Global shipments of augmented reality (AR) and virtual reality (VR) headsets edged back into growth territory during the third quarter of 2024, reversing two consecutive quarters of decline. The increase, estimated at 12.8% YoY, was largely attributed to strong gains by Meta, according to new figures from the IDC.

Meta secured a dominant position in the market, accounting for more than 70% of all units shipped during the quarter. This upswing followed what had been a soft period in the year-ago quarter, when shipments slipped by nearly 23% as Meta wound down sales of its Quest 2 model. The long-anticipated release of the Quest 3, along with an expanded range of content and time-limited discounts such as Prime Day promotions, appears to have revitalized Meta’s presence in the sector. As long as Meta keeps throwing money at VR and AR, there is a market.

Sony’s PlayStation VR2 took the second spot with a 6.7% share, supported by interest from the PC gaming community and sales incentives. Apple, ByteDance, and Xreal filled out the rest of the top five, making up a field that together accounts for more than 90% of all AR/VR headset shipments.

Still, the report suggests that not all players may be committed for the long haul. Jitesh Ubrani, research manager at IDC, noted that Sony and ByteDance appear to be pulling back from the market as their shipments slow, potentially clearing space for competitors like Xreal and Viture, which have made strides appealing to gaming audiences and integrating more sophisticated hardware and software.

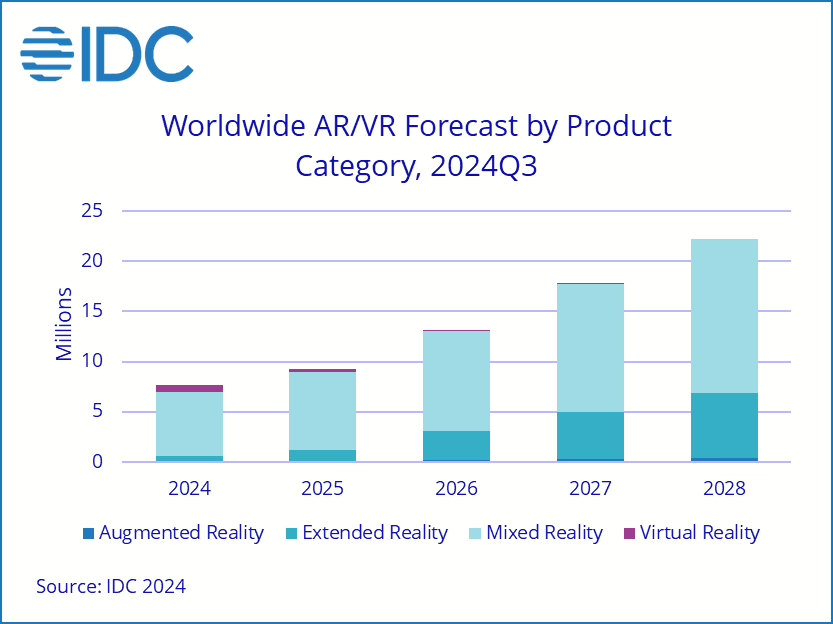

One bright spot in the broader AR/VR ecosystem has been the rise of mixed reality (MR) devices. These headsets, which blend digital elements with the real world, are poised to outpace other categories. IDC forecasts MR headset shipments to climb by more than 20% next year, reaching 7.7 million units. Analysts see this segment as the largest category going forward, with more basic extended reality (XR) devices—those that offer heads-up displays or simple content mirroring—expected to grow rapidly as well.

According to IDC, simple XR devices tethered to a smartphone or other computer platforms could more than double their shipments in 2025. The researchers also anticipate intensified competition as Google reintroduces itself to the market with Android XR. With Apple and Meta still vying for mass-market dominance, the stage is set for a race to define the next generation of consumer and enterprise headsets.

Yet, fully realized augmented reality headsets, exemplified by Meta’s forthcoming Orion project, remain a long-term bet. High battery demands, evolving display technologies, and the complex engineering required mean these devices are unlikely to break into the mainstream soon. IDC’s outlook projects the category will remain small but growing, with shipments rising from an estimated 59,000 units this year to roughly 377,000 by 2028.