When we started 2015 we had high hopes for augmented and virtual reality to develop into the “next big thing” for the AV industry. With the year coming to an end, it is fair to ask how far we have come on this front?

More and more publications (on-line as well as print) are recognizing AR/VR as a field that needs explaining and constant attention. This is certainly true for the companies developing hardware, software, and content for any type of extended reality you can think of.

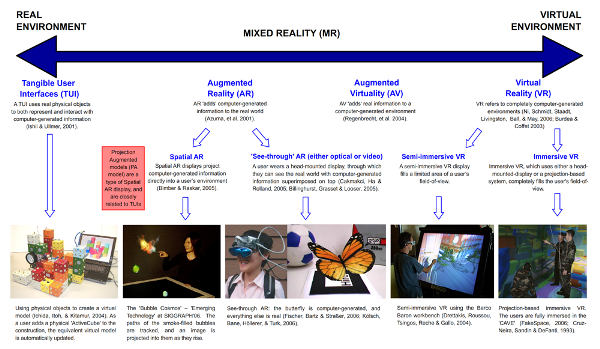

One focus in the press is the definition of AR / VR, with some involved companies using a variety of terms to set themselves apart from the rest of the industry. The following chart from Wikipedia is based on a 1994 article by Paul Milgram and Fumio Kishino, “A TAXONOMY OF MIXED REALITY VISUAL DISPLAYS” that analyses various computer interfaces. Much has changed since then, but most of the terms have been defined there including the Microsoft favorite, “mixed reality”.

Source: Wikipedia “Adapted milgrams VR AR continuum” (Click on image to see a higher res version)

Source: Wikipedia “Adapted milgrams VR AR continuum” (Click on image to see a higher res version)

While spatial AR is not really playing an important role today, AR and AV (augmented virtuality) have basically morphed into AR by today’s understanding; many companies try to distinguish their approach by slightly altering the underlying definitions. This does not change the result for the user though. Anything with an “A” will allow real images to be seen in addition to computer generated content. The “V” technology uses a head mounted display that blocks the real world completely. This means from a technical perspective that all “A” type technologies need an optical combiner, while “V” solutions do not. A gray area is the use of a camera to create a real world image within a “V” type display. For me this is still a “V” solution as the photons from the real world do not reach the eyes of the user.

With these many technology solutions available, it should be expected that the spectrum of companies in the ‘new reality’ arena would grow. While Google is refocusing its efforts on industrial and enterprise applications, while developing a new headset that may appeal more to the general public, other players have entered and left the arena at a record pace.

All in all, we saw again no major product releases that are aimed at the general consumer, but basically all players now focusing on very specific applications in the industrial, enterprise or military world. Business models make way more sense where money is much less of an object than functionality (military) or is driven by ‘return on investment’ as it is typically in professional markets. In the professional markets AR/VR has made considerable progress through successful test programs that are now turning into larger orders for the providers. Still, selling a few thousand installations (certainly better than a few hundred for the test programs) will still not be able to fund the development efforts needed to bring this technology to the consumer. This means more money is needed to carry the development efforts for the underlying technologies.

We are going into 2016 with basically the same expectations we had a year ago, AR / VR solutions may be AV highlights in the coming year, starting with a larger footprint at CES 2016. Investment firms are spending money on getting into these markets without even knowing who will succeed with what. One of the big expectations from a consumer perspective is certainly the release of the Oculus Rift for the gaming market. Now if this release would be further delayed, it would create as big or even bigger impact as the withdrawal of Google Glass from the consumer market. It seems I may be writing part two of this article in a year from now. Stay tuned.

– Norbert Hildebrand