Earlier this week, I started to write an article about the talk at the DSCC/SID Business Conference by Stephen Baker of NPD, but it turned into a different article as I wrote it! (Pricing Reality in the Display Market) Still, overall the topic was much the same. However exciting new products are, few consumers will radically change the kind of price that they want to pay for an established product category.

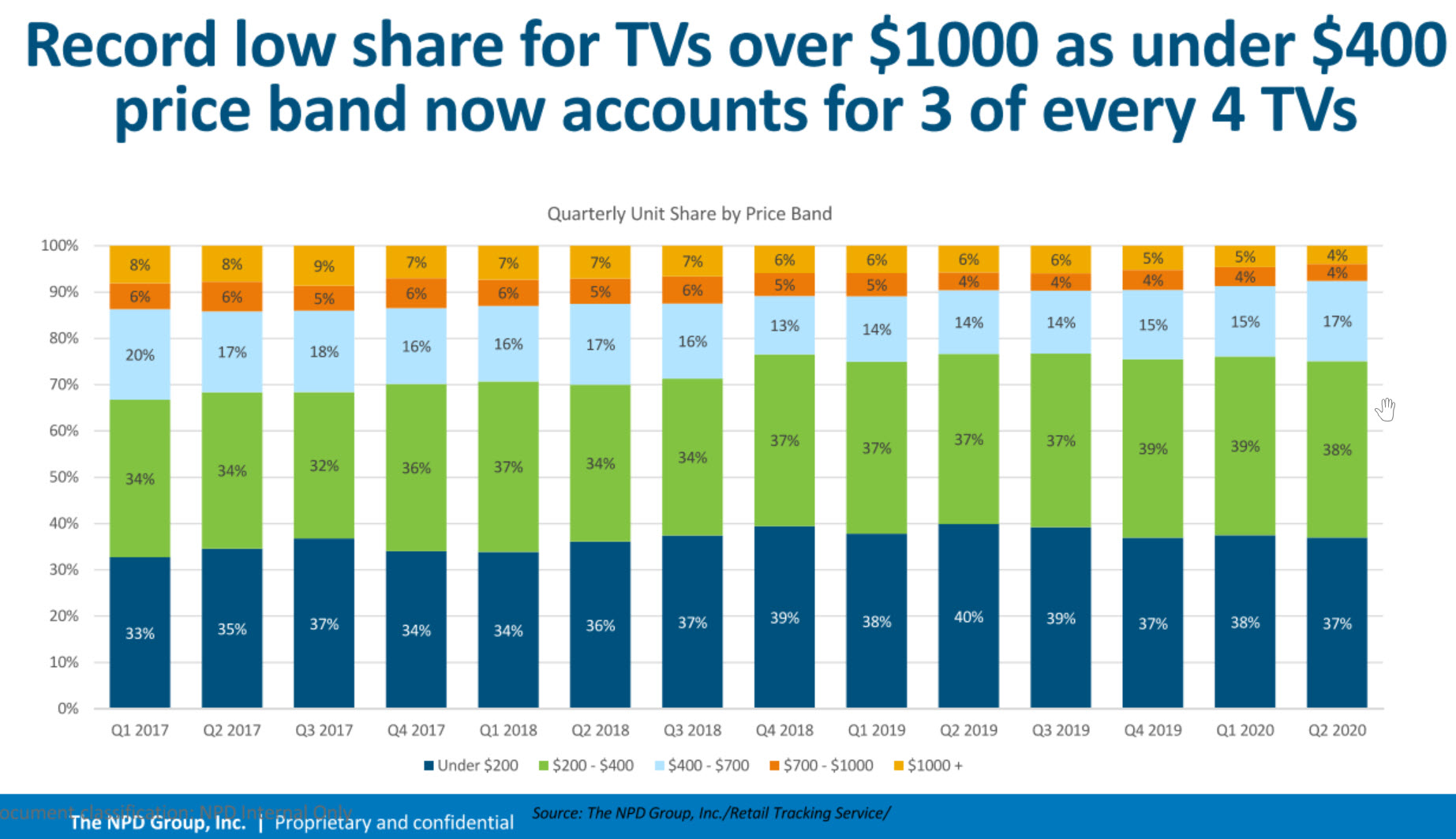

A point of evidence on this is that the ASP of TVs sold in the US, according to NPD, is $360, in line with longer term trends, although it was lower earlier in the year at the beginning of the epidemic. Baker highlighted that consumers are not spending more than normal and three of every four US TVs is being sold for under $400.

The share of the high end market has been falling. Click for higher resolution

The share of the high end market has been falling. Click for higher resolution

The more worrying statistic for those of us that love the latest and best TVs, the share of TVs over $1,000 is at a record low of 4%, down by half since early 2017. Prices fell early on in the crisis, but have drifted up again. So, while TV makers are highlighting 8K, OLEDs, miniLED, dual-panel LCD, microLED and other high end specifications, the reality is that the part of the market that will spend more to get these features is small and getting smaller (in the US). (It looks, to me, as though ‘good enough’ is driving out the best.)

