Admittedly it may just be the writing on the wall, but IHS is seeing a slight price drop in LCD panels in 2H17 after a fifteen (count ’em -15!) month consecutive price increases in the “Venetian blind-like” (liquid crystal) technology that serves at the core of most all of our large displays. But the crystal cycle is alive and well in the global market place with oversupply perhaps looming on the horizon as fresh capacity comes on line following billions of investment dollars in the space for both LCD and OLED manufacturing capacity.

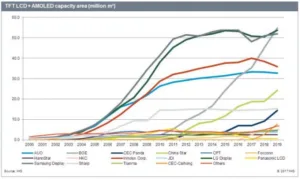

Case in point, last month in his IHS analysts blog, David Hsieh noted China based BOE will hit an industry milestone less than two years out, with 2019 TFT-LCD and AMOLED semiconductor display technology capacity to top 54.8 million square meters (m²) that year. Compare that with the 2019 forecasts of current ranking top three panel capacity makers : LG Display, Foxconn Group, and Samsung with 53.8M-, 53.7M- and 52M m², respectively, (see IHS capacity chart below).

But for now times are good and the multi-quarter consecutive price rise also helps account for LG Display’s performance in the LCD display panel space with the company just reporting a 1Q17 net operating profit record of slightly under $1B for the quarter at $921M (or KRW of 1,027 million). Panels made for TVs account for almost half (43%) of LGD’s Q1 revenue. It’s on the big screen side of the market that LG dominates. In January IHS reported the top three TV panel makers: LG with 21.4%, Innolux with 16.3%, and BOE with 15.9%.

On the notebook PC display side, IHS said BOE supplied 29% of the global market and Innolux was ranked number two, supplying 20% market share globally.

The caveat here for BOE is their dedicated focus and slow but steady growth approach that does, perhaps, give them some leeway to react to changing markets. Hsieh points out that the company will have “modest growth” in 2017 and will not ramp up its gen. 10.5 plant until late 2018. In the short to mid-term, 2017 and 2018 capacity will increase by 10M m². The company works heavily with local, regional and national government groups in its display fab build-outs, and BOE is also focusing on a diverse business portfolio that includes, “…set assembly, the OEM/ODM business, semiconductors, medical care, solar, lighting, and components and materials,” Hsieh notes in his blog. But display manufacturing dominates in revenue generation for the China based company.

Also keep in mind the lines between OLED and LCD panel manufacturing (on the bean counting side anyway) are blurring. IHS’s Hsieh said “In calculating the current display capacity totals, IHS Markit combined TFT-LCD and AMOLED capacity because companies like Samsung Display and LG Display are shutting down TFT-LCD capacity in favor of expanding capacity in AMOLED. Significant TFT backplane capacity is reserved for AMOLED displays, including LTPS—or low-temperature polysilicon—for mobile OLED displays and oxide for large OLED displays.”

Like Japan, Korea and Taiwan before them, China is a growing force in display capacity, projected soon to overtake the current leader in panel supply. And if history is a teacher of anything in this business, the crystal cycle is something all display panel makers will want to plan for and eventually have to contend with. — Steven Sechrist

LG Electronics Result 27/04/2017

China’s BOE to have world’s largest TFT-LCD+AMOLED capacity in 2019

BOE Takes First Place in Large LCD Shipments

BOE Display To Invest In New $145 million OLED TV Production Line

Orbotech’s Solutions Selected by BOE for World’s First Gen 10.5 FPD Fab