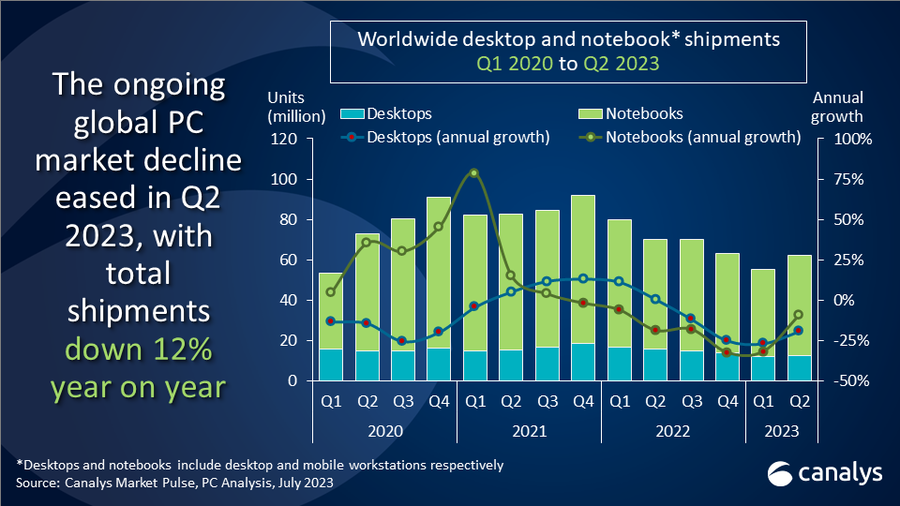

The latest data from Canalys reveals that the worldwide PC market experienced a slowdown in its decline during Q2’23. Total shipments of desktops and notebooks declined by 11.5% year-on-year to reach 62.1 million units. This represents a significant improvement compared to the previous two quarters, where shipments had declined by over 30%. The second quarter also saw a sequential increase in shipments by 11.9%, indicating a positive trend and signaling an accelerated recovery in the second half of the year.

Notebook shipments experienced a 9.3% annual decline, reaching 49.4 million units, while desktops faced a larger decline of 19.3%, with shipments totaling 12.6 million units.

Among the top PC vendors, Lenovo emerged as the leader in terms of shipments, with 14.2 million units in Q2’23, accounting for 22.9% market share. However, Lenovo experienced an 18.1% decline compared to the same period last year. HP followed closely with 13.4 million units and a market share of 21.6%, experiencing a marginal decline of 0.4% year-on-year. Dell secured the third position with 10.3 million units and a market share of 16.6%, but faced a significant decline of 21.9% compared to Q2’22.

Apple showed impressive growth, shipping 6.8 million units in Q2’23, marking a 50.9% increase compared to the previous year. The company captured an 11.0% market share. Acer, on the other hand, faced a decline of 21.6% with 4.0 million units and a market share of 6.4%.

Other vendors collectively shipped 13.3 million units, accounting for a market share of 21.4%. This group experienced a decline of 19.3% compared to Q2’22.

Canalys analysts point out that the PC market is displaying early signs of recovery after a challenging period. While the global macroeconomic situation remains difficult, the sector is witnessing indications that the issues affecting it are starting to subside. Key industry players have noted that end-user activation rates are stronger than sell-in shipments, and as conditions improve, businesses are expected to reallocate spending toward IT upgrades. The return of public sector funding has also contributed to strong back-to-school demand for PCs in Q2’23.

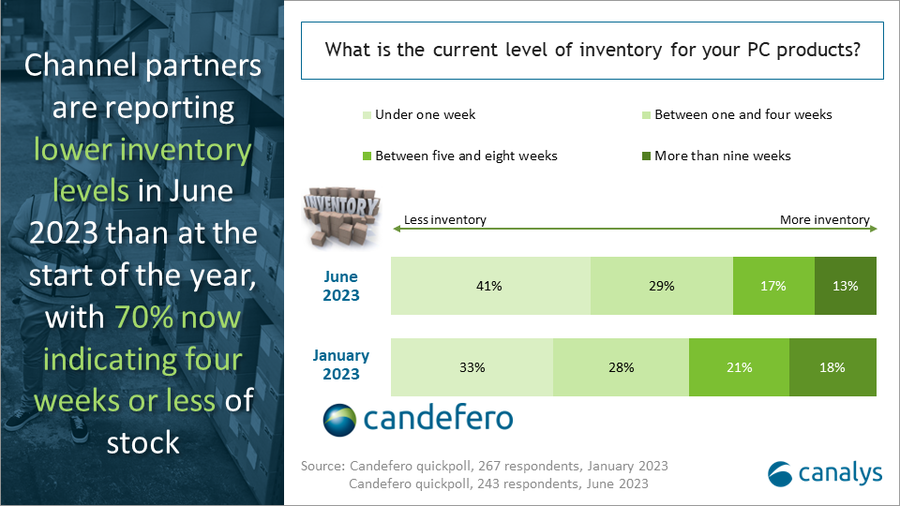

Looking ahead, the PC industry is expected to continue its improvement in 2023. Inventory levels reduced further in Q2, with a significant number of channel partners reporting less than one week of PC inventory. All customer segments are anticipated to show sequential improvement throughout the remainder of the year due to inventory corrections and stronger seasonality in the latter half. However, it is predicted that full-year 2023 shipments will be lower than those of 2022 as consumers prioritize spending on other categories in the post-pandemic environment.

| Vendor | Q2’23 Shipments | Q2’23 Market Share | Q2’22 Shipments | Q2’22 Market Share | Annual Growth |

|---|---|---|---|---|---|

| Lenovo | 14,202 | 22.9% | 17,340 | 24.7% | -18.1% |

| HP | 13,433 | 21.6% | 13,493 | 19.2% | -0.4% |

| Dell | 10,329 | 16.6% | 13,233 | 18.9% | -21.9% |

| Apple | 6,811 | 11.0% | 4,515 | 6.4% | 50.9% |

| Acer | 3,998 | 6.4% | 5,085 | 7.2% | -21.6% |

| Others | 13,297 | 21.4% | 16,473 | 23.5% | -19.3% |

| Total | 62,061 | 100.0% | 70,139 | 100.0% | -11.5% |