Worldwide smartphone sales will grow at a single-digit rate for the first time this year, says Gartner. The firm expects growth of just 7% in the global market, which will reach 1.5 billion units. The total mobile phone market, which includes feature phones, is forecast to reach 1.9 billion units. The news for PCs, however, was more positive.

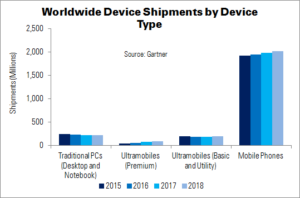

Combined ‘device’ shipments (PCs, tablets, ultramobiles and mobile phones) are expected to equal 2.4 billion this year, up 0.6% YoY. End-user spending (in constant US dollars) will fall by 1.6%, however.

“Historically, worsening economic conditions had negligible impact on smartphone sales and spend, but this is no longer the case,” said Gartner’s Ranjit Atwal. “China and North America smartphone sales are on pace to be flat in 2016, exhibiting 0.7% and 0.4% growth respectively.”

Mature markets are forecast to be largely flat or in decline. Users are likely to hold on to smartphones for longer, as carriers’ deals become more complex. This will be reinforced by technology updates that incremental, rather than revolutionary. In addition, the volumes of users upgrading from feature phones to smartphones will continue to slow; more feature phones are now being replaced by devices of the same type.

The news is slightly more optimistic for emerging markets. Smartphone sales will continue to rise in these regions, although growth will slow. Through 2019, 150 million users are expected to delay upgrades to smartphones in APAC, until the price/functionality combination of low-cost units become more appealing.

Prices are not expected to fall enough this year to drive upgrades from feature phones to low-end smartphones. ‘Good enough’ smartphones still cost more than $50, according to Gartner’s Annette Zimmermann.

New mobile phone growth will come from countries such as India. Sales of smartphones in India are expected to reach 29% in 2016, and double-digit growth will continue through 2018.

In the PC market, 2016 will mark the final year of declines before a return to growth in 2017. Gartner projects a total market of 284 million units this year, declining 1.5% YoY. Traditional (desktop and notebook) PCs will fall 6.7% YoY, to 228 million units, with the remaining 57 million made up of premium ultramobiles.

Atwal said, “The biggest challenge, and potential benefit, for the PC market is the integration of Windows 10 with Intel’s Skylake architecture. It has the potential for new form factors with more attractive features.”

Demand for tablets may weaken, as some consumers and businesses continue to be frustrated by their capabilities. Ultramobile (basic and utility tablet) demand is also expected to slow, down 3.4% this year. Users are extending lifetimes, and some may simply not replace the devices at all through 2016.

| Worldwide Device Shipments by Device Type, 2015-2018 (Millions) | ||||

|---|---|---|---|---|

| Device Type | 2015 | 2016 | 2017 | 2018 |

| Traditional PCs (Desktop and Notebook) | 244 | 228 | 223 | 216 |

| Ultramobiles (Premium) | 45 | 57 | 73 | 90 |

| PC Market | 289 | 284 | 296 | 306 |

| Ultramobiles (Basic and Utility) | 195 | 188 | 188 | 194 |

| Computing Devices Market | 484 | 473 | 485 | 500 |

| Mobile Phones | 1,917 | 1,943 | 1,983 | 2,022 |

| Total Devices Market | 2,401 | 2,416 | 2,468 | 2,521 |

| Source: Gartner | ||||