So why is there so much noise around the premium segment? Baker didn’t address this in his talk, but it’s simply that much of the profit in the business comes from the sets that are in the 25% of the market above $400. In the TV business, as in other CE segments, volume drives the cost down, but it’s in the premium branded segments that margins are best and profits can be made.

US consumers still want big TVs and larger TVs are selling better than smaller ones. Covid has changed buying patterns with fewer buyers going into the store to buy. In store is now past its peak, with etailing really coming into its own. In this kind of market, having the right product at the right price and place is critical, he said. Instead of going to the store and having a set delivered, buyers now want to order and then collect from the store, immediately. That kind of purchase was growing, but has now ‘exploded’. There is a downside to this for retailers – there is no chance to ‘upsell’ a buyer

Big screen TVs have really hit low prices and for 65″, the key price point is $499 with between 45% and 65% of 65″ sets selling at under $500 during the crisis and 80% at less than $700. Bigger sets have kept selling at higher prices.

The average installed base is 5.3 years old, although buying recently may have reduced that to five years. When users buy a new TV they upgrade in size by, typically, 3″ (7.5cm) to 5″ (12cm). Going to 4K TV means a move up by 7″ (18cm) , typically. This is a historic opportunity to upgrade and upsize US TVs, Baker said.

Some buyers have brought forward TV buying decisions and that has been mainly wealthier and older consumers. Game console sales have also helped drive TV sales. Some younger buyers are moving to TVs from tablets and other devices.

