UBI Research has published new data analysing the OLED industry for the year of 2017, including panel makers’ development trends, key issues, applied products, and relevant markets from various perspectives on rigid and flexible OLED, as well as solution-processed OLED. According to the report, the full-screen smartphone, which has become a trend in recent years, can mainly be applied to flexible OLEDs, while rigid OLEDs using chip on glass are required to ensure module space at the top and bottom. Therefore, it is expected that panel makers will implement full-screens with a notch rather than the current rectangle type to improve the added value and demand of rigid OLED, which is on the decline.

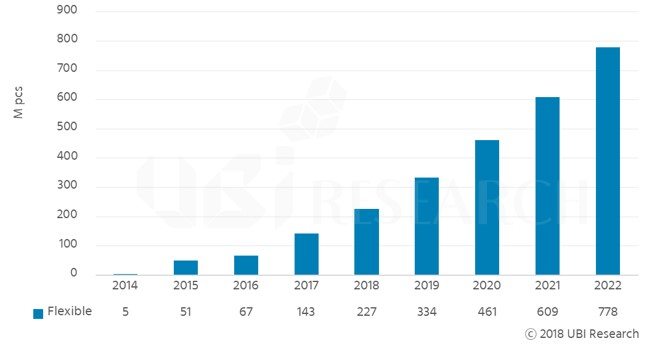

Meanwhile, the company predicts that shipments of rigid OLEDs will be 270 million units and flexible OLEDs will be 230 million units in 2018, generating sales of $12.5 billion and $23.9 billion, respectively. Analysis shows that the solution process, capable of manufacturing large-area OLED panels with RGB structure without cutting mother glass at 8G-or-above, will be adopted when mass production begins in 2019. Consequently, 2 million units of solution-processed OLED will be shipped in 2019 and 9.2 million units will be shipped in 2022.

Total AMOLED shipments and sales in 2017 were recorded as 440 million units and $27.1 billion, up 13.6% and 62.3% respectively, compared to the previous year. The number of AMOLED smartphone shipments grew to 95.1% in 2017, and its market share for revenue was 89.7%. The number of shipments of flexible AMOLEDs reached 140 million units in 2017, increased by 2.1 times compared to the previous year. Analysis shows that shipments of flexible AMOLEDs will reach 230 million units by 2018, with a share of 46%.

AMOLED shipments for TVs grew by 1.8 times year-on-year to 1.72 million units in 2017, and the AMOLED market for TV is expected to continue to grow, as LG Display’s 8G plant in China is scheduled to start operation in the second half of 2019. In terms of supply, shipments of displays are projected to decline compared to the global capacity of display makers, due to the accelerated increase in the size of AMOLED panels and Samsung Display’s shift of rigid AMOLED lines into automotive and foldable applications.

The growth of demand for AMOLED panels for smartphones is expected to decrease. In 2018, demand for flexible AMOLED panels for Chinese set makers is expected to decrease due to the introduction of low-priced, full-screen LCDs and rising prices of flexible AMOLED panels. The total AMOLED shipment market is expected to grow at a CAGR of 17.5%, reaching 995 million units in 2022. The revenue is projected to grow at a CAGR of 22%, forming a market of $80.5 billion in 2022.

Yi Choong-Hoon, CEO of UBI Research, commented:

“20% oversupply is expected to occur by 2021, however, since then, panel prices have fallen due to the entry of Chinese panel makers into the flexible AMOLED market, and oversupply will decrease by 11% in 2022″.