As locked-down consumers upgraded their TV sets, Advanced TV revenues jumped in the third quarter of 2020, according the new DSCC Quarterly Advanced TV Shipment and Forecast Report, now available to subscribers. This report covers the worldwide premium TV market, including the most advanced TV technologies: WOLED, QD Display, QDEF, Dual Cell LCD and MiniLED with 4K and 8K resolution.

The report looks at current and future TV shipments and revenues by technology, region, brand, resolution and size, and forecasts the growth of all of these technologies. The report includes the preliminary shipment results for Q3 2020 and a forecast to 2025. This week we will cover the Q3 results, with a focus on the brand competition in the premium segment, and next week we will cover our updated forecast.

We define an “Advanced TV” (capitalized) as any TV with an advanced display technology feature, including all OLED TVs, 8K LCD TVs and all LCD TVs with quantum dot technology. The historical data in the report allows analysis by feature for Advanced LCD TVs, including:

- QDEF TV: TV using a Quantum Dot Enhancement Film; these TVs are sold as “QLED” by Samsung, TCL, and others.

- MiniLED: LCD TVs with a MiniLED backlight, as sold by TCL starting in 2019.

- Dual Cell: LCD TVs employing dual-cell technology, as introduced by Hisense in 2019.

- LCD Others: this category includes LCD TVs with 8K resolution, that do not fall in any other category.

The historical data for OLED TV includes only one product configuration, LGD’s White-OLED (WOLED) technology, but the forecast in the report includes QD Display, which designates QD OLED and successor technologies such as QNED and EL-QLED, as well as Rollable OLED and MicroLED. Our forecast for MicroLED TV is based on product sizes up to 110”, as products in larger sizes such as Samsung’s 146” The Wall belong in a different category than “TV”.

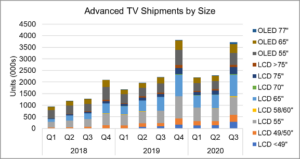

Advanced TV shipments in Q3 2020 jumped by 64% Q/Q and by 71% Y/Y to 3.8 million units, as shown in the first chart here. While in general the trend in TVs is toward larger sizes, in Q3 2020 the smaller screen sizes of Advanced TVs recorded the biggest gains, as Advanced TV technologies in both LCD and OLED are offered at smaller screen sizes to reach lower price points. Advanced LCD TVs smaller than 49” saw a 220% Y/Y increase, and LCD TVs at 49”/50” increased by 113%, while in OLED the first shipments of 48” have been recorded in 2020. Although the smallest sizes saw the biggest gains, every screen size in both Advanced LCD and OLED increased Y/Y.

Advanced TV Shipments by Size and Display Technology, Q1 2018 to Q3 2020

Advanced TV revenues saw a smaller increase than units, by 32% Y/Y as price declines combined with a smaller product mix meant that the average price of an Advanced TV declined from $1587 in Q3 2019 to $1225 in Q3 2020. Nevertheless, revenue increased across all screen sizes in both Advanced LCD and OLED. Increases for 55”, which is the most mainstream and mature product size among Advanced TV, were smallest among screen sizes, with revenues up 3% and 2% for 55” Advanced LCD and OLED, respectively.

While in unit terms Advanced LCD fared better than OLED, in revenue terms the reverse was true. OLED TV revenues increased by 39% Y/Y in Q3, while Advanced LCD TV revenues increased by only 27%. As a result, OLED’s revenue share of Advanced TV increased to 39% in Q3 compared to 37% a year ago even while unit share decreased from 30% in Q3 2019 to 27% in the most recent quarter.

The report’s pivot tables allow analysis of brand share by screen size, region, technology, resolution and other variables. In Q3 2020, among all Advanced TV products Samsung increased unit shipments by 90% Y/Y, increasing its unit share to 61% by expanding its QDEF product line into more affordable models. TCL Advanced LCD TV shipments declined Y/Y, while Hisense managed only a 4% increase Y/Y as the TV market in China stalled while western markets surged. In OLED TV, the top two global brands, LG and Sony, increased shipments by 70% and 54% Y/Y, respectively, but Panasonic got only a 2% increase, while TPV/Philips saw shipments decline Y/Y.

