One of the big stories in the last couple of weeks has been the action by the US in the escalating trade war between the two largest economies in the world – the US and China. The US plans to impose a 25% tariff on a number of products imported from China. This could have a significant effect on the display industry, although the US is looking for comments from industry before introducing the new tariffs. The US government has proposed to impose a 25% tariff on a wide range of products. Written comments need to be submitted by May 11th and a public hearing will be started on the 15th May, with the comment period closing on the 22nd May. The main item that may be affected in displays is the tariff code 852884950, which is for TVs. Monitors, computers and smartphones are not affected.

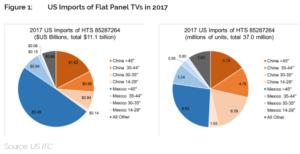

In a substantial blog on the topic, DSCC said that 18.8 million sets, valued at $3.9 billion came from China in 2017. Most of these fell into the category as having a recording device, meaning a duty rate of 3.9% (the customs classification includes TVs with USB recording facilities). Most TVs imported to the US come from Mexico and have no duty and the total imports, DSCC said, are 41.3 million with just over 10% without recording.

US TV Imports – Image DSCC

DSCC went to Best Buy to get a sense of where sets were coming from and identified that Samsung is importing from Vietnam and Mexcio, Sony from Mexico and Hisense from Mexico. Smaller sets may be made in China. Sharp-branded products (Hisense has the Sharp brand licence in the US for the moment) were from China, although a Hisense set was made in Mexico (as Hisense took over a TV factory there from Sharp)

The analyst expects that the companies that would be hardest hit are likely to be Vizio and the Insignia brand (Best Buy) which are believed to be supplied exclusively from China.

For the moment, the list of codes that would be subject to tariffs includes only those sets that can record, so a short term solution for importers would be to take out the port. However, the list of changes could easily change.

Other analysts believe that Korea could be hit by the dispute with forecasts that exports from South Korea would fall by 6.4% if a full on trade war starts. Korea supplies a lot of memory and other semiconductors to Chinese companies that are likely to reduce their demand.

Analyst Comment

Of course, the monitors and computers are covered by the WTO IT Agreement, which mandates 0% duty for computer products and a treaty that will be very well recognised by veterans of the monitor industry who fought a long battle with the EU authorities over the classifications of TVs and monitors.

Europe, of course, has had a 14% tariff on TVs for a long time and that has meant that the supply chain has largely moved to Europe, including Turkey, to mitigate the effects of the duty. If the US action goes ahead, we might well expect even more manufacture in the US or, more likely, in Mexico. An exception might be Foxconn which has started a project to build a G10.5 fab in Wisconsin, US and is likely to make TVs there, even before the LCD fab is complete.

Just after we went to press with this article, we got more on this topic from the Chinese point of view. The View on Tariffs from China (BR)