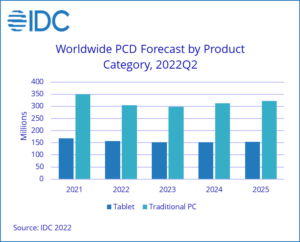

Tumultuous times are ahead for the PC and tablet markets according to a new forecast from the International Data Corporation (IDC) Worldwide Quarterly Personal Computing Device Tracker. Global shipments of traditional PCs are forecast to decline 12.8% in 2022 to 305.3 million units while tablet shipments will fall 6.8% to 156.8 million. Inflation, a weakening global economy, and the surge in buying over the past two years are the leading causes for the reduced outlook.

Further contraction is also expected in 2023 as consumer demand has slowed, the education demand has been largely fulfilled, and enterprise demand gets pushed out due to worsening macroeconomic conditions. The combined market for PCs and tablets is forecast to decline 2.6% in 2023 before returning to growth in 2024.

“Though demand is slowing, the outlook for shipments remains above pre-pandemic levels,” said Jitesh Ubrani, research manager for IDC Mobility and Consumer Device Trackers. “Long-term demand will be driven by a slow economic recovery combined with an enterprise hardware refresh as support for Windows 10 nears its end. Educational deployments and hybrid work are also expected to become a mainstay driving additional volumes.”

“With economic headwinds gaining speed, we expect worsening consumer sentiment to result in further consumer market contractions over the next six quarters,” added Linn Huang, research vice president, Devices & Displays. “Economic recovery in time for the next major refresh cycle could propel some growth in the outer years of our forecast. Though volumes won’t hit pandemic peaks, we expect the consumer market to drive towards more premium ends of the market.”

Worldwide Personal Computing Device Forecast by Product Category, Shipments, Year-Over-Year Growth, and 2022-2026 CAGR (shipments in millions) |

|||||

Product Category |

2022 Shipments |

2022/2021 Growth |

2026 Shipments |

2026/2025 Growth |

2022-2026 CAGR |

|

Consumer |

265.3 |

-9.9% |

269.3 |

0.6% |

0.4% |

|

Enterprise |

57.6 |

-1.6% |

63.6 |

-0.2% |

2.5% |

|

Public Sector |

69.2 |

-20.3% |

69.0 |

0.9% |

-0.1% |

|

SMB |

70.0 |

-10.5% |

75.9 |

0.5% |

2.0% |

|

Total |

462.1 |

-10.8% |

477.7 |

0.5% |

0.8% |

|

Source: IDC Worldwide Personal Computing Device Tracker, September 1, 2022 |

|||||

Notes:

-

Shipments include shipments to distribution channels or end users.

-

Traditional PCs include Desktops, Notebooks, and Workstations and do not include Tablets or x86 Servers. Tablets include Detachable Tablets and Slate Tablets that are part of the Personal Computing Device Tracker.

-

Public Sector denotes purchases made by schools and governments.