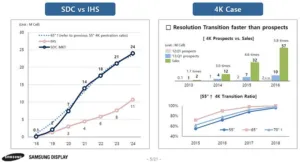

Chris Chinnock opened the ADS with his talk titled Addressing the Challenges of Selling 8K. This talk mostly addressed issues associated with UHD-2 TV, not 8K cinema systems. The transition from Standard Definition (SD) to High Definition (HD) TV was driven by multiple factors besides resolution, such as a government mandate in the US, digital instead of analog transmission, 16:9 aspect ratio and (slightly) improved color gamut. In addition, the improved resolution was clearly visible to virtually all consumers. The transition from HD to 4K (UHD-1) and now from 4K to 8K (UHD-2) is driven by push from the LCD fabs, not pull from the consumer. The large number of Gen 10 and 10.5 fabs, a size optimized for 65” and 75” cuts and capable of producing 4K and 8K LCD panels, is driving the TV industry toward 8K, even if there is little or no consumer demand for it.

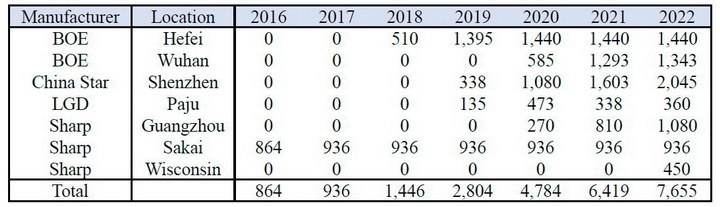

Gen 10+ Capacity, # of Substrates per year in thousands. (Source: DSCC Quarterly Display Capex & Equipment Service)

Gen 10+ Capacity, # of Substrates per year in thousands. (Source: DSCC Quarterly Display Capex & Equipment Service)

LCD Panel Maker plans for 8K panels (Source: Insight Media at ADS)

LCD Panel Maker plans for 8K panels (Source: Insight Media at ADS)

Chinnock addressed a number of questions about marketing 8K TV, including:

- 8K TV and panel maker concerns, including how to best establish the value proposition of 8K vs. 4K TV

- Consumers concerns about 8K TVs, including “Can I see the difference between 4K and 8K in my living room?” and “Is the extra cost of 8K worth it?”

- Is an 8K industry organization needed?

This last question was discussed during the Panel Discussion on 8K. The consensus was that an organization to promote 8K was needed. Some felt that no new organization was needed, because the UHD alliance should (or at least could) support UHD-2 (8K) as well as UHD-1 (4K).

Michael Cioni, SVP at Panavision and Light Iron (a Panavision Company) spoke about Opportunities in an 8k Future. Among other things, he addressed four of the most common technical objections to 8K, which were:

- Resolutions are too high

- Downloads are too slow

- Storage is too expensive

- Render times are too long

While he addressed each of these issues separately, he came to a similar conclusion for each of questions. He looked at the SD to HD conversion and the ongoing HD to 4K conversion and for all four of these issues found that Moore’s law applied to each issue. Then he showed that, taking Moore’s law into account and the time difference between the introduction of 4K and 8K, 8K will cost about the same as 4K when it was first introduced and 4K cost about the same as HD when it was first introduced.

This, of course, only addresses the cost issue, not the need for 8K resolution at the consumer’s TV screen. He said very little about this other than there has been an exponential growth in display resolution from SD to 8K, which he expects to continue to 16K and 32K. The fact that 8K, 16K and 32K are possible doesn’t mean that they make sense as a consumer or even cinema format. 8K imposes limits on how stories can be told on TV or in the cinema. 8K and higher resolutions would require essentially no motion in the “moving” images that make up the story for the higher resolution to be visible to the viewer.