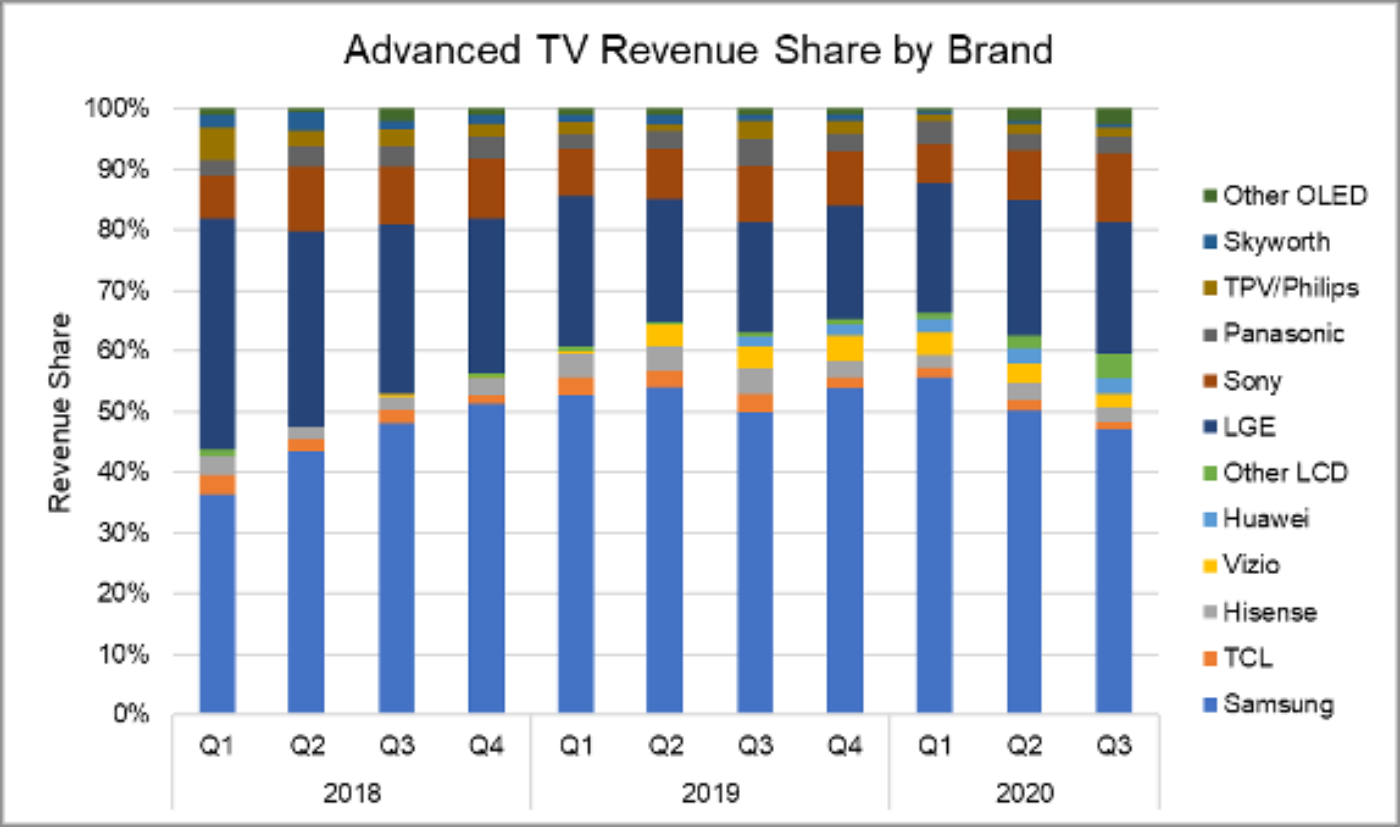

Samsung also leads the industry in revenue share for Advanced TV, as shown in the next chart here, but Samsung’s revenue share declined for the second consecutive quarter after peaking at 54% in Q1. Samsung’s revenue share in Q3 was 47%, down from 50% in both Q2 2020 and Q3 2019. LG has sustained the #2 position in revenue share at 22%, and regained 4 share points compared to last year. Sony sustained the #3 position in brand revenue with 11% share, up 2% from a 9% share in Q3 2019.

Advanced TV Revenue Share by Brand, Q1 2018 to Q3 2020

The report divides worldwide shipments into eight geographic regions, and up to now Western Europe and North America have been the largest regions for Advanced TV. These two regions represented a combined 66% share of Advanced TV in both units and revenue in Q3 2020. Shipments to Western Europe increased 102% Y/Y in Q3 2020, and revenues increased by 66% Y/Y as OLED TV did particularly well there. Shipments to North America increased 85% Y/Y but revenues increased by only 36% Y/Y as Advanced LCD gained share, while in China Advanced TV shipments increased by 32% Y/Y but revenues declined by 1%.

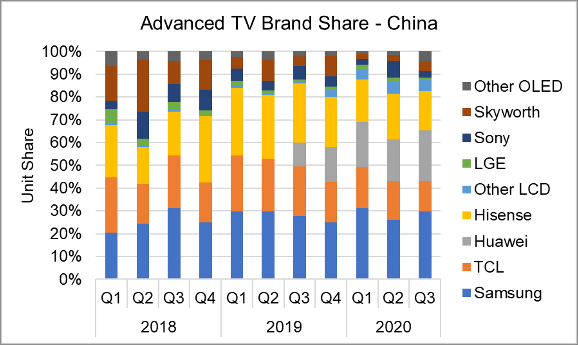

The Powerpoint report includes analysis of brand share by region and product segment, allowing a more focused view of brand share battles. The share battle in China has gotten increasingly intense, as shown by the next chart here. China has become a true battleground with four companies with double-digit % market share. Samsung’s share of Advanced TV increased both Q/Q and Y/Y in Q3 2020 to 30% unit share and 31% revenue share. Despite only introducing TV products in 2019, Huawei has emerged as a major player in Advanced LCD TVs, capturing a 22% share in Q3 in both units and revenue for 2nd place in both categories. Hisense and TCL both lost share in Q3 2020 on both a Q/Q and a Y/Y basis. LG fares poorly in China with only 1% share in Q3, but Sony fares better with its OLED TVs with 7% revenue share in Q3 despite only 3% unit share.

