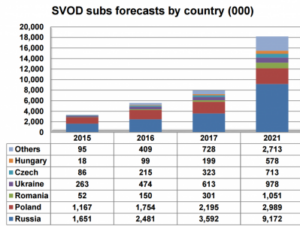

Eastern Europe will have 18.19 million paying SVOD subscribers [for TV episodes and movies – excluding sports, for example] across 18 countries by 2021, up from 3.33 million at end-2015 and 5.58 million by end-2016 – almost sextupling between 2015 and 2021, according to Digital TV Research.

The Eastern Europe SVOD Forecast estimates that Russia accounted for 44% of the region’s SVOD subs in 2016, with this proportion slowly growing to half the total by 2021. From the 12.61 million SVOD additions between 2016 and 2021, Russia will supply 6.69 million.

By 2021, the top five SVOD platforms will account for half of the region’s SVOD subscribers. Netflix (3.50 million subs) will be the leader, followed by Russia’s Ivi (2.43 million), Megogo (1.32 million in Russia and the Ukraine), Russia’s Okko (1.08 million) and Poland’s Ipla (0.90 million).

Simon Murray, Principal Analyst at Digital TV Research, said: “Netflix launched across the region in January 2016, with some success. However, many consider the platform to be expensive. Netflix requires customers to pay with credit cards and in dollars or Euros, despite low levels of credit card ownership in Eastern Europe. Furthermore, most of Netflix’s content is in English, with little local fare. At launch, Netflix had no local distribution partnerships.”

Murray continued: “However, the company adapted its strategy during 2016. It now has non-exclusive distribution agreements with Liberty Global (owner of the UPC cable networks in Czech Republic, Hungary, Poland, Romania and Slovakia) and Telia (active in the Baltic States).”

“Netflix also made a significant effort to localize its Polish platform. However, Digital TV Research does not think that Netflix will make much effort to localize its platform elsewhere – including in Russia. The Russian government is hostile to foreign media companies. Furthermore, Russia has the region’s most developed SVOD sector, with several large players offering a lot of local content.”