Historical analysis suggests that major global sporting events like the Olympics typically boost TV sales, as consumers are motivated to upgrade their sets for a better viewing experience. Retailers and manufacturers often run promotions and offer discounts around these events, making it an ideal time for new TV purchases.

So, it’s fair to say that major sports events generate a lot of public interest, which can spur sales. That’s certainly one expectation of the 2024 Paris Olympics, which will showcase a wide array of sports, attract diverse audiences, potentially leading to a broader consumer base interested in upgrading their TV sets.

Major sporting events are also great times to raise adoption of new broadcasting technologies (such as 4K, 8K, HDR) or new services (like improved streaming capabilities). This technological leap can act as a catalyst for consumers to purchase new TVs to take advantage of these enhanced features.

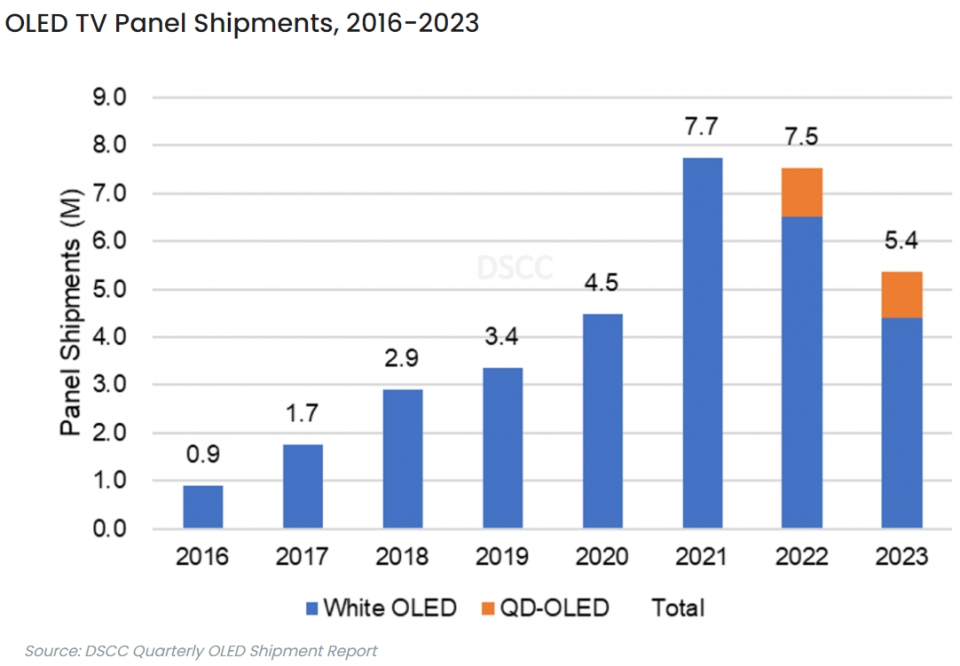

According to DSCC, this year’s Paris Olympics should boost sales of premium TVs in Western Europe. Samsung is expected to order between 900k and 1.1M WOLED TV panels from LG Display this year, up from 500k last year. Is that a sign of better things to come this year or just a sign that Samsung doesn’t have the capacity, maybe even the focus, on QD-OLED sales this year? The sales of OLED TV panels, again according to DSCC, amounted to 5.4M units in 2023 down from 7.6M in 2022. We do know that pandemics increase TV sales as they did during COVID, the Olympics? It’s anybody’s guess this year.

There are too many factors at play mostly around events and macro environments that are beyond anyone’s controls. There’s war, which is now happening in Europe and the Middle East. There is the economy, which is in limbo, not quite recessionary and not expansionary. There’s little devices and clips and social media; will there be more watching of the Olympics on phones than actual TVs?

But, why focus on premium TVs, and OLED TVs? It could be that most of the aggressive coverage of the TV market stats and most of the impact on premium TV sales, are felt in Korea. The fortunes of Samsung and LG in the OLED market this year come against the expectation that the market demand is more likely for OLED displays in the IT market, and that prices on LCD panels and OLED panels are going to decline throughout the year which tends to favor the Chinese manufacturers.

If you take OLED TVs out of the equation, TV sales could increase this year, and they could be spurred by the Olympics, but they’ll be driven by deals. Roku is probably a good example of where the premium TV market may be focused this year. The company just released the Roku TV Pro series. The key takeaway from the announcement is that Roku wants you to know that whatever it does, it will come under $1,500 with its pricing.

Lower TV pricing, a war of competing deals and incentives and discounts leading up to the Olympics, is the most likely booster of TV sales. There is an expectation that inventory levels will be kept tightly controlled and that pricing will be managed. That does not look likely to happen.

So, bigger, cheaper TVs are the only booster this year. An election cycle in the US, an Olympics in Paris, and any number of other events could provide a boost, but there doesn’t seem to be any of the economic incentives that existed during the pandemic that helped OLED TV sales, for example. And the big question mark is the changing sports viewing habits of younger generations who prefer clips to long, drawn out broadcasts.