DD Contributor and OLED Association CEO Barry Young recently wrote an interesting article about the global macroeconomic situation which included material from a recent Omdia briefing. It also covered the battle between OLED and miniLED LCD technologies. It was a bit long for a single DD article, so we’re covering the economic and industry side part today and we’ll cover the technology battle in Part 2. We’ll count them as one if you have our limited free subscription.

There are multiple forces operating on the economy as the lockdowns and government largesse have changed global and US economic conditions.

- First, the US economy was artificially boosted by borrowing money and distributing it through PPP loans and pandemic benefits. Retail sales are up 25.2% between February 2020 and February 2022, while industrial production is up just 2.3%, and the US has 1.6 million fewer jobs than it did pre-lockdown. Unlike the Great Society programs of the 1960s, the spending done in response to the Financial Crisis and Covid-19 are not permanent increases in entitlements. Some of our Covid response spending is likely to be permanent, but not all of it.

- Second, the US M2 money supply has increased more than 40% since February 2020, as the Fed renewed Quantitive Easing and monetized deficit spending. The impact of these policies was like giving morphine to an accident victim. The economy was damaged by the lockdowns, but the morphine masked the pain. All that pain-killer stimulus boosted sales and profits. This year, without new spending legislation and as the Fed starts to reverse course, the US economy will lose its morphine drip. Similar patterns are being seen in other developed economies.

- Third, the reopening of the economy will end the generous pandemic unemployment benefits in the US, which had a massive impact on employment. Now that Joe Biden’s Build Back Better plan appears dead, people are heading back to work. In the first three months of 2022, 1.69 million jobs have been filled in the US. This year will likely total 4 million jobs, or more.

As the US Federal Reserve (Fed) lifts rates and deficits are reduced, the economy will expand in 2022 and profits should continue to rise. But real GDP growth will remain under 3%, while inflation remains over 5%. This is reminiscent of the 1970s, and once the reopening from lockdowns is over, the full impact of these policies will be felt. The US is now stuck in a Keynesian dilemma of its own making, and it appears to be dragging Europe with it.

Impact on the Display Industry

The display industry has been impacted has been affected by world changing events. Some of the changes are related to the acceptance of Covid into our “way of life” changing the nature of consumer electronics demand, others are due to Russia’s invasion of the Ukraine and still others are related to the adoption of OLEDs and the need for LCD manufacturers to compete:

- Russian’s invasion of Ukraine eliminated the demand from 200m people

- The end of the blip in TV buying

- The shift from producing smaller TV panels (<50”) to IT panels has run its course.

- The shipment time from China to North America has doubled and the cost is up by 5X

- MiniLEDs LCD panels are now prominent in Advanced TVs and high-end IT products

- Automobile demand has gone back to pre-pandemic levels pushing display usage to its highest level ever.

While large LCD panel makers struggle to adapt to lower demand and higher capacity, the impact on OLEDs is expected to be minor:

- Market share for OLED smartphones continues to rise but could be dampened by a desire to lower the BOM in mid-range phones. This trend could be offset by a 50% growth in shipments by Chinese OLED panel makers and an expected lower price than Samsung charges for rigid displays

- OLED TV shipments should increase by 20% with the introduction of QD-OLEDs and the adoption of OLEDs in TVs by Samsung Visual.

- OLEDs remain a minor player in vehicles with a concentration in the high end

- Domination of smartwatch displays continues and the suggestion of microLED as a display is pushed back to 2023/2024

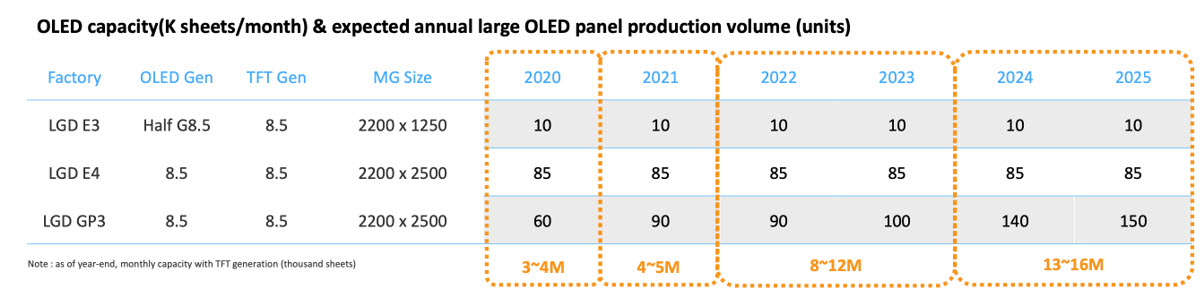

Table 1: LGD OLED Capacity 2020-2025

Source: Omdia

The Impact of the Russian Invasion in Ukraine

Russia’s 2022 GDP annual growth rate forecast was 3.4% before the invasions and is now -11.1% and falling. Ukraine’s GDP growth is likely to be zero. From a consumer perspective, 200 million people have stopped purchasing display-based products, reducing global demand for TVs, notebooks and monitors by ~3%. Moreover most of the reductions will be in the smaller TVs, low end PCs and monitors, where the bulk of the global demand is already down.

