For the past few years every few days we were reporting on some new wearable device being developed or entering the consumer electronic market. Smartwatches have been available for quite some time and fitness bands are on the shelves in many department stores. Conferences and exhibitions looking at new developments in the consumer electronic market are highlighting wearables in all forms and shapes.

It seems that the dawn of wearables is upon us and we’d better get with the program of supporting the new device universe. At least that is what market research firms make us believe, if we follow their market analysis and forecasts. Let’s summarize a few market forecasts published in recent months.

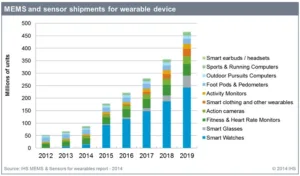

The first forecast from IHS shows us a unit forecast for MEMS and sensor shipments up to 2019. Half of the unit forecast will apply to smartwatches, which seems to be the the clear winner in 2015, as the unit shipments are expected to increase almost ten fold during this year. This forecast is for MEMS and sensors used in wearable devices, it can be argued that one wearable device can contain more than one sensor and therefore the total number of devices sold may be smaller than the number of sensors.

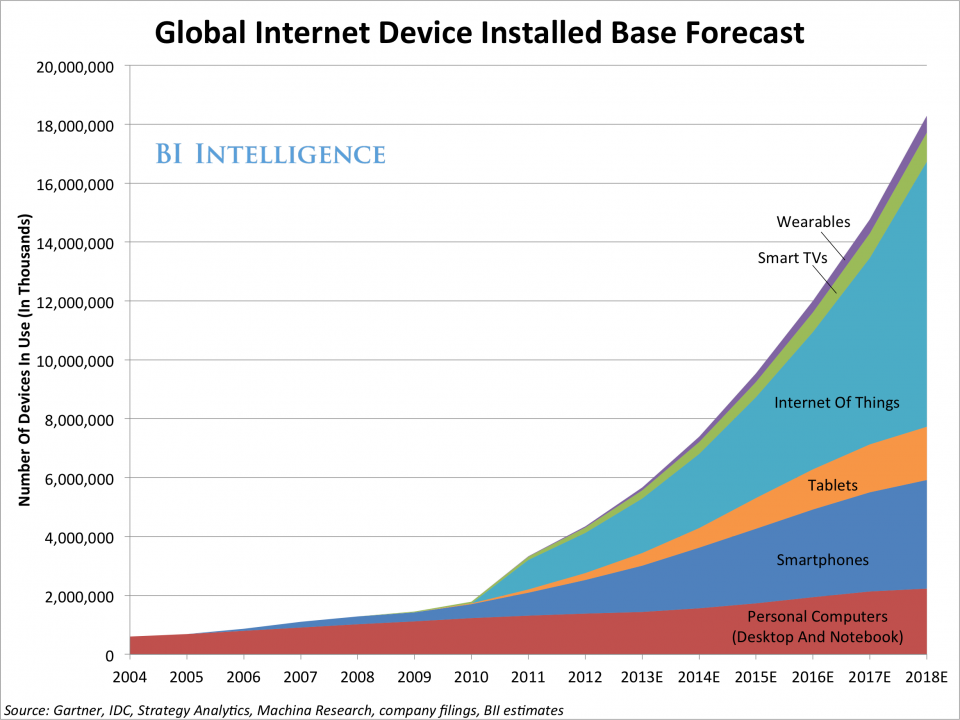

For the Business Insider, wearables are also growing but at a much lower and less important rate. Its forecast of installed devices shows that by 2018 significantly less than 1 billion devices will be in use. This compares to over 8 billion ‘Internet of Things’ devices in use by 2018.

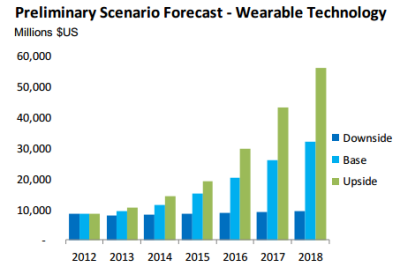

These forecasts are quite different from a forecast IHS published in 2013 as shown above. Back then IHS was not so sure what could happen with wearables. While the company expected some growth in this segment, as shown in its base forecast, on the downside IHS did not see any growth at all. Some things must have changed in the last year.

