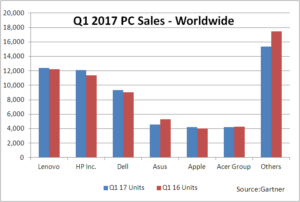

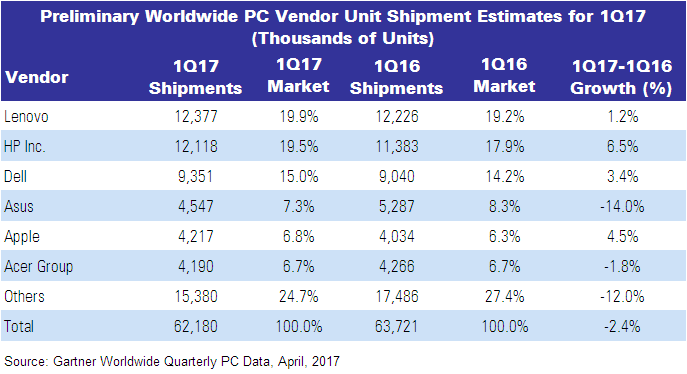

Worldwide PC shipments totalled 62.2 million units in the first quarter of 2017, a 2.4% decline Q1 2016, according to preliminary results by Gartner, Inc. Q1 2017 was the first time since 2007 that the PC market saw shipments below 63 million units in a quarter. Consumer demand was particularly weak, although there was modest growth in business PCs.

Consumers continued to refrain from replacing older PCs, and some consumers have abandoned the PC market altogether. The business segment still sees the PC as an important device, and it remains the main work device for businesses.

“While the consumer market will continue to shrink, maintaining a strong position in the business market will be critical to keep sustainable growth in the PC market. Winners in the business segment will ultimately be the survivors in this shrinking market”, said Mikako Kitagawa, principal analyst at Gartner. “Vendors who do not have a strong presence in the business market will encounter major problems, and they will be forced to exit the PC market in the next five years. However, there will also be specialized niche players with purpose-built PCs, such as gaming PCs and ruggedized laptops”.

“The top three vendors — Lenovo, HP and Dell — will battle for the large-enterprise segment. The market has extremely limited opportunities for vendors below the top three, with the exception of Apple, which has a solid customer base in specific verticals”.

The competition among the top three vendors intensified in the first quarter of 2017. Lenovo and HP were in a virtual tie for the top spot. Lenovo accounted for 19.9 percent of worldwide PC shipments (see Table 1), followed by HP with 19.5 percent share, and Dell at 15 percent share. Lenovo’s growth exceeded the regional average in all key regions except the U.S.

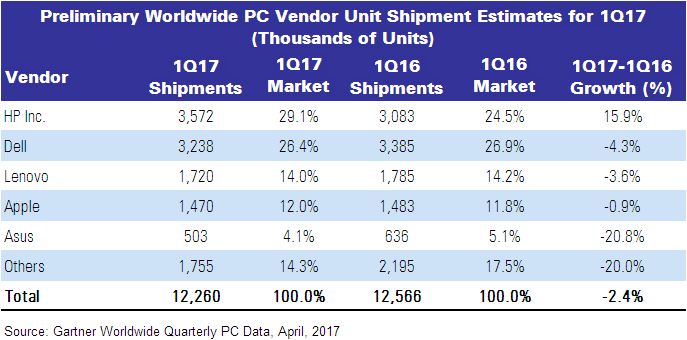

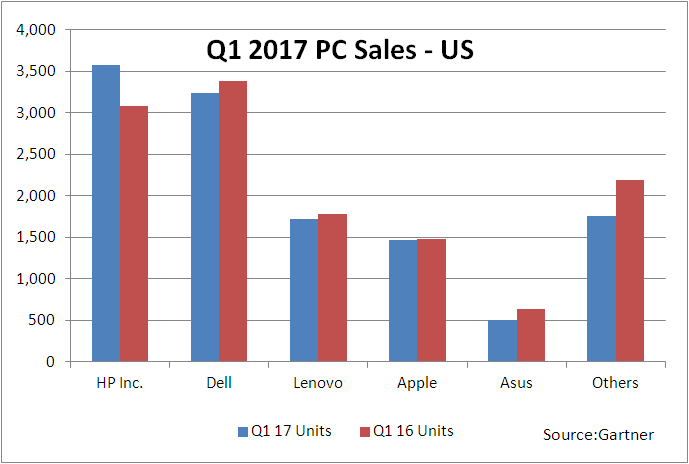

HP showed the strongest growth among the top six vendors, as its global PC shipments increased 6.5% in the first quarter of 2017. HP’s shipments grew in all regions, and it did especially well in the U.S. market, where it had a 15.9% increase in PC shipments.

Dell has achieved four consecutive quarters of year-over-year growth. It had PC shipment increases in all regions except the U.S. Dell enhanced its channel program and expanded its share in the large-enterprise market.

The PC industry is also experiencing price increases. The key factor is component shortages.

The PC industry is also experiencing price increases. The key factor is component shortages.

“DRAM prices have doubled since the middle of 2016, and SSD has been in short supply as well,” Ms. Kitagawa said. “The price hike will suppress PC demand even further in the consumer market, discouraging buyers away from PC purchases unless they are absolutely necessary. The price hike started affecting the market in 1Q17. This issue will grow into a much bigger problem in 2Q17, and we expect it to continue throughout 2017.”

PC shipments in EMEA totalled 17.9 million units in the first quarter of 2017, a 6.9% decline year over year. All major regions in EMEA experienced a decline in the first quarter. However, Russia saw single-digit PC growth, which was attributed to stabilisation of the local economy.

The Asia/Pacific PC market showed some stabilization, as PC shipments totalled 22.8 million units in the first quarter of 2017, a 0.8% decline from the first quarter of 2016. PC spending in China began to show a modest recovery. Steady economic conditions were an influencing factor driving a PC refresh.

In the U.S., PC shipments totaled 12.3 million units in the first quarter of 2017, a 2.4% decline from the first quarter of 2016. The U.S. market has experienced a modest decline for two quarters. Much of the decline is attributed to the weak consumer market.

Notes: Data includes desk-based PCs, notebook PCs and ultramobile premiums (such as Microsoft Surface), but not Chromebooks or iPads.

Analyst Comment

IDC estimated volumes a bit lower at 60.3 million and thought that growth was 0.6%. IDC highlighted growth in Japan and strong notebook performance in Europe. It estimated HP’s sales as 13.1 million, ahead of Lenovo. We suspect that this might be because of different definitions and at press time, we had asked IDC if Chromebooks were included. (BR)