Advanced TV Revenue Share in China by Brand, Q1 2018 to Q3 2020

In North America, Samsung enjoys a dominant position on the strength of its large-screen product portfolio, and Samsung increased its lead in Q3 2020 with 75% unit share of Advanced TV. LG has sustained its #2 position in both units and revenue and regained some share in Q3 2020 to 20%. Vizio emerged as a major player in the market in 2019 with affordable QDEF TVs. Vizio stumbled a bit in Q3 2020 with its unit share dipping to 9% compared to 16% in Q3 2019, but with an aggressive OLED TV offering in a Black Friday deal (see separate story this issue), Vizio may be positioned to regain share in Q4 2020. Sony’s revenue share at 10% is much higher than its unit share of 4%, as it has maintained its focus on very large sizes and higher-priced OLED TVs.

In Western Europe, Samsung continued to lead in Q3 2020 with 58% unit share but this has fallen from a peak of 71% in Q2 2020. Samsung’s revenue share in this region was only 41% as OLED TV sells at premium prices in Europe, and Samsung’s advantage in larger sizes means less to European consumers. LG regained unit share to 25% in Q3 2020, and took 35% revenue share with premium OLED TV prices. Sony has been able to sustain a double-digit revenue share in Europe with an attractive OLED TV product line, but Panasonic and Philips have seen their positions erode to low-single digits.

Another interesting cut of the brand data is the battle by screen size, with the 65” battle shown in the next chart. Samsung continues to lead this size category in Q1 2020 with more than 50% unit share, but Samsung’s revenue share in 65” is only 43%; even with some mix of higher-end QLED products such as 8K its average price is substantially lower than the OLED TV makers. LG took 17% unit share in Q3 2020, flat with Q2 2020 and a slight increase from 16% in Q3 2019, but LG’s higher-priced OLEDs gave it 24% revenue share in the latest quarter. Sony, Hisense and Vizio round out the top five brands for 65” Advanced TV.

Worldwide Advanced TV Revenue Share for 65” by Brand, Q1 2018 to Q3 2020

The battle for larger sizes is no battle at all, as in 70”+ Samsung captures 75% of units and 63% of revenue. Samsung has seen its position slip a bit in 2020, though, as LG and Sony sales of 77” OLED have increased dramatically, bringing their revenue shares to 17% each, while Samsung’s revenue share has dropped nearly 20% in the last year.

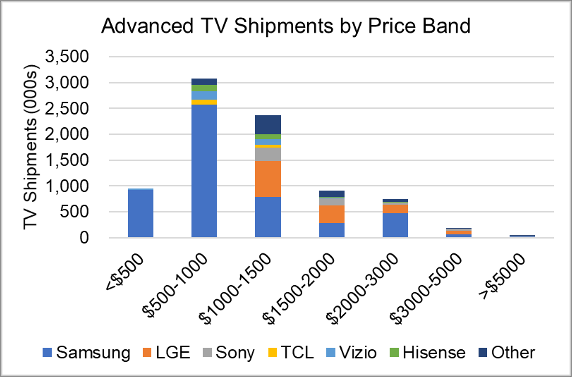

The last chart here shows one last valuable cut of the data, units by brand by price band. The pivot tables allow for this analysis by any time period, and the Powerpoint report includes the data for 2019, but the chart here shows the market by price band for the first three quarters of 2020. The chart shows that Samsung’s leading position in Advanced TV is mostly a function of its dominance in Advanced TVs under $1000. Samsung’s strategy of pushing its QLED product line toward mainstream price points has allowed it to thrive, but Vizio also appears as a competitor at these lower prices. LG’s OLED TVs give it a solid position in the range of $1000-$3000, and LG holds a leading position in the market above $3000, but as the chart indicates the volumes at these highest price points are miniscule.

Worldwide Advanced TV Units by Price Band for Q1-Q3 2020

DSCC’s Quarterly Advanced TV Shipment and Forecast Report includes technical descriptions of all major Advanced TV display technologies, plus quarterly shipment results from Q1 2018 through Q3 2020 preliminary results, sortable by technology, region, brand, resolution and size, and includes pivot tables for analysis of units, revenues, ASPs and other metrics. The report includes DSCC’s quarterly forecast for the current year plus an annual forecast for five years across technology, region, resolution and size. Readers interested in subscribing to the DSCC Advanced TV Shipment Report should contact [email protected].