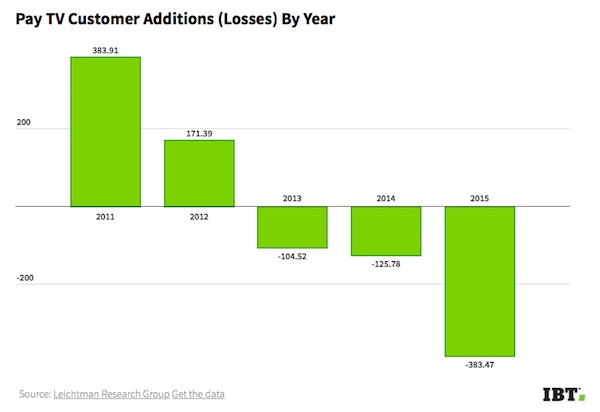

In a recent article, Tom Allen of Display Daily reported on data from the Leichtman Research Group that the cable subscriber base in the US has dropped by about 385,000 subscribers in 2015 (US IPTV Suffers First Decline). This is seen as a continuation of the ‘cable cutter’ syndrome that has been haunting US cable providers for quite some time.

Of course we have to realize that Pay TV is big business and there is more than one research group that is willing to sell its market insights to the various Pay TV operators. Looking at these different research companies, we can see an agreement on the underlying trend, but we do not see an agreement on the quantitative consequence. First of all, here is a short overview.

The results from the Leichtman Research Group show acceleration in the loss of pay TV subscribers over the last few years. With 2013 marking the first year when the pay TV customer additions turn negative; the graph shows this development very clearly.

According to SNL Kagan, the losses were much more substantial than that. They see a decline of over 1 million customers in 2015. This result includes cable, DBS and telco sections of the industry. At the same time, they say that the fourth quarter was rather flat and that the cable cutting trend has slowed considerably. This trend seems to have carried over into 2016, as some providers actually saw an increase in subscribers for the first quarter. SNL also see a different picture for the various segments. Overall, they see a drop of 1.1 million subscribers in 2015 with a slightly stronger decline in the residential customer base.

MSO’s (multiple system operators) lost 599,000 video customers which was the best performance since 2007. Losing subscribers seems to be a much older trend than the recent cord cutting pattern. DBS (direct broadcasting satellite) providers lost 478,000 subscribers compared to a loss of 39,000 subscribers in 2014. The telco segment ended 2015 basically flat, with some shift from certain platforms holding the segment back.

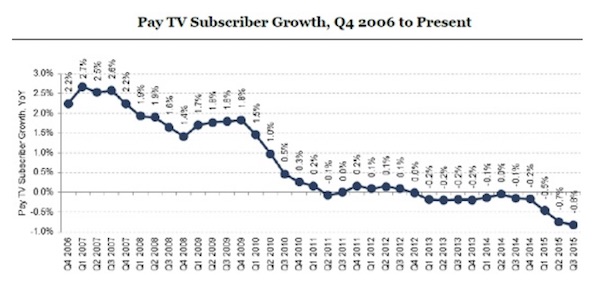

A similar view was shown by MoffettNathanson in an article in FierceCable from 2015. The image shows basically the same trend since the 4th quarter of 2006. This means for the last nine years the Pay TV industry in the US has not seen any significant growth, but a more or less steady decline.

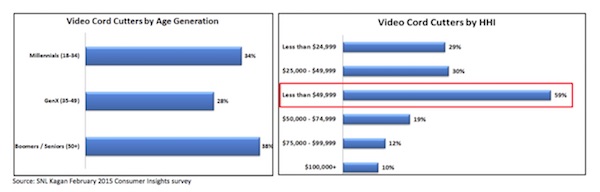

What does this all mean? In a whitepaper published by the Video Advertising Bureau, SNL Kagan studied the consumer demographics of cord cutters. Yes, the survey was done in February of 2015 and is not what I would call a new insight. However they repeated the study from 2014 and found that cord cutting relates more to cost cutting than anything else. The strongest groups cutting the cable are the ‘baby boomers’ with 38% followed by ‘millenials’ with 34%. When it comes to household income, those in the biggest group of cord cutters have a yearly income below $50,000. In 2015, 58% of those that stopped their service stated that the cost of cable TV is too high (compared to 35% in 2014). It will be very interesting to see if the same survey is being repeated this year and what the outcome will be.

At the same time the pat TV providers are seeing significant shifts in viewing behavior. More and more consumers are watching video via the internet. A high speed internet connection in the home is currently viewed as a necessity for other uses and if it can replace cable as well, all the better.

Since we are not talking about any new trend here, it comes as no surprise that pay TV providers are looking at alternative platforms to augment or even replace their lost business in the traditional subscription model. Just think of Sling TV for example. Depending on what the respective companies are trying to establish, some of these approaches are already creating subscriptions that are or are not counted in the declines that have been reported. Not all research firms look at the same model in the same way. It all comes down to definitions and what the respective customers want to prove to their investors. Wall Street can be a tough customer when it comes to declining revenue.

Incomes a Big Issue

If the main driver behind the cable cutting movement is cost to the consumer, as the SNL Kagan survey suggests, it can be expected that this trend will continue until household income shows an upward movement here in the US. Looking at the current political debates, this issue is influencing more than just cable cutting, it is influencing the political landscape in a dramatic fashion. If the consumers want to dial back their spending, a one to one replacement between various video offerings will not result in any revenue increase, it will lead to a decrease in revenue, no matter what.

The industry must be realizing that and is looking for an alternative income stream. It seems that targeted advertising may be coming to the rescue. In recent months, ad agencies have increased their spending on particular programs that are driven by detailed data from connected set top boxes.

In the history of cable TV in the US, Nielsen was the king that created data on viewing percentages for the available content. Of course, all those data were based on consumer surveys that targeted a rather small group of consumers. These consumers wrote down their viewing habits in detail for a complete week. Since this survey was limited in group size, it was difficult to estimate the viewing percentages of smaller channels that cater to narrow viewing preferences. (and there were seasonal variations that broadcasting companies exploited to try to drive their rating scores – Man. Ed.)

Now, set top boxes report data on viewing back to the Pay TV providers. Not only is this analytical data free, it is much more complete and accurate than any data Nielsen ever provided. Based on this data, pay TV providers can now insert advertising that is catering to the consumer in a similar way advertising is inserted into web browsing today. Have you ever wondered why the ads you see on certain websites reflect web searches you did recently? Of course this is based on cookies, however a similar trend will be coming to the TV with programmatic advertising. It seems this may be a way for the pay TV providers to augmented their revenue.

All in all, the cable industry is looking at fundamental changes in its business models. As nobody knows what will work and what will not, we can expect to see players in this industry battling for market share with different strategies and experiments. Eventually we will see consolidation and a stabilization in the industry based on the more successful business models. Will all players survive? Most likely not. – NH