One of Cioni’s conclusions was “We will always need a better quality acquisition than our exhibition.” I agree he’s right about that and 8K makes sense as an acquisition tool for 4K or even HD programming. In addition to eliminating aliasing artifacts, it gives considerable overhead for editing the content and it is well known in the content creation community that HD content shot on a 4K camera looks better than the same HD content shot on a HD camera. Since Panavision is on the content-creation end of the HD/4K/8K industry, the company’s pursuit of 8K makes sense, even if that content is reduced to 4K or 2K for distribution.

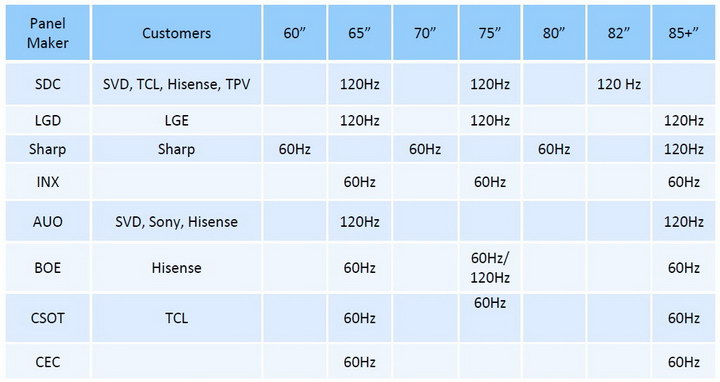

Abhijeet Solat from Samsung Display Corp (SDC) gave a talk titled 8K with Quantum dots is the NEXT BIG thing. He didn’t actually talk about quantum dots other than to say that the current high-end large screen Samsung TVs were based on quantum dots. Instead, his talk was divided into two sections, both of which were mostly about 8K: I) Market Outlook and II) Why 8K?

SDC’s market forecasts for 8K are based on the faster than expected penetration of 4K (Source: SDC at ADS)

In his Market Outlook section, Solat gave SDC’s forecasts for 8K penetration. The SDC forecast showed the sales in 2024 for 8K to be more than twice as large as the forecast from IHS, as shown in the left hand forecast. This fast penetration of 8K into the market is based on the much faster than expected penetration of 4K into the market. This is shown in the top right figure where the actual sales of 4K in the 2013 – 2016 time frame are compared to the sales for these years that had been forecast in 2012 and 2013. This high forecast is roughly the same regardless of whether it is based on 55” or 65” 4K sales. As a part of his market outlook section, Solat reviewed the 8K infrastructure development from 2012 through 2020. In essence he said that the infrastructure will all be in place for NHK to broadcast the 2020 Olympics in 8K.

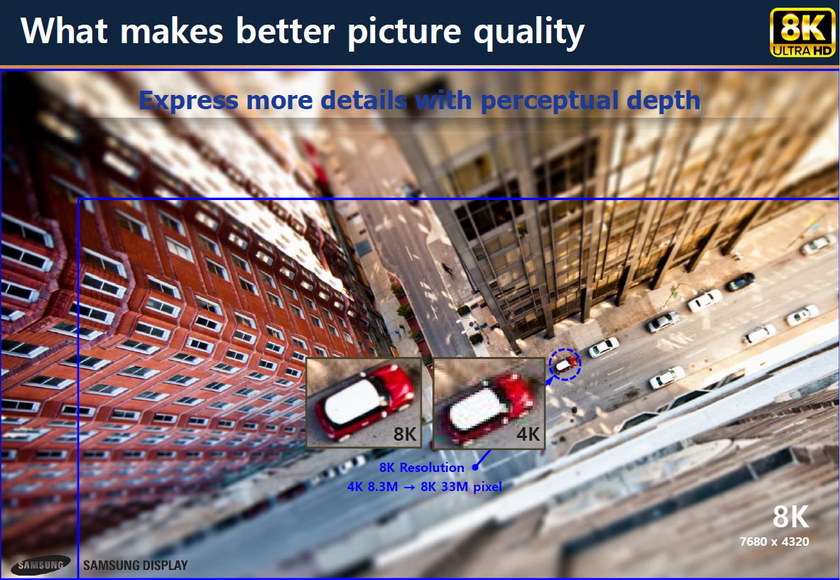

The higher resolution of 8K is visible if you examine small details in the image (Credit: SDC at ADS)