Overall CE Spending

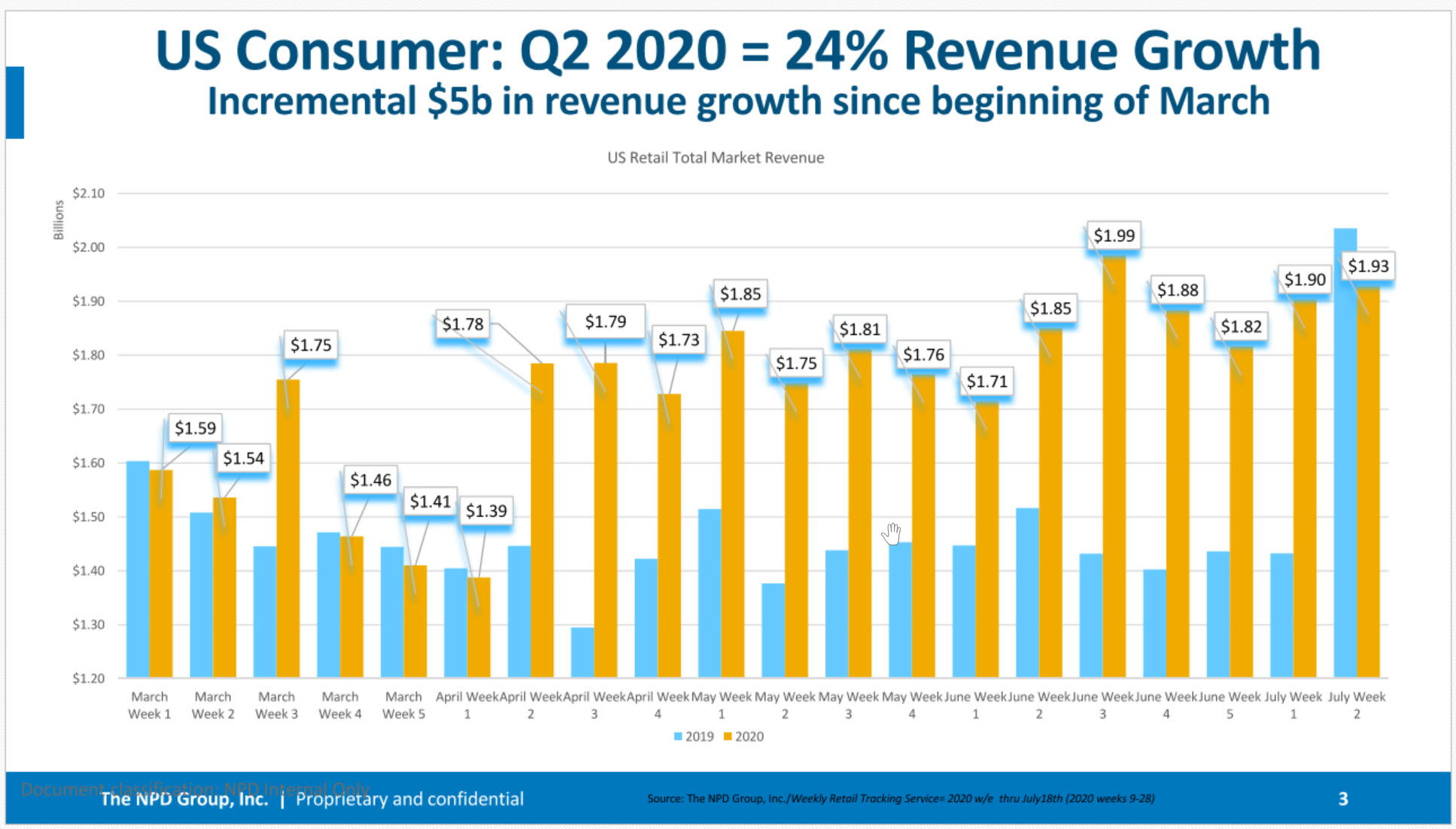

There has been record revenue growth in CE spending with 24% growth in Q2 2020 and with four of the five best ever non-holiday weeks of sales. Incremental sales have been $5 billion since early March.

Consumer growth was strong in Q2, but forecasts are very unclear. Click for higher resolution

Consumer growth was strong in Q2, but forecasts are very unclear. Click for higher resolution

In the US, tech growth is being driven by one or two categories but this year there is broad growth in many categories of consumer electronics. Why? Because tech is seen as a necessity, not a luxury. It is for entertainment, working from home (WFH) and learning from home (LFH), so there is lots of appeal for quarantined consumers. That should help sustain sales over coming quarters, Baker continued.

There is a lot of uncertainty in the forecasts, but current volumes are probably not sustainable, but there are lots of opportunities. although barriers to entry for new brands and channels will be higher. Channel shifting will be the main way to get brand growth.

The forecast has been difficult and the market overall could grow by 2% in Q4 or decline by 10% in Q4, based on the most optimistic and pessimistic scenarios. Growth in large screen TV will not be so big compared to last year as 2019 saw strong growth. (BR)

Note that access to the Business Conference will still be available online for some time.