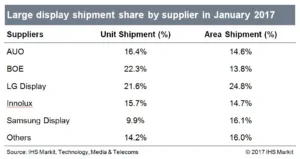

According to IHS Markit’s market tracker, China’s display maker, BOE has taken the top position for large TFT-LCD display unit shipments in January 2017. BOE took a total share of 22.3% in unit shipments just ahead of LG Display with 21.6%. This is the first time that a Chinese display maker is in the top position, and is displacing South Korea’s display makers, the historical leaders in this market.

According to IHS Markit’s market tracker, China’s display maker, BOE has taken the top position for large TFT-LCD display unit shipments in January 2017. BOE took a total share of 22.3% in unit shipments just ahead of LG Display with 21.6%. This is the first time that a Chinese display maker is in the top position, and is displacing South Korea’s display makers, the historical leaders in this market.

For notebook PC displays in particular, BOE had a 29% share of the shipments, with Innolux taking second spot with 20%. LG Display remains top for large displays for TV applications, with 21.4%, followed by Innolux with 16.3% and BOE with 15.9%.

In terms of area shipments, LG display maintains its top position with 24.8% followed by Samsung Display with 16.1% and Innolux with 14.7%.

Total unit shipments for applications in the month, were as follows:

- For nine inch and larger tablet panels, shipments fell by 20% om month but rose 9% on year.

- For notebook PC panels, shipments fell 8% on month but rose 20% on year.

- For monitor panels, shipments fell 6% on month and were flat on year.

- For TV panels, shipments fell 6% on month and 3% on year.

Total unit shipments on an area basis, were as follows:

- Large panel shipments fell 8% on month and rose 11% on year

-

LCD TV panels shipments fell 7% on month and rose 11% on year.

Analyst Comment

As I’ve said before, one of the jobs we have is to identify ‘inflection points’. Although the level of investment in China has meant that it has been obvious for a number of years that China would start to take an increasing share of the market, the first time that a Chinese maker hits the top spot as significant. At the moment, CSOT and others are some way behind, but starting at the end of this year, there will be a big boost in the share taken by Chinese makers as a group.

The other surprising number is the 9.9% share by volume of Samsung Display (although if you look at the area number, the company is second and BOE drops back to fifth). Intellectually, it has been clear for a long time that Samsung had no more interest in growing LCD, but it’s still a surprise to see the company with less than half the volume of LG.

Looking at area, the Korean companies still control over 40% of the market and it’s the larger panels that have the better profit potential, so the companies have healthy businesses, at least until the new Chinese fabs that are being built have got into production and reached reasonable levels of yield. (BR)