The higher resolution of 8K is visible if you examine small details in the image (Credit: SDC at ADS)

In his “Why 8K?” section, Solat discussed how an 8K image could “Express more details with perceptual depth.” He illustrated this claim with several images, such as the one above. Note how the details of the red car with the white roof are clearer in the 8K blow-up of the car compared to the 4K blowup.

He also discussed a number of features that are expected to be incorporated into 8K content that are an improvement over what is shown in 4K content. For example, you can expect wide color gamut (WCG) as a part of the 8K experience. He says that for 4K, WCG means roughly DCI-P3 colorimetry but for 8K WCG will mean Rec. 2020 colorimetry. Instead of HDR, you can expect “Next Generation HDR” and instead of 10 bit encoding you can expect 12 bit encoding. All these auxiliary features, if they produce perceptually improved features, can be included in 4K as well as 8K, of course.

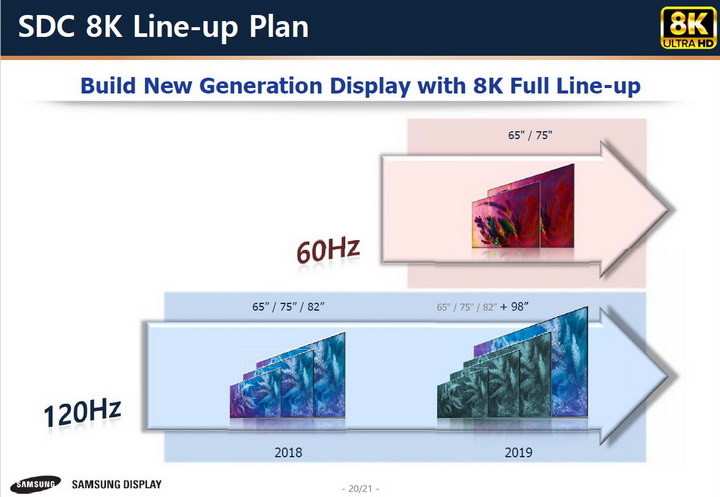

2018 and 2019 Samsung lineup of 8K TVs. (Source: SDC at ADS)

2018 and 2019 Samsung lineup of 8K TVs. (Source: SDC at ADS)

While Solat did not discuss the issue of 60Hz vs 120Hz, there is near universal agreement that the judder in a 8K image running at 60Hz is unacceptable and 8K TVs will need to be (at least) 120Hz. Clearly this is SDC’s position as well since its initial introductions of 8K products in 2018 and 2019 will all be 120Hz. Samsung can be expected to introduce “low end” 60Hz 8K systems in 2019, however.

Yoko Kimua from AstroDesign talked about Broadcast Driven 8K Development. While Abhijeet Solat from SDC touched briefly on the broadcast infrastructure needed for 8K transmissions such as the 2020 Olympics, the broadcast infrastructure was the focus of Kimua’s talk and has been the continuing focus of AstroDesign since its founding in 1977. The company introduced the first programmable signal generator in 1979, which I remember using to test cathode ray tubes. (Remember them?)

