On Tuesday, we published the first part of Barry Young’s article on the developments in the large area panel market and we focused on the macroeconomics and LCD supply side. In this article, he looks at the developments in OLEDs and miniLED LCDs and the impact of these developments on display area and revenue growth.

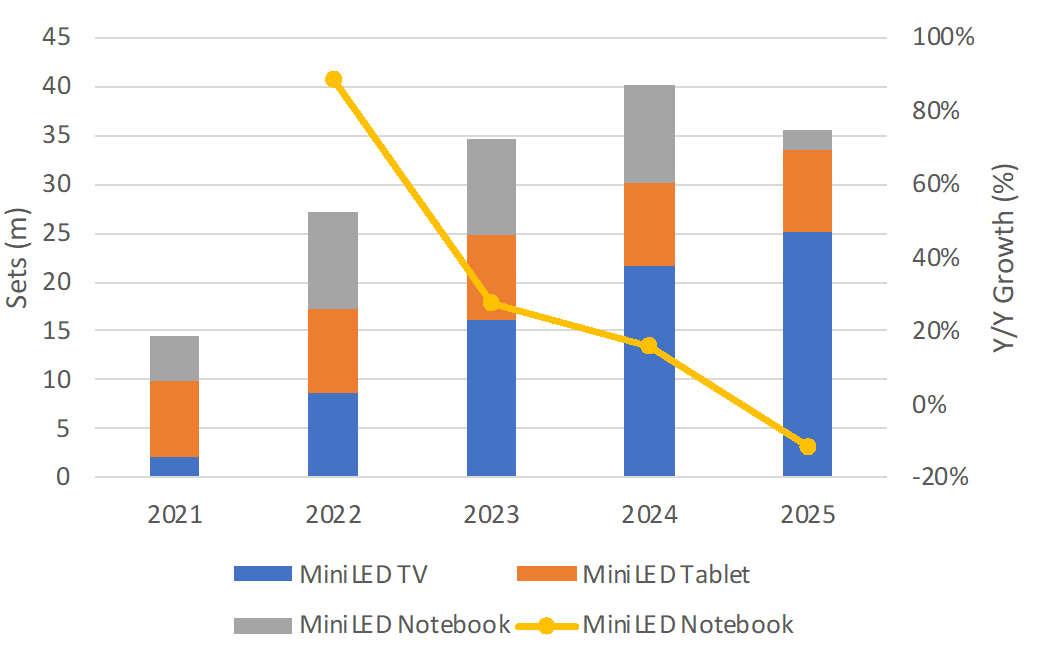

On the way to developing microLED display technology, LCD panel makers found miniLED backlights and in 2021, shipped 2 million TVs, 7.9 million tablets and 4.5 million notebooks. The miniLED trend was led by Apple rather than TV makers. MiniLED allows LCD to get closer to OLEDs in terms of contrast, a key feature for buyers.

The volume of miniLED is being hindered by a huge cost gap between LED and miniLED products and even OLEDs depending on the miniLED configuration. As the cost gap falls, miniLED products are expected to increase in share in the TV segment, helped by increasing demand for high end TVs and limited growth in OLED capacity. But the introduction of the higher priced miniLED LCDs has also been positive for OLEDs as the consumer’s expectation that they may have to pay higher ASPs for notebooks, TVs and tablets in the upper price category has been raised.

