses are still expected to increase by 11.5% compared to 2021. DSCC notes that AMOLED panels have already started shipping for the Sony headset, so they contribute to this year’s panel revenues.

Display Panel Revenues (VR and Passthrough AR)

The panels in the PlayStation VR2 will reach 850 PPI, a significant increase over the 615 PPI that was available on previous AMOLED headsets, such as the Oculus Quest 1 and the HTC Vive Pro. DSCC’s Guillaume Chansin, Director of Display Research stated, “We believe Samsung Display has developed a new process to achieve this level of pixel density. One can speculate that the patterning technology is based on photolithography, although advanced FMM is also possible (as presented by APS Research during the AR/VR Display Forum). It remains the be seen whether other brands will adopt high resolution AMOLED for future headsets.”

LCD still easily beats AMOLED on pixel density. The recently launched Meta Quest Pro and Pico 4 feature panels with 1050 PPI and 1200 PPI, respectively. Some LCD panel makers have even demonstrated over 2000 PPI. To go beyond that, it becomes necessary to use microdisplays made on CMOS silicon backplanes.

Flagship VR Headsets

We expect that OLED on Silicon (SiOLED) microdisplays for the Apple headset will start shipping next year. The device is expected to be a high-end headset targeted at developers and professionals. Apple will most likely release a more affordable headset for consumers afterwards, but there is some uncertainty about the display configuration. We assume that Apple will stick to SiOLED and will push suppliers to lower the cost of the displays. Meta may also consider SiOLED technology for the second generation of the Quest Pro. Under this assumption, SiOLED revenues could reach as much as $1.3B next year and double in 2024.

For see-through AR, most companies developing advanced smart glasses appear to be betting on MicroLED technology, with the exception of Magic Leap which adopted LCoS. Meta was one of the first to recognize the importance of MicroLED and has been investing in the technology for several years. Vuzix is still planning to release its first MicroLED smart glasses, although they will only show monochrome images. Earlier this year, it was revealed that Google acquired Raxium, a startup developing full color MicroLED displays.

Several Chinese brands are offering so-called Smart Viewers, based on birdbath optics instead of waveguides. These devices are currently using SiOLED displays to allow users to project virtual monitors to watch videos, play games or even work on documents. Considering that SiOLED will be used in both AR and VR devices, we expect that SiOLED will have the largest market share of AR/VR displays from 2025 onwards.