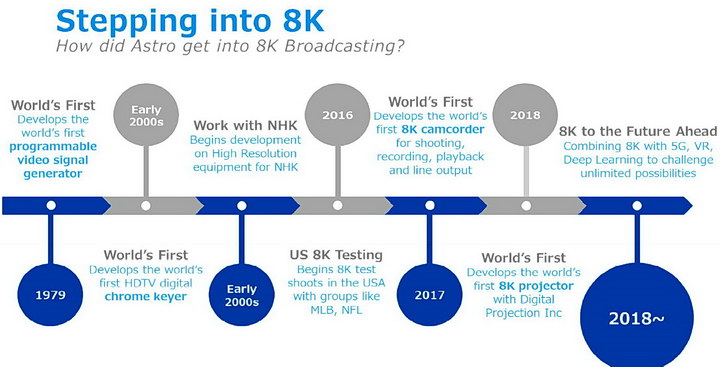

AstroDesign has worked on 8K since the early 2000s. (Source: AstroDesign at ADS)

AstroDesign has worked on 8K since the early 2000s. (Source: AstroDesign at ADS)

Work on 8K at AstroDesign began in the early 2000s when they developed 8K equipment for NHK. They also developed an 8K camera head, the AH-4801-E/G, plus the peripherals to turn it into a 8K camcorder in 2017. This camera head has a single 1.7” sensor UHD-2 (7680 x 4320) resolution, 60Hz & 120Hz frame rates, HDR (ARIB STD-B67, which was issued in 2015 and uses the HLG EOTF), 4:4:4 sampling, 12 bit encoding and a PL lens mount. In addition, AstroDesign worked with Digital Projection Inc. to develop DPI’s Insight Laser 8K projector.

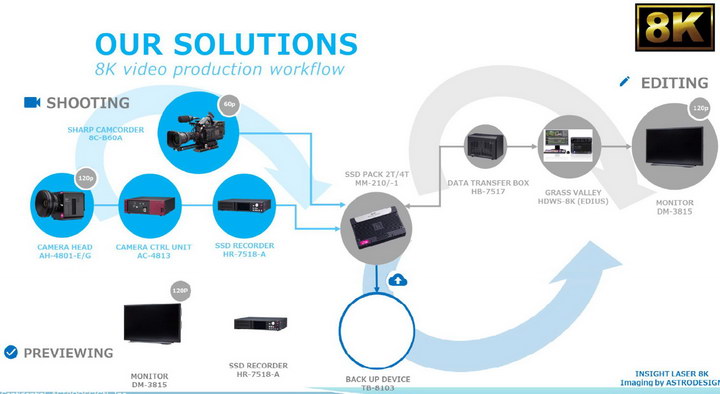

A complete 8K production/post-production infrastructure. (Credit: AstroDesign at ADS)

A complete 8K production/post-production infrastructure. (Credit: AstroDesign at ADS)

Kimua showed how a complete 8K production and post-production infrastructure could be assembled from existing components and vendors. Not all of these elements are from AstroDesign, of course. This is common – it would be rare for an end-to-end production workflow solution would be available from a single vendor, even at HD resolution. Additional elements are available from other vendors – this is not the only possible 8K workflow, just an example to show that it is not necessary to use prototype or untested equipment in the workflow. She also showed how four of the company’s VG-876/879 digital signal generators could be synchronized together to produce test signals for 8K/120p equipment.

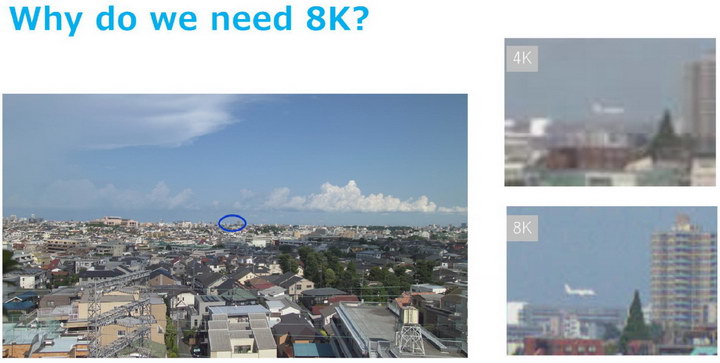

AstroDesign’s “Why 8K?” image (Credit: AstroDesign at ADS)

AstroDesign’s “Why 8K?” image (Credit: AstroDesign at ADS)

Kimua couldn’t resist putting a “Why 8K?” slide in in her presentation. I find this even less convincing than the SDC “Why 8K?” slide. Since the airplane isn’t even visible in the full image, what difference does it make that it has higher resolution in 8K than 4K? She did give use cases for 8K production equipment where the end content was not 8K consumer video. This included use in medical applications where the ultra-fine details visible in an 8K image may be medically important. She also discussed how 8K input allows digital zoom without a lost of resolution for HD systems. This is particularly important for sports and security applications where it can reduce the number of cameras used and reduce the need to pan the cameras.

