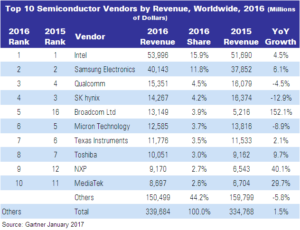

Worldwide semiconductor revenue totaled $339.7 billion in 2016, a 1.5% increase from 2015 revenue of $334.8 billion, according to preliminary results by Gartner. The top 25 semiconductor vendors’ combined revenue increased by 7.9% compared with 2015, and accounted for 75.9% of the market.

“After a poor start to the year, characterized by inventory burn-off, the second half of 2016 was fuelled by inventory replenishment and improved demand and pricing,” said Adriana Blanco, senior research analyst at Gartner. “Overall, semiconductor revenue for the second half of the year was much stronger than the first half, reflecting the strengthening memory market and continued inventory replenishment, as well as inventory build for both the iPhone 7 and the holiday season.”

Intel remained in the top spot, reaching a quarter of a century as the No. 1 semiconductor vendor, with 15.9% market share. Samsung Electronics maintained the No. 2 position for the 15th year with 11.8% of the market. Broadcom Ltd. was the best performer in the top 25, climbing 11 places to reach the fifth position after the Avago Technologies acquisition of Broadcom Corporation.

“When it comes to end-application markets, wireless and compute are the largest end markets for semiconductors but showed very different growth patterns in 2016,” said Ms. Blanco. “Wireless revenue grew 9.6% and continued to be driven by smartphones and the exposure to the memory markets, where conditions were much more favorable than the overall memory market, in part because of strong bit content growth, and also improved performance of other device categories, including ASICs and nonoptical sensors. Compute revenue, on the other hand, declined 8.3%, as it continues to be dragged down by a sluggish PC and tablet market and exposure to the memory segment.”

In terms of macroeconomic factors during 2016, the euro was relatively stable compared with the U.S. dollar, whereas the yen strengthened significantly. The U.K. Brexit decision in June 2016 had no significant effect on the global semiconductor market, although equipment demand in the U.K. was hit by higher pricing as a result of a weakening sterling.

Analyst Comment

Separately, Gartner said that IT spending globally would grow 2.7% to $3.464 billion in 2017, and 2.6% in 2018, although ‘devices’ will only rise by 0.1% and 0% in the respective years. The value of the devices market fell 8.9% in 2016 to $588 billion. (BR)