Vuzix, the supplier of smart glasses and AR technologies and products, reported its fourth quarter and full year financial results for the year ended December 31, 2022.

“In 2022, Vuzix made critical investments in staff, core technology and infrastructure to expand our capabilities and global footprint to meet the demand for our products, components and services,” said Paul Travers, President and CEO. “We made significant advancements in our core technology and our waveguide manufacturing technologies. We also kicked off upgrades and expansion of our waveguide manufacturing capabilities and entered into a lease for additional manufacturing space. Both are helping to uniquely position Vuzix to play an important role in the expected multibillion dollar AR market. Furthermore, we also entered into a series of agreements with Atomistic, a France-based firm related to the development of next generation microLED technology. We successfully developed and integrated miniature AR imaging systems and transferred this technology from the R&D lab into the industrial design and product assembly of the Vuzix Ultralite smart glasses OEM platform. We acquired Moviynt, a revenue generating SaaS solution provider that supports SAP and traditional handheld hardware used in warehousing, as well as Vuzix smart glasses. On the operational side, we invested in staff and infrastructure to help our company scale and take advantage of the opportunities at hand in the market.”

“2022 as a whole was a challenging year to navigate with supply chain issues, uncertainty caused by Covid, geopolitical tensions and darkening macro-economic forces. Despite these headwinds, there were segments of our business that accelerated, such as our OEM business group, which delivered year-over-year revenue growth of 250% fueled by new customers and follow-on programs from existing customers. During 2022, we also witnessed accelerated smart glasses adoption by key accounts, especially in warehousing and logistics in the form of larger orders to support expansion into additional warehouses and distribution centers. Additionally, in 2022 we continued to expand our global sales channel and strategy within select markets to provide end-to-end smart glasses-based services to end customers,” said Mr. Travers.

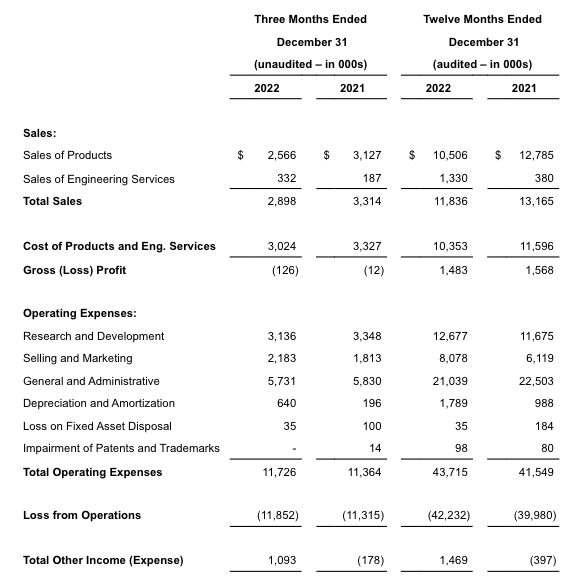

The following table compares condensed elements of the Company’s summarized Consolidated Statements of Operations data for the fourth quarters and years ended December 31, 2022 and 2021, respectively.

Full Year 2022 Financial Results

For the full year ended December 31, 2022, total revenues were $11.8 million, a decrease of 10% over the comparable period in 2021. The decrease in revenues for the year was due to lower sales of smart glasses, which resulted from a combination of higher average sales discounts due to larger volume reseller sales, negative foreign exchange comparatives and, to a smaller degree, a decrease in overall unit sales. Sales of engineering services for the year ended December 31, 2022, were $1.3 million as compared to $0.4 million in the same period of 2021, an increase of 250%.

There was an overall gross profit of $1.5 million or 13% for the full year ended December 31, 2022 as compared to overall gross profit of $1.6 million or 12% for the same period in 2021.

Research and Development expense was $12.7 million for the year ended December 31, 2022 compared to $11.7 million for the comparable 2021 period, an increase of 9% largely due to a $0.6 million increase in external development expenses related to the Shield and Blade 2 and a $0.4 million increase in salary and benefits expenses due to additional personnel.

Selling and Marketing expense was $8.1 million for the year ended December 31, 2022 compared to $6.1 million for the comparable 2021 period, an increase of 32% that was largely due to a $1.7 million increase in salary and salary benefits related expenses.

General and administrative expense was $21.0 million for the full year ended December 31, 2022 compared to $22.5 million for the comparable 2021 period, a decrease of 7%. The decrease was largely due to a $1.3 million decline in non-cash stock-based compensation and decreases in legal expenses.

The net loss for the full year ending December 31, 2022 was $40.8 million or $0.64 cents per share versus a net loss of $40.4 million or $0.66 for the same period in 2021.

Net cash flows used in operating activities for 2022 was $24.5 million as compared to the prior year’s total loss of $27.0 million.

As of December 31, 2022, the Company maintained cash and cash equivalents of $73 million and an overall working capital position of $76 million.

Fourth Quarter 2022 Financial Results

For the three months ended December 31, 2022, total revenues were $2.9 million, a 13% decrease over the prior year’s period. The decrease was due to lower sales of smart glasses products, partially offset by higher engineering services sales.

There was an overall gross loss of $0.1 million for the three months ended December 31, 2022, as compared to gross loss of $0.01 million for the same period in 2021.

Research and Development expense was $3.1 million for the three months ended December 31, 2022 versus $3.3 million for the comparable 2021 period.

Selling and Marketing expense was $2.2 million for the three months ended December 31, 2022 versus $1.8 million for the comparable 2021 period.

General and administrative expense for the three months ended December 31, 2022 was $5.7 million versus $5.8 million for the comparable 2021 period.

Management Outlook

“We expect 2023 will be an exciting year for Vuzix and its shareholders. We entered 2023 in a position of strength and are focused on execution of our business plan to leverage and monetize the critical and prudent investments that were made throughout 2022. Thus far, our first quarter of 2023 is off to a strong start. Based on current shipments in Q1-2023 and purchase orders being processed for shipment in Q1-2023, we should outpace our reported total revenues for every one of our 2022 quarters. For the full year, we have a strong book of business with identified opportunities, large deals and cornerstone customers on the enterprise and OEM side of our business that we expect to come in over the course of the calendar year. As a result, we expect to achieve record overall revenues in 2023 fueled by stronger sales of core smart glasses, SaaS solutions and OEM products and engineering services,” said Mr. Travers.