While 2015 was a roller coaster one for the display industry, 2016 will be ‘sluggish’, according to IHS.

2015 began with ambitious business plans set by panel makers, based on an optimistic outlook at the end of 2014. Set makers, who experienced supply shortages at the end of that year, aggressively developed their panel demand-supply strategies. This resulted in a rise in panel prices through the first half of 2015, driven by TV panel demand. Shipments of these units also reached a record high of 136 million units: an 11% YoY increase.

However, from the end of Q2 the market began to change. Weak demand from emerging markets was driven by the strong dollar; concerns over TV panel inventory; and shrinking IT product demand. The price of a 32″ Full HD open-cell fell from $95 in early 2015, to $65 in September.

TV panel shipments are forecast to reach 265 million units this year, while TV set shipments will total 225 million – creating a 40 million-unit oversupply.

IHS’ newly-released ‘Display Long-Term Demand Forecast Tracker’ predicts that the TV panel industry will fall next year, for the first time ever. Shipments are predicted to decline 3% YoY, to 257 million units. The TV industry represents about 70% of the entire display market in terms of area. In addition – as seen as in recent market fluctuations influenced by the strengthening dollar – the display market is increasingly being affected by external economic factors.

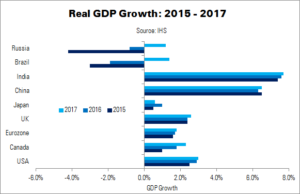

While North America’s economy – driven by the USA – is performing well, other regions are experiencing a significant fall in their GDP growth. These include Russia, China and Brazil. Some are even seeing falling GDP. Again, the strong dollar would have had a huge impact; in fact, it has caused lower consumption in developing and emerging economies worldwide, such as Eastern Europe. Global companies, such as Samsung Electronics and LG Electronics, were affected more than those focusing on domestic demand, such as Chinese TV makers.

| Real GDP Growth: Preliminary October Forecast | ||||||

|---|---|---|---|---|---|---|

| Country | 2012 | Jul-05 | 2014 | 2015 | 2016 | 2017 |

| World | 2.6% | 2.5% | 2.7% | 2.6% | 3.0% | 3.3% |

| USA | 2.2% | 1.5% | 2.4% | 2.5% | 2.9% | 3.0% |

| Canada | 1.9% | 2.0% | 2.4% | 1.0% | 1.8% | 2.3% |

| Eurozone | -0.7% | -0.2% | 0.9% | 1.6% | 1.7% | 1.8% |

| UK | 1.2% | 2.2% | 2.9% | 2.4% | 2.4% | 2.6% |

| Japan | 1.7% | 1.6% | -0.1% | 0.5% | 1.0% | 0.6% |

| China | 7.7% | 7.7% | 7.3% | 6.5% | 6.3% | 6.5% |

| India | 5.1% | 6.9% | 7.3% | 7.4% | 7.6% | 7.7% |

| Brazil | 1.8% | 2.7% | 0.1% | -3.0% | -1.9% | 1.4% |

| Russia | 3.5% | 1.3% | 0.6% | -4.2% | -0.8% | 1.2% |

| Source: IHS | ||||||

The USA’s Federal Reserve Bank is now concluding its quantitative easing programme, and is considering the right time to raise interest rates. Rising interest rates would cause an outflow of US dollars from foreign countries back to the USA. In the process, the FRB is likely to try and protect the strength of the currency. IHS therefore expects the emerging market weakness caused by this to continue in 2016.

China is showing signs of recession, recording mid-7% growth before 2015. Growth this year is expected to be 6.5%, down 0.8% from 2014. 6.3% growth is predicted in 2016. The country is both the largest producer and consumer for IT products and TVs in the world, so the strength of its economy has a significant impact on the display industry.

Thirdly, the Brazilian economy is falling, after hosting the 2014 World Cup and preparing for the 2016 Olympics. The government has raised consumption tax to combat this deficit, and has also taken several other unsuccessful measures; this has ‘raised alarm bells’. Brazil is a large exporter of minerals, and China is its largest customer. However, China’s recession means that mineral demand has declined, further aggravating the Brazilian economy. A 3% GDP decline is forecast in 2015, and a trend that will continue in 2016. Brazil’s presence among third-world countries and Latin America means that its economic downturn is a risk to the display industry, which relies on the growth of emerging markets.

These are the major economic factors that will influence the display market next year, although there are other non-economic factors, too.

Latecomers in the display industry (represented by China) are rapidly catching up to established TFT-LCD names, such as those in Korea. IHS recommends moving quickly to the next generation of display technology, such as AMOLED and flexible screens, to progress to the next level.