Figure 1: MiniLED Sets – 2021-2025e

Source OLED-A/Omdia

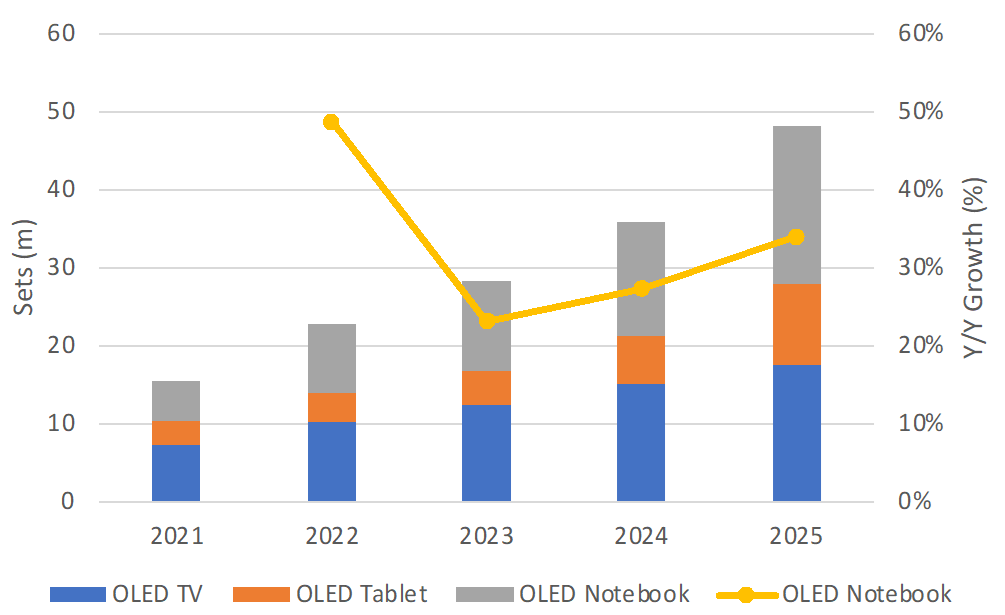

Figure 3: OLED Sets – 2021-2025e

Source OLED-A/Omdia

By 2025, when Samsung’s. BOE’s and LG Displays Gen 8.5 IT fabs are fully operational, OLEDs for TVs, Tablets and PCs are expected to outsell miniLEDs by 35% after reaching parity in 2024.

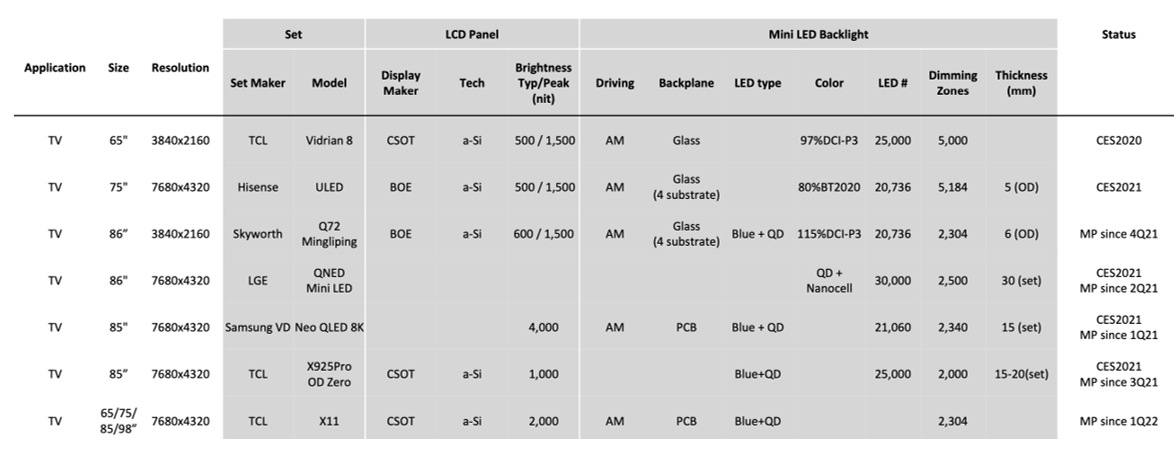

OLED panels outperform miniLEDs in terms of CR, lack of blooming, power consumption and form factor. OLEDs will catch up in luminance when the OLED IT panels use tandem structures for twice the brightness and greater lifetime, which should ameliorate the image sticking issue. The second contribution to the OLED position is the cost of miniLED backlights, which are currently 80% higher than OLEDs for a competitive panel with sufficient dimming zones to provide near competitive CR. The next table includes the specs of some high-end miniLED TVs.

