Most of us are generally aware that some electronics companies are moving their sources of display out of China. Even Foxconn, the China-friendly Tawan-based company that is China’s largest employer plans to move more of its production from China to insulate itself from the increasingly fractious trade war between China and the U.S., wrote Alan Patterson in EET Asia in late August.

Since Hon Hai’s more than a million employees assemble iPhones for Apple, servers for Dell, and games for Nintendo, the company has good reason to protect itself from any trade walls, embargoes, or tariffs the U.S. might erect to block products assembled in China. At MIC Forum Spring in June, Foxconn Chairman Yong Liu predicted the long-term effect on supply chains after the current pandemic eases.

“The ‘world’s factory’ no longer exists,”

he said.

Reuters reported in July that Foxconn plans to initiate a $1 billion expansion of a factory in southern India that assembles iPhones, motivated by Apple’s desire to move iPhone production out of China. Digitimes Chairman Colley Huang said in late July that production of laptop PCs in China — where virtually all PCs are currently made regardless of the label they carry — will drop by half in the next three years.

“After three years, Vietnam will account for about 30 percent of total laptop production, followed by Taiwan with 20 percent and Thailand with about 15 percent,”

said Huang.

However, it will come as no surprise to you, knowledgeable readers, that there is an exception to this significant trend, and that the exception is display panels.

In a recent slide-deck white paper, Ian Hendy of Hendy Consulting asked

“What then will be the future of the display industry under Chinese leadership?”

The white paper is rich with detail, but I will borrow very selectively from the top layer.

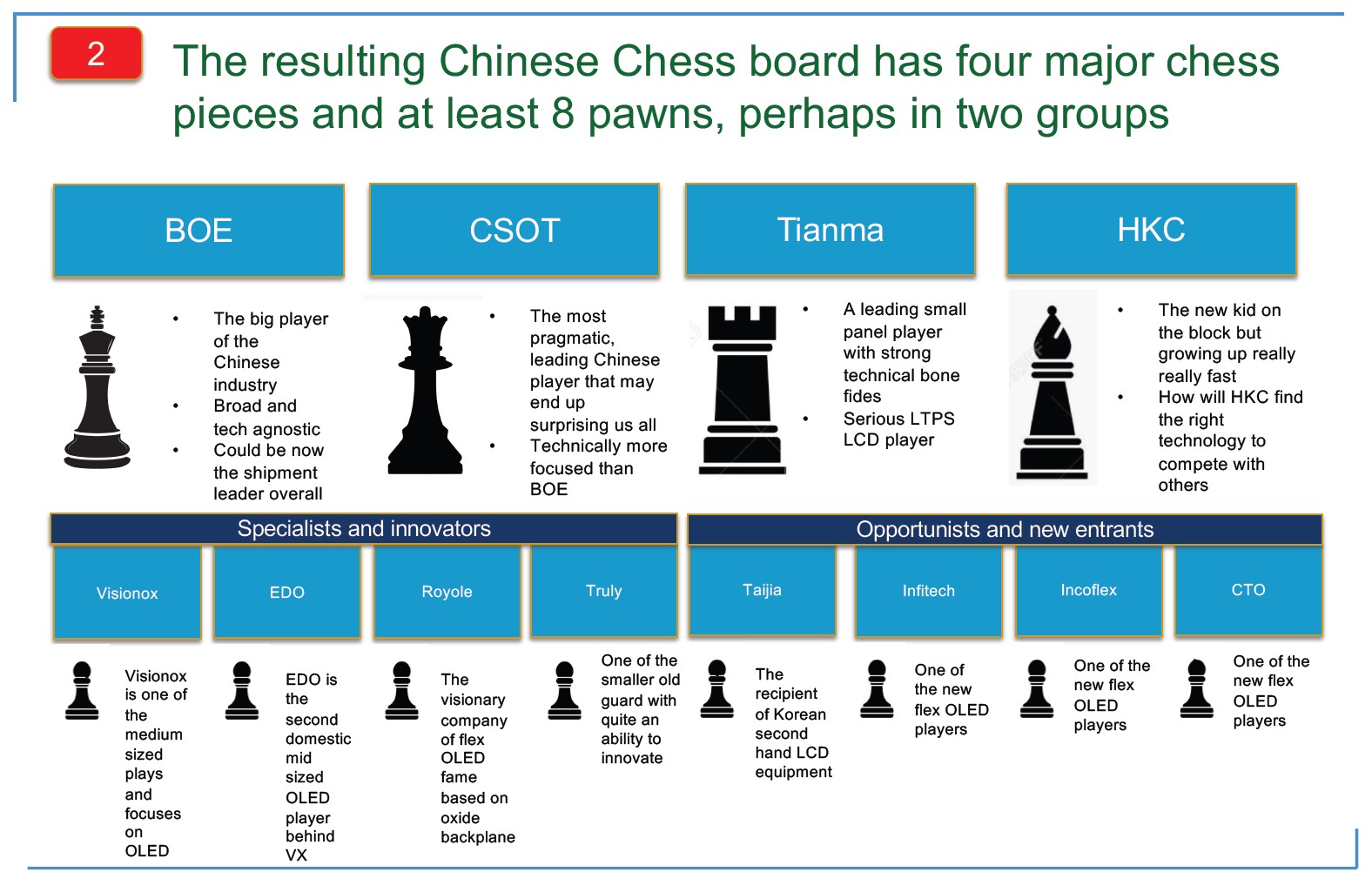

Hendy identifies four companies as the leading players: BOE, CSOT, Tianma, and HKC. BOE is the 800-pound gorilla. CSOT, says Hendy, is “the most pragmatic leading Chinese player that may end up surprising us all; [it is] technically more focused than BOE.” Tianma, he says is “a leading small panel player with strong technical bona fides; [it is a] serioous LTPS LCD player.” HKC might be something of a surprise in this list. The company, which used to be a major maker of monitors, is relatively new to making displays but is growing very rapidly. HKC is not strong on technology, so developing technological chops and finding the right display technology are essential if the company is to compete with the others long-term.

Analysis of other Chinese industries might lead us to think that Chinese display companies will use huge government subsidies to compete unfairly and hasten a race to the bottom. We have certainly seen those subsidies in the display sector. But, says Hendy, “Our conclusion is that there is at least some evidence that firms like CSOT, Royole and Tianma, and maybe others, may continue an innovation race and may indeed begin to behave like the Korean leaders. Once these firms have solid positions and IP portfolios to protect…then a more balanced set of behaviours may result that still may give an exciting future to our industry. We are not sure what leadership behaviour BOE will choose to take.”

Hendy concludes, “Overall, while Gen 10 has meant a lowering of prices, and a lot of Gen 10 investment has been done by the Chinese, we still think there will be a balance in a Chinese led future. The cost focus may be higher than under Korean leadership but firms like CSOT, Tianma and Royole may show us a path of rich technology innovation under Chinese stewardship.” (KW)

Much of the detail in Hendy’s white paper did not make it into this Display Daily. (Figure: Hendy Consulting – click for higher resolution)

Much of the detail in Hendy’s white paper did not make it into this Display Daily. (Figure: Hendy Consulting – click for higher resolution)

Ken Werner is Principal of Nutmeg Consultants, specializing in the display industry, manufacturing, technology, and applications, including mobile devices, automotive, and television. He consults for attorneys, investment analysts, and companies re-positioning themselves within the display industry or using displays in their products. He is the 2017 recipient of the Society for Information Display’s Lewis and Beatrice Winner Award. You can reach him at [email protected] or www.nutmegconsultants.com.