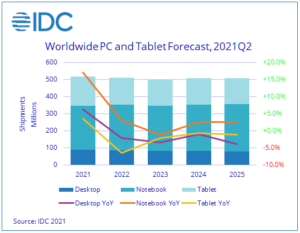

According to a new forecast from the International Data Corporation (IDC) Worldwide Quarterly Personal Computing Device Tracker, worldwide shipments of PCs are expected to grow 14.2% to 347 million units in 2021. This is down from IDC’s May forecast of 18% growth with continued supply chain and logistical challenges cited as the main reasons.

The Tablet market is also expected to grow in 2021 but at a much slower pace of 3.4%.

“We continue to believe the PC and tablet markets are supply constrained and that demand is still there,” said Ryan Reith, program vice president with IDC’s Worldwide Mobile Device Trackers. “The lengthening of the supply shortages combined with on-going logistical issues are presenting the industry with some big challenges. However, we believe the vast majority of PC demand is non-perishable, especially from the business and education sectors.”

Over the full 2021-2025 forecast period, Traditional PCs, inclusive of desktops, notebooks, and workstations, are expected to have a compound annual growth rate (CAGR) of 3.2% while tablets are expected to decline 1.5%. Despite short-term supply constraints related to panels and ICs, notebook PCs will remain the main driver of future PC growth.

Personal computing devices played an instrumental role in many consumers’ lives over the last eighteen months, enabling individuals to work, learn, game, and connect from home despite lockdowns and social distancing. Although COVID-19 cases are resurgent, eventually a level of normalcy will return. Even then, IDC expects personal computing devices to retain a central role in the personal lives of most.

“How much is this newfound PC centricity worth?” asked Linn Huang, research vice president, Devices & Displays at IDC. “In November of 2019, we published our last pre-pandemic forecast, which stretched out to 2023. At that juncture, we projected a total market of 367 million units in 2023. Today, we are expecting over half-a-billion units of personal computing devices to be shipped that year. So how much is that compute centricity worth? A simplified view would suggest about 135 million units or 37% more than the original market forecast.”

In the latter years of the forecast, consumer spending is expected to rebalance towards travel and leisure – the categories of spending that suffered most during the various states of lockdown – and away from technology. Additionally, the strong quarterly performances over the last year will eventually catch up with the market and drive unreachable comparisons. In short, a market slowdown is inevitable. However, even when it does occur, the total available market for personal computing devices will be significantly greater than it would have been if not for the months spent working, learning, gaming, and connecting on these devices during the pandemic.

IDC’s Worldwide Quarterly Personal Computing Device Tracker gathers data in more than 90 countries and provides detailed, timely, and accurate information on the global personal computing device market. This includes data and insight into global trends around desktops, notebooks, detachable tablets, slate tablets, and workstations. In addition to insightful analysis, the program delivers quarterly market share data and a five-year forecast by country. The research includes historical and forecast trend analysis.

About IDC Trackers

IDC Tracker products provide accurate and timely market size, vendor share, and forecasts for hundreds of technology markets from more than 100 countries around the globe. Using proprietary tools and research processes, IDC’s Trackers are updated on a semiannual, quarterly, and monthly basis. Tracker results are delivered to clients in user-friendly Excel deliverables and on-line query tools.

About IDC

International Data Corporation (IDC) is the premier global provider of market intelligence, advisory services, and events for the information technology, telecommunications, and consumer technology markets. With more than 1,100 analysts worldwide, IDC offers global, regional, and local expertise on technology, IT benchmarking and sourcing, and industry opportunities and trends in over 110 countries. IDC’s analysis and insight helps IT professionals, business executives, and the investment community to make fact-based technology decisions and to achieve their key business objectives. Founded in 1964, IDC is a wholly owned subsidiary of International Data Group (IDG), the world’s leading tech media, data, and marketing services company.