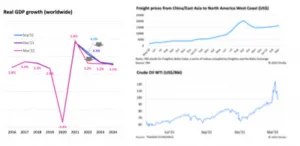

Figure 1: Real GDP, Freight and Oil Price Changes

Large Area LCD Panel Surplus

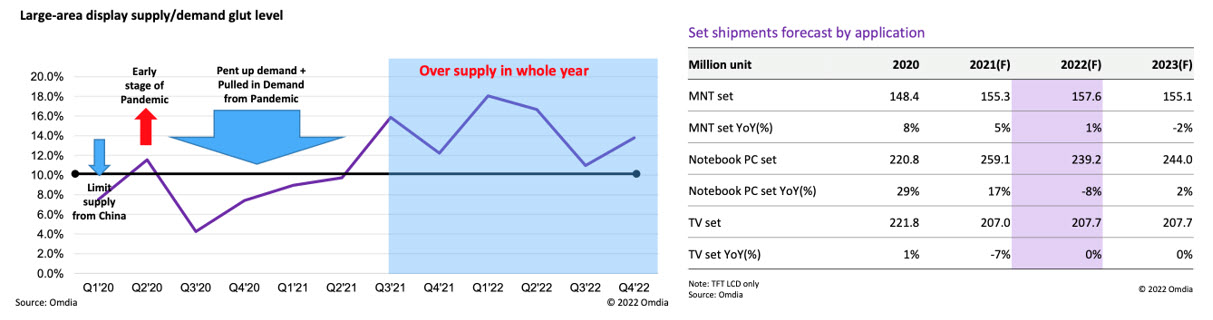

The glut in large area displays is expected to rise to 18% in Q222 and 16% in Q322, before dropping to 12% in Q322, when seasonal demand for panels to make TVs peaks. Anything over 10% glut creates pressure on prices and the accumulation of inventories. As prices drop, more pressure is put on panel makers to absorb inventory fluctuation as brands delay purchase orders waiting for the lowest price.

Figure 9: Large Area Display Supply Demand vs. Set Shipments 2020-2-22e

Source: Omdia

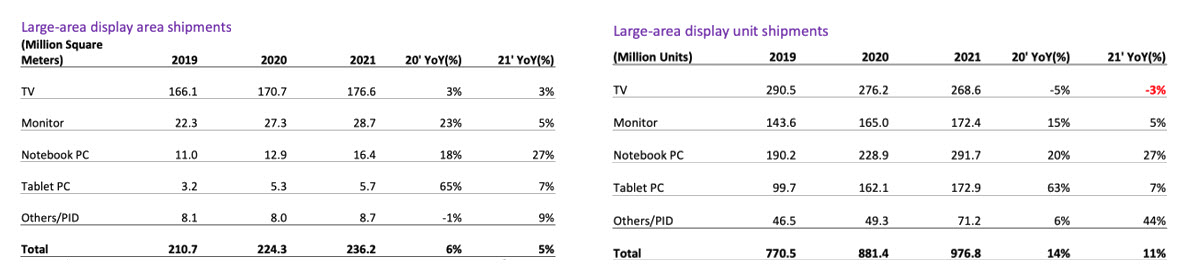

2022 set shipments for monitors, tablets, notebooks and TVs are all forecast to be down Y/Y, and 2023 doesn’t appear to be a recovery year as shown in the figure above. Inventory weeks, which were in the 3 week range in 1H21, rose to just under 4 weeks in 2H21 and is forecast to rise to 4.4 weeks by May’22.

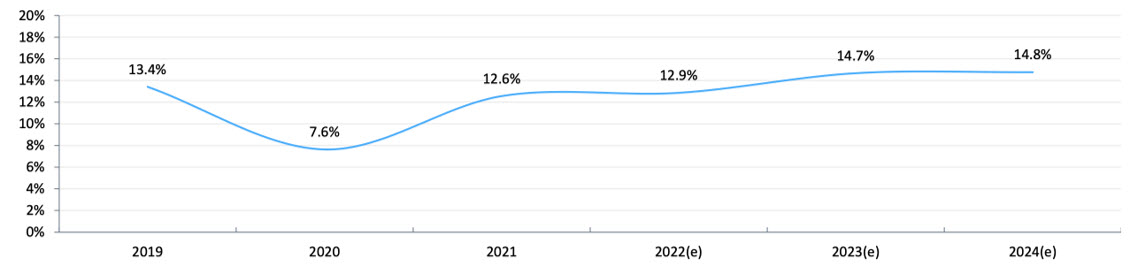

The glut, which was 13.4% in 2019, a tough year for the industry, was down to 7.6% in 2020 and should average between 12.6% in 2021 and 14.8% in 2024. (which means continuously in significant glut conditions – editor)

Figure 11: Annual Large Area Supply/Demand Glut

Source: Omdia

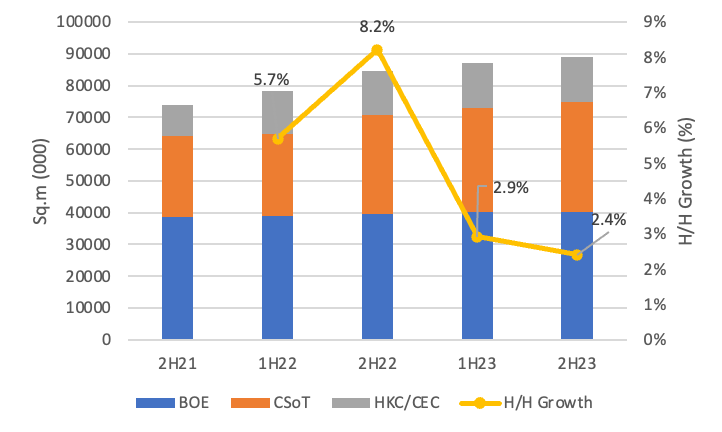

The large area supply is dominated by China’s panel makers, BOE, CSoT and HKC that together account for 80% of the industry’s capacity and production. (BY)

Large Area Display — Shipments and Area—2019-2021

Barry Young is the CEO of the OLED Association