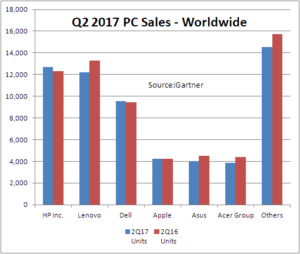

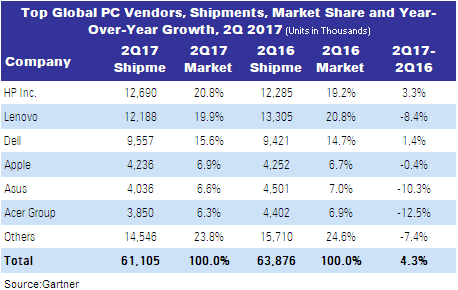

According to preliminary results from Gartner, worldwide PC shipments totalled 61.1 million units in the second quarter of 2017, which is a 4.3% decline compared to the second quarter of 2016 and is the lowest quarter volume since 2007. The PC industry has experienced a five-year slump, and this is the eleventh straight quarter of declining shipments.

According to Mikako Kitagawa, principal analyst at Gartner, higher PC prices due to the impact of component shortages for DRAM, solid state drives and LCD panels had a pronounced negative impact on PC demand in the second quarter. Some vendors absorbed the component price, while other vendors transferred the costs to the end-user price. In the business segment, vendors could not increase the price too quickly, especially in large enterprises where the price is typically locked in based on the contract. In the consumer market, the price hike has a greater impact as buying habits are more sensitive to price increases.

According to Mikako Kitagawa, principal analyst at Gartner, higher PC prices due to the impact of component shortages for DRAM, solid state drives and LCD panels had a pronounced negative impact on PC demand in the second quarter. Some vendors absorbed the component price, while other vendors transferred the costs to the end-user price. In the business segment, vendors could not increase the price too quickly, especially in large enterprises where the price is typically locked in based on the contract. In the consumer market, the price hike has a greater impact as buying habits are more sensitive to price increases.

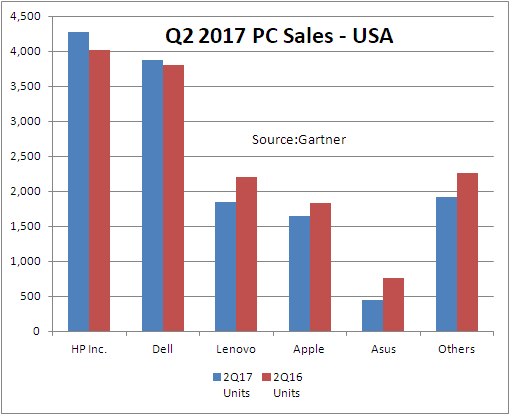

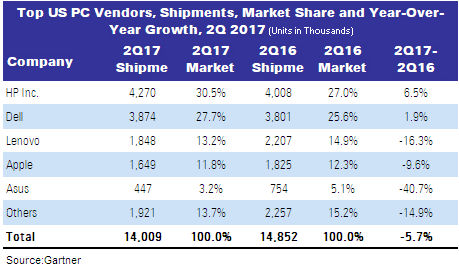

HP reclaimed the top position from Lenovo in the quarter of 2017 and has achieved five consecutive quarters of growth, compared to the same quarters a year previous. Shipments grew in most regions, and it did especially well in the US market where its shipments growth far exceeded the regional average.

Lenovo’s global shipments declined 8.4% in the quarter, after two quarters of growth. Lenovo recorded shipment declines in all key regions and Kitagawa stated that the results could reflect Lenovo’s strategic shift from unit share gains to margin protection.

Dell achieved five consecutive quarters of global shipment growth, as shipments increased 1.4%. Dell has put a high priority on PCs as a strategic business. Among the top three vendors, Dell is the only vendor which can supply the integrated IT needs to businesses under the Dell Technologies umbrella of companies.

Notes: Data includes desk-based PCs, notebook PCs and ultramobile premiums (such as Microsoft Surface), but not Chromebooks or iPads. All data is estimated based on a preliminary study. Final estimates will be subject to change. The statistics are based on shipments selling into channels. Numbers may not add up to totals shown due to rounding.

Notes: Data includes desk-based PCs, notebook PCs and ultramobile premiums (such as Microsoft Surface), but not Chromebooks or iPads. All data is estimated based on a preliminary study. Final estimates will be subject to change. The statistics are based on shipments selling into channels. Numbers may not add up to totals shown due to rounding.

In the US, PC shipments totalled 14 million units, which is a 5.7% decline from the second quarter of 2016. The US market declined due to weak consumer PC demand, although the business market has shown some consistent growth. However, the education market was under pressure from strong Chromebook demand.

The Chromebook market has been growing much faster than the overall PC market. Gartner does not include Chromebook shipments within the overall PC market, but it is moderately impacting the PC market. Worldwide Chromebook shipments grew 38% in 2016, while the overall PC market declined 6%.

PC shipments in EMEA totalled 17 million units, which is a 3.5% decline compared to the same quarter last year. Due to the election in the UK, some businesses delayed buying, especially in the public sector. In France, consumer confidence rose more than expected after Emmanuel Macron was elected president, however spending on PCs remains sluggish. PC shipments increased in Germany as businesses invest in Windows 10-based new hardware, and the Russian market continued to show improvement driven by economic stabilisation.

In Asia/Pacific, PC shipments surpassed 21.5 million units, which is a drop of 5.1% compared to the same period last year. In India, the demand cooled down after the first quarter, coupled with the absence of a large tender deals. The China market was hugely impacted by the rise in PC prices due to the component shortages.