Table 2: Mini LED TV Specs

Source:Omdia

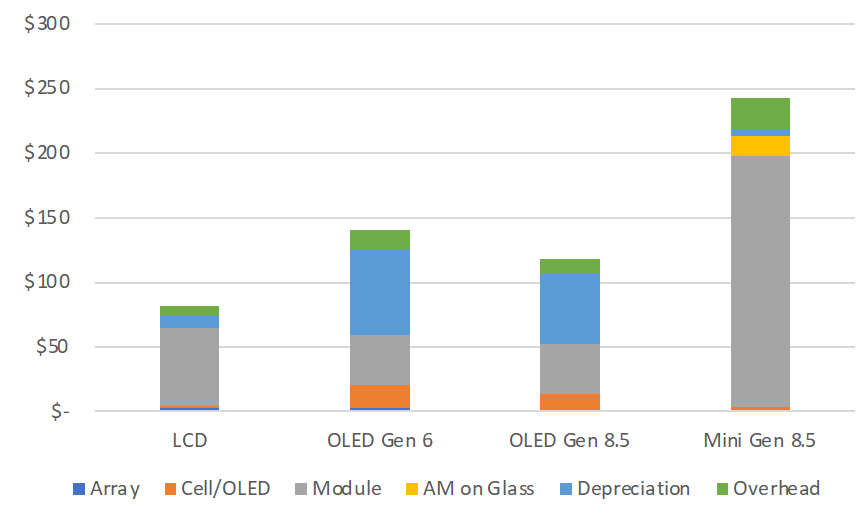

WOLED panels are 2.7 the cost of a regular LED LCD, but that premium is more than doubled for the current low volume, low yield QD-OLED which costs over five times a regular LCD to make. MiniLED panels come in many configurations depending on the number of LEDs and dimming area. The high density miniLEDs, which compete with OLEDs are currently four times the cost of ‘vanilla’ LCDs and twice the cost of WOLEDs.

Notebooks and Tablets

For tablet and notebook panels, the number of dimming zones is not high, but miniLED panel costs are currently 75% more than OLEDs. The current issue for OLEDs is the lack of capacity to make rigid OLEDs, where Samsung and Visionox are the only source of panels. The cost difference could get wider for miniLEDs assuming Samsung’s IT Gen 8.5 enters mass production in 2024, increasing the differential to 105%. For miniLEDs, the offsetting factors will be a cost reduction effort that will likely cut the backlight cost by ~50% and the supply glut, which will lower the basic panel prices. Nonetheless, Apple, the tablet leader and the #1 supplier of high-end notebooks has indicated that by 2024/2025, it will be introducing OLED panels for these products: that’s pretty much in-line with the availability of tandem emission structures and Samsung’s Gen 8.5 IT fab.

Figure 4: 12.9” FHD Panel by Display Technology

Source: Omdia, OLED-A

Over the next 5-years, the cost of miniLED backlights is expected to come down by a CAGR of 4.5%, 10% and 13.7% for low, mid and high density backlights, respectively.

The tasks for cost reduction in miniLEDs are

- to reduce the size of the LEDs,

- use larger wafers in MOCVD equipment, e.g. shifting from 4”,6” and 6” to 12”;

- use higher end clean rooms to improve the yield and

- develop integrated driver systems.

Samsung Visual Display, the largest TV supplier has embarked on a miniLED backlight cost reduction program, where they are integrating the LED driver IC with the LED PCB. Each LED module is equivalent to a dimming zone. The Neo QLED and the TCL X11 both use the technique. Samsung’s Neo QLED 8K has 21,000 LEDs has 2,100 dimming zones and therefore 2,100 driver chips. Should a TV set maker set up a foundry to integrate the driver ICs with the LEDs, the cost reduction has been estimated to be between 20% and 40%.

Overall Area & Revenue Result

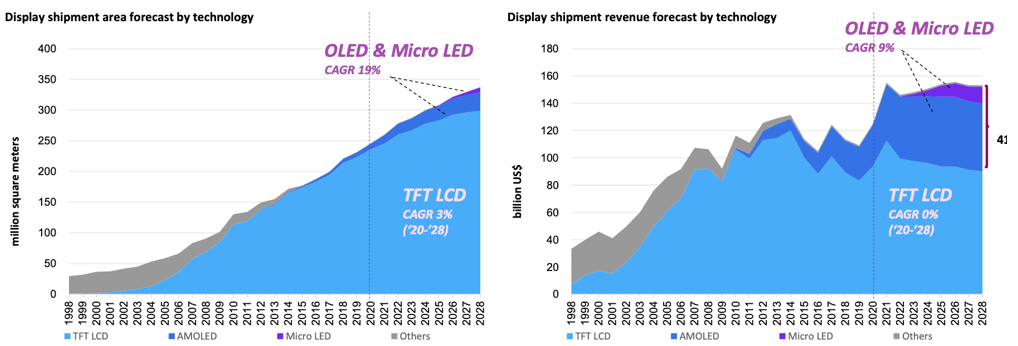

Taking into account these changes in OLED and miniLED, combined with the macroeconomic and glut issues that we talked about in Part 1, the forecasts look quite different from the revenue and area points of view. Even with the shipment area growth continuing to be dominated by LCDs, OLEDs are expected to account for the majority of the revenue growth between 2022 and 2028, with a small contribution from MicroLEDs, although MicroLEDs are not expected to generate much revenue before 2025. (BY)

Figure 5: Display Shipment Area and Revenue – 1998-2028e

Source Omdia

Barry Young is CEO of the OLED Association.

This is the second part of an article but we are treating the two parts as one for those that have free accounts. Part 1 is here. World Events and the Coming Glut in Large Area LCD Panels – Part 1