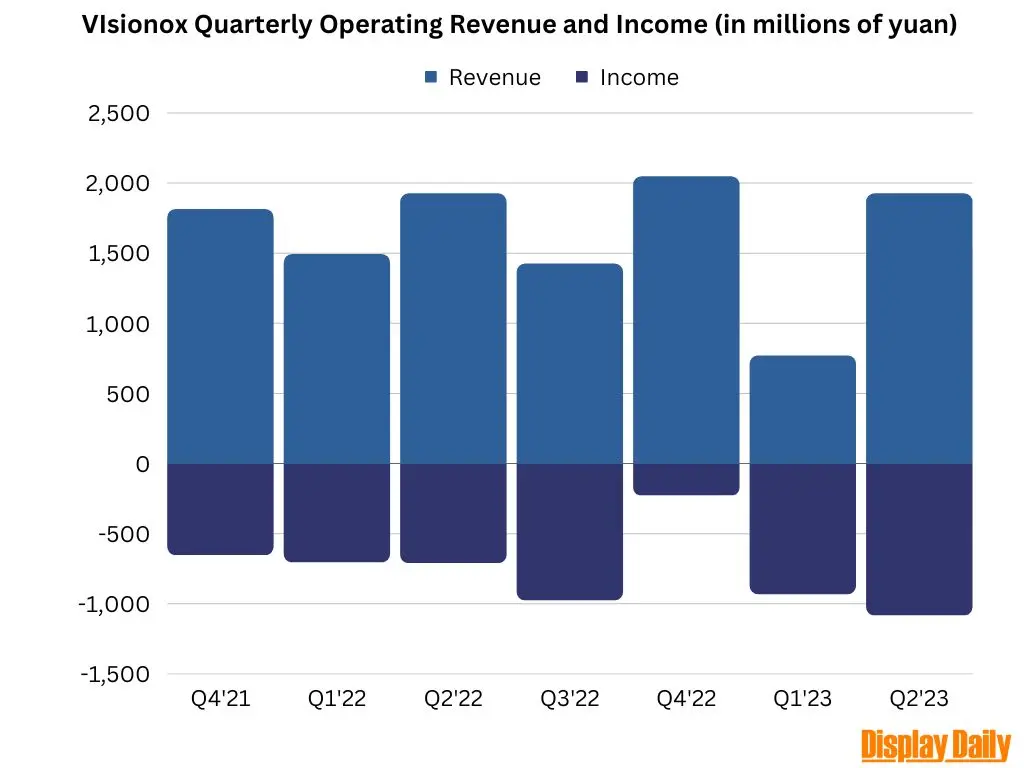

Visionox had what appears to be a remarkable 150.27% sequential revenue growth in the second quarter of 2023, with operating revenue of 1.924 billion yuan ($261.8 million). This surge aligns with the launch of the Huawei Mate 60 for which Visionox is one of the primary suppliers of the flexible OLED screens. However, it wasn’t all rosy for Visionox. A year-over-year (YoY) evaluation shows a 21.06% decline in revenue for the first half of 2023, 2.693 billion yuan, and a net loss of 1.634 billion yuan, a drop of 42.35% from the previous year.

Amid these financial revelations, Yan Ruoyuan, the co-president of Visionox, provided insights into the future trajectory of the company’s OLED business at the 2023 World Display Industry Conference in Chengdu. Visionox’s ambitious plans includes deploying 8.5 generation or higher production equipment for medium to large-sized OLED panels, which is expected the company claims will reduce production costs by an estimated 48%. Visionox expects to retain its competitive edge, especially as the global OLED landscape is shifting. According to Ruoyuan, by 2028, OLED panel shipments are predicted to surpass 1 billion units with a market value exceeding $55 billion.

Visionox is also touting foldable phones, a rapidly growing sector with a 37% expected growth rate for 2023, and medium-sized OLED displays in IT products, especially with news that Apple might be transitioning its entire iPad range to OLED screens by 2024. Visionox is also bullish on automotive, and while the company doesn’t have the direct numbers for its own opportunity, it pointed to Audi’s commitment to use 2.7 million OLED panels for vehicular displays from 2027 to 2030.