Arguably, the biggest boost for the wearable market was the announcement from Apple that it would join the wearable market with its Apple Watch later in 2015. We will see if the Apple device has as much impact as many market analysts expect.

Forecasting a new technology is difficult and is always based on a set of assumptions on how the consumers will react to this new technology. The most used forecast method is based on market penetration models that typically assumes a market penetration similar to some other products introduced earlier. The issue with this approach is to chose the right penetration curve.

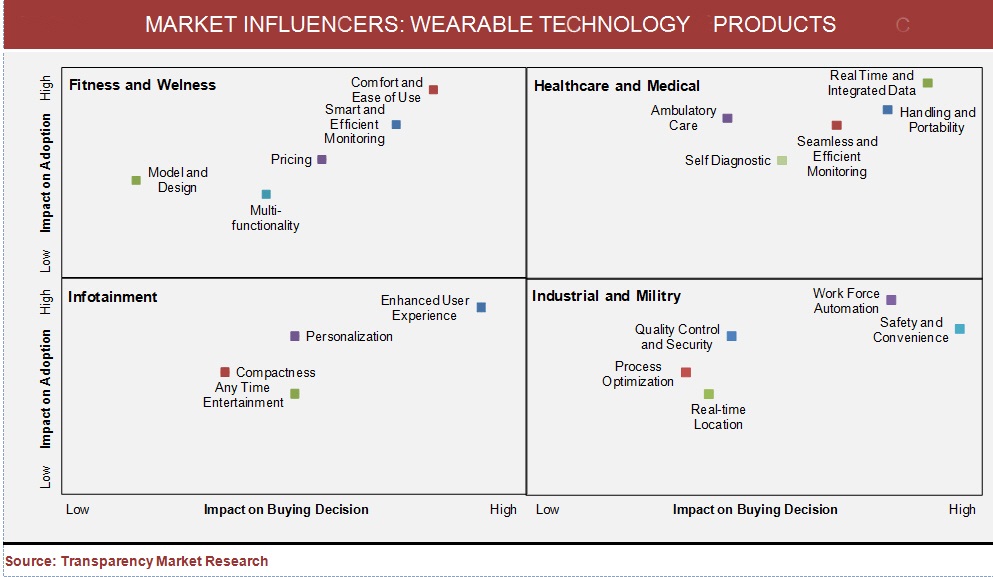

To answer this question market researchers often break down what consumers may find appealing or distracting in the new product category. The following chart shows this analysis, courtesy of the Korean market research firm Transparency Market Research.

The analyst pointed out what it thinks are the greatest drivers for adoption and buying decisions of the consumer. It differentiates four markets and plots the respective drivers in matrix style charts, where the upper right quadrant identifies the drivers for adoption and buying the new product.

The analyst pointed out what it thinks are the greatest drivers for adoption and buying decisions of the consumer. It differentiates four markets and plots the respective drivers in matrix style charts, where the upper right quadrant identifies the drivers for adoption and buying the new product.

When we look at the consumer markets like fitness and infotainment, the main drivers for adoption are comfort, efficiency of use, user experience and efficient monitoring. This means in my eyes that the only hard fact for using a smart wearable device is the fact that it collects data, the rest is based on ease of use. This makes some sense when we accept the fact that fitness bands are the majority of the market today. Interesting for me is the assessment that multifunctional devices are not seen as helping in market adoption. Yet still most manufacturers are offering a multitude of features to raise interest for their wearables.

In the medical, industrial and military field the drivers are much more clearly defined with data, safety and automation as identified drivers for wearable devices. In most cases, the decision to adopt such a device does not lie with the wearer of the device but with other groups.

Research of actual users of fitness bands, for example, has shown that the actual usage rates of these wearable devices after buying are dropping rather quickly as time progresses. This is not true for successful products like smartphones and tablets and shows that we should not expect the wearable electronics market to replace smartphones and tablets any time soon.

So far wearables are often seen as an extension of the smartphone and the biggest question is if a consumer will buy a device to avoid retrieving a smartphone from the pocket? From a display standpoint, wearables will often include some form of visual response system, may that be a small display or some LEDs. Besides virtual and augmented reality headsets as well as smartwatches, most wearables will have little impact on the display industry.

The consumer will answer the question of product success with their ‘purchase or not purchase’ decision. However, if the Apple Watch enjoys the success some analysts expect, Apple will become the omnipresent technology company for years to come. – Norbert Hildebrand