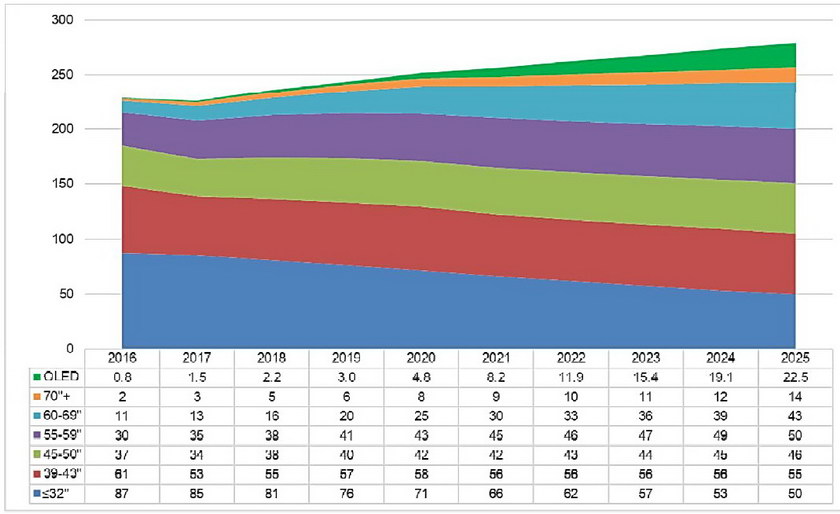

Screen size forecast through 2025 (Source: DSCC at ADS)

Screen size forecast through 2025 (Source: DSCC at ADS)

The final 8K talk was from Display Supply Chain Consultants (DSCC) and was titled The 8K Market is Coming. Bob O’Brien at DSCC had prepared the talk but could not attend the summit so it was presented by Chris Chinnock. As in Chinnock’s talk, there was an emphasis on the capacity growth in Gen 10+ fabs. Since these large substrates can be efficiently cut into 8-up 65” or 6-up 75”, this capacity growth is, in turn, driving the market for TVs to these larger sizes. The growth in the 55-59” category has a CGAR of about 5% from 2017 – 2025, while the CGAR for the 60-69” category is 16% and in the 70”+ category is 19%. The smaller sizes, from under 32” up to 43”, the market is stable or even declining both in absolute terms and in market share.

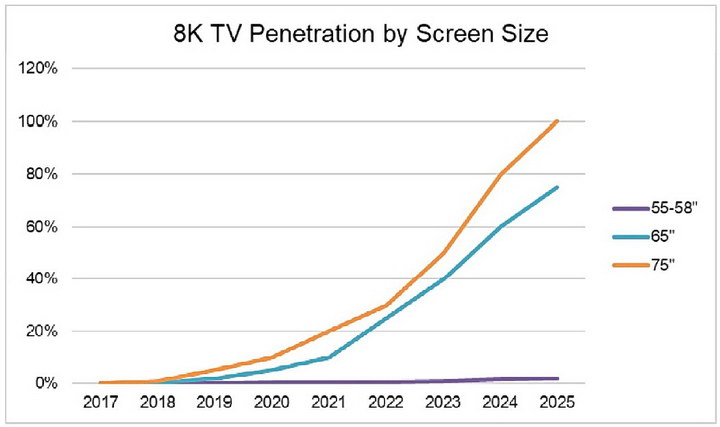

8K market share by screen size. (Source: DSCC at ADS)

8K market share by screen size. (Source: DSCC at ADS)

DSCC expects 8K to be a factor in only the largest screen sizes, with near 100% penetration in the 75” size by 2025 and about 75% penetration in the 65” market. O’Brien doesn’t expect significant penetration in the 55-58” size range, since 8K is “not needed” in this size range. He says if prices for 8K decline even faster than he expects, then penetration into this market may be greater than shown. He justified it by saying that while 4K is not needed in the 40” market, the low premium of 4K over HD has allowed significant penetration into that market anyway.

