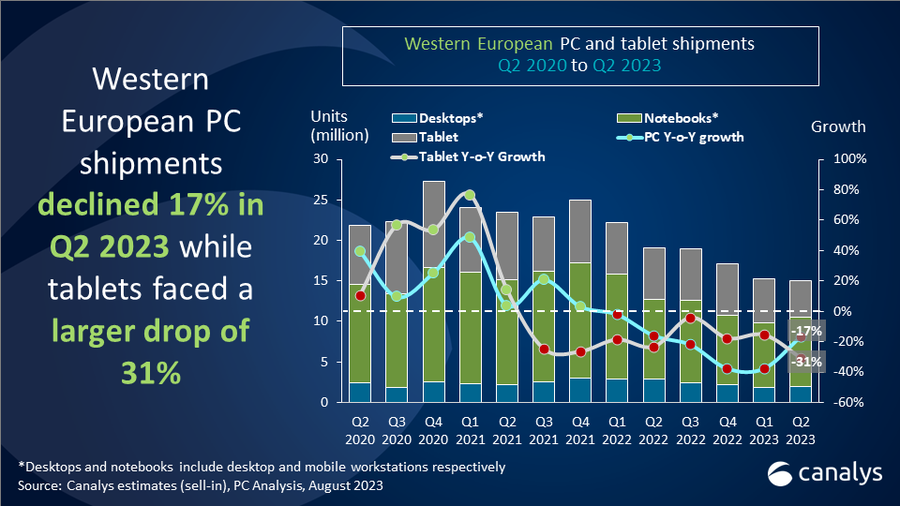

Western European PC shipments, which includes desktops, notebooks, and workstations, experienced a decline of 17% year-on-year (YoY), amounting to 10.5 million units in the second quarter of 2023, according to a recent study by Canalys. However, this is an improvement from the preceding quarter when the shipments faced a sharper drop of 37%.

Notebook shipments, at 8.6 million units, fared better than most, recording only a 12% decrease, compared to desktops which saw a 33% slump, with 1.9 million units for Q2. The tablet market in Western Europe witnessed a decline, with shipments plummeting by 31% to 4.4 million units. Despite these figures, the trajectory of the market is arching upwards even with an anticipated 13% drop for the full-year 2023 PC shipments and a 14% decline for tablets. There is a stabilization in the decline of demand over the past 18 months, and with inventory levels under control giving hope that the latter half of 2023 could witness consistent sequential growth.

| Vendor | Q2’23 Shipments (in thousands) | Q2’23 Market Share | Q2’22 Shipments (in thousands) | Q2’22 Market Share | Annual Growth |

|---|---|---|---|---|---|

| Lenovo | 2,824 | 26.8% | 3,785 | 29.9% | -25.4% |

| HP | 2,773 | 26.3% | 3,031 | 23.9% | -8.5% |

| Dell | 1,609 | 15.3% | 1,878 | 14.8% | -14.3% |

| Apple | 933 | 8.8% | 997 | 7.9% | -6.4% |

| Acer | 794 | 7.5% | 1,000 | 7.9% | -20.7% |

| Others | 1,621 | 15.4% | 1,973 | 15.6% | -17.8% |

| Total | 10,553 | 100.0% | 12,664 | 100.0% | -16.7% |

While consumer confidence is picking up, discretionary spending has been directed elsewhere. Interestingly, the commercial market is set to outpace the consumer segment in 2023. Whereas the commercial market is forecasted to decrease by only 9% YoY, the consumer segment might see a more significant drop of 21%. In the latter half of 2023, SMB and enterprise PC shipments could register 16% growth compared to the same period in 2022. Markets such as Spain, Portugal, and Greece seem ripe for potential growth. Meanwhile, countries with a dominant high-end segments like Germany, France, and Switzerland may only experience a partial rebound in early 2024.

| Vendor | Q2’23 Shipments (in thousands) | Q2’23 Market Share | Q2’22 Shipments (in thousands) | Q2’22 Market Share | Annual Growth |

|---|---|---|---|---|---|

| Apple | 1,615 | 36.4% | 2,562 | 40.0% | -37.0% |

| Samsung | 1,135 | 25.6% | 1,299 | 20.3% | -12.7% |

| Lenovo | 594 | 13.4% | 991 | 15.5% | -40.1% |

| Amazon | 345 | 7.8% | 605 | 9.4% | -42.9% |

| Microsoft | 138 | 3.1% | 160 | 2.5% | -13.9% |

| Others | 610 | 13.7% | 789 | 12.3% | -22.7% |

| Total | 4,437 | 100.0% | 6,406 | 100.0% | -30.8% |

Sadly, Fujitsu announced its departure from the European PC market. It previously held a 2.5% market share in desktops. This move is expected to create a gap in commercial PC demand, particularly in Germany and Austria, where Fujitsu had market shares of 12% and 11% respectively among large enterprises.

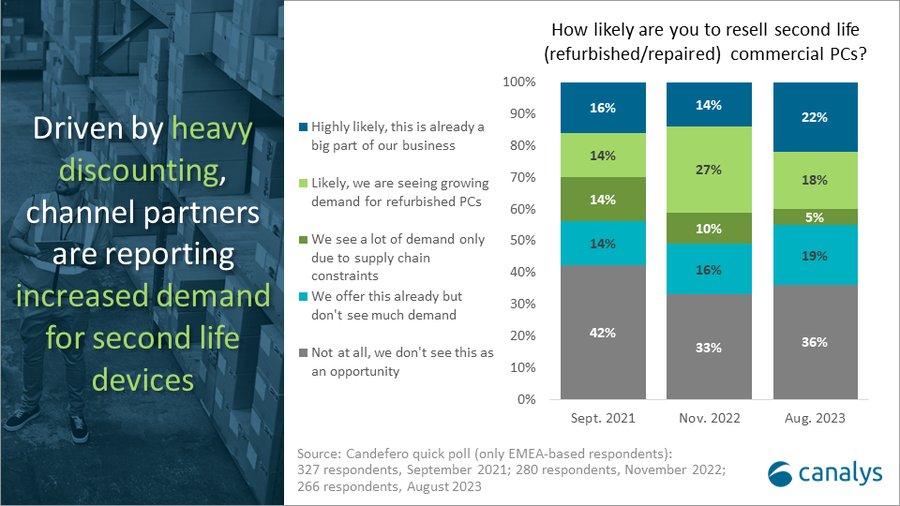

The Canalys research also suggests a rising trend towards the refurbished device market with over two-thirds of EMEA-based respondents to a channel poll offering some services related to refurbished devices. Among these, a further two-thirds have reported an increased demand for refurbished PCs, a growth of 10% since the end of 2021.