Paul Gray of IHS then gave a display market overview which he called “Chinese Companies Gaining Control”.

He said that the current “spreading unhappiness” is a logical consequence of the events of recent years. He also said that the future is not just “the past plus a few points” – new things are happening and that will mean new directions in the future.

Gray showed a nice slide that he had prepared of LCD and OLED fabs in China which showed that there are currently 11 fabs active in the country, 10 under construction and eight more planned (including foreign-owned fabs). They are broadly divided into two groups with, broadly, G5.5 and G6 fabs intended to make displays for mobile applications. There are eight G8 – G10+ fabs in operation, three being built and five being planned; they will, broadly, make TV panels.

At the moment, the rate of investment looks like over-investment, but when the decisions were made, it was not obvious. It’s largely a question of timing and Gray believes that today’s capacity will be needed as consuming markets continue to grow.

Finance was different in the past. In the old days, individual companies made the investments, but in China, provincial governments are investors and they have GDP targets set by the central government. Investment decisions may not be made conventionally. For example, in a big investment in Fuqing, the loan from the government was CNY 15 billion at 0% interest.

Gray then showed a diagram that shows how the display investment feedback loops work to drive GDP growth. Investment in display-making capacity drives GDP by adding sales revenues and employment, which improves tax revenue as well as boosting the value of land and capital value of the businesses. More GDP means rewards from central government for regional governments.

Turning to the global supply side, the display output from Taiwan will be matched by Chinese capacity by the end of 2016, and in early 2018, China goes past Korea in terms of raw capacity to become the largest supplier country.

However, China’s technology lags in its display fabs. Firms are investing in R&D, but at nowhere near the level at which the Koreans are spending. Chinese display makers are still optimising their processes. Having “the recipe” is not enough, Gray said: you have to know the process details as well. CSOT ramped up surprisingly fast but BOE’s plant is mainly making 32″ TV panels. IHS believes that 40% of all 32″ panels are from BOE and Gray said that there are “no spec sheets” for these panels – quality is a moving target for the firm.

Management experience is essential in running the fabs in the longer term – for example, “what do you do with the fab when it is half loaded?”. At the moment, the oversupply means that 32″ panels are being sold at or below material cost. When is it better to just do nothing?

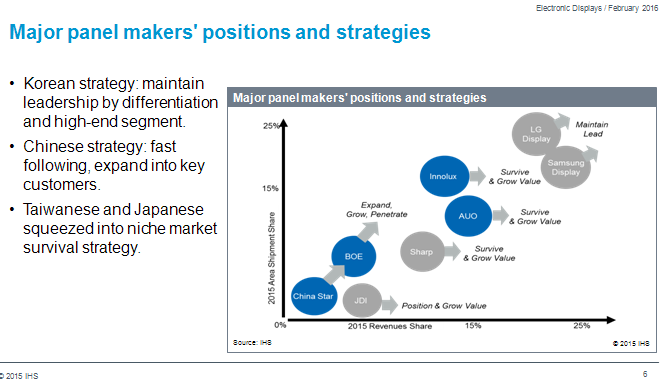

So what are the strategies for the different vendors? LG & Samsung are looking to drive and exploit their technology leadership. Chinese makers are driving pure volume, while AUO is looking at new applications. Innolux is good at automotive: the firm started early to address this market, and is broadly following “the Japanese model” of looking for customers that need something special.

Gray said that an often-overlooked advantage is that Chinese consumers will be really useful for testing new products – as Korean and Japanese consumers to those countries’ consumer electronics businesses were before; this is an under-valued concept.

There is a threat in the slowing down of replacement cycles for consumer products. In the longer term, China will have no niches to defend. The country is in a potential commodity trap – this pattern was previously seen in the development of the memory business and China could be in trouble if displays become a commodity, as memory did.

Chinese makers are also in a bidding war for equipment – for example, companies wanting to make OLEDs may have to buy equipment from Korea for OLED evaporation and those companies could be influenced by their Korean customers.

For the future, the type and level of finance is a critical point. In a bad oversupply, the Chinese solar industry was widely restructured. Without this kind of financial brutality, Gray said that there could there be “zombie panel companies” in the future.