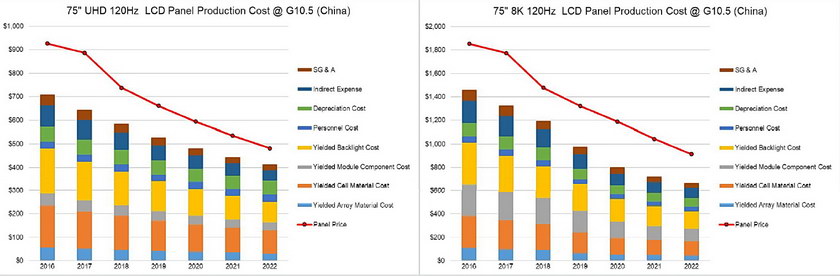

DSCC’s cost estimates for 75”, 120Hz 4K and 8K panels. (Source: DSCC Advanced TV Cost Report as presented at ADS)

DSCC’s cost estimates for 75”, 120Hz 4K and 8K panels. (Source: DSCC Advanced TV Cost Report as presented at ADS)

The trend toward 8K is at least partially enabled by the forecast cost structure of 4K vs 8K 75” panels, as shown in the figure. In 2018 the 75” 8K panel is about 2.0x the cost of a 4K panel the same size. DSCC expects this to decline to about 1.5x the cost of a 4K panel by 2022. This is then reflected into the sales price of the panel and, ultimately, the 4K/8K market share ratio. Of course, in 75” sizes, the market share for HD (2K) is effectively 0% in 2018. O’Brian also showed data comparing the cost of 8K ink-jet printed OLED panels from Korea (i.e. LGD) compared to the cost of an 8K QDEF panel from China. For Gen 8.5 fabs, DSCC believes OLED will have a cost advantage in 2021 while for Gen 10.5 fabs, QDEF will have a cost advantage. Costs in Gen 8.5 fabs are generally lower than in Gen 10.5 fabs due to the fact that by 2021, the Gen 8.5 fabs will be fully depreciated.

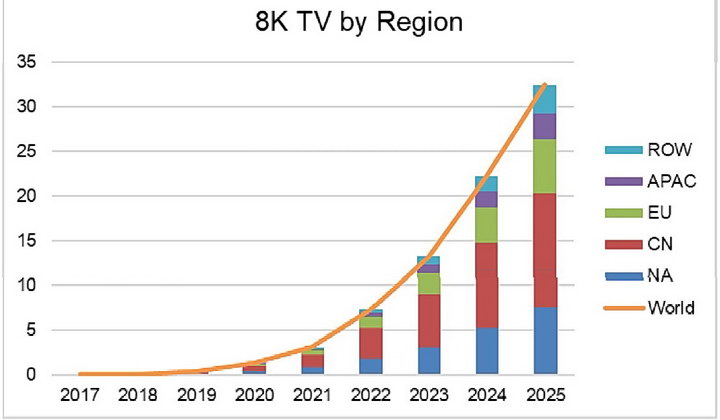

8K TV by Region (Source: DSCC at ADS)

8K TV by Region (Source: DSCC at ADS)

Currently almost all of the (very small) market for 8K systems is in the US and China, the two biggest markets for large-screen TV. By 2025, however, DSCC expects other regions to get on the bandwagon and become significant markets for 8K as well. – Matthew Brennesholtz