The landscape of the smartphone industry is poised for a significant transformation in 2024, propelled by the popularity of OLED screens and strategic shifts among leading brands, according to the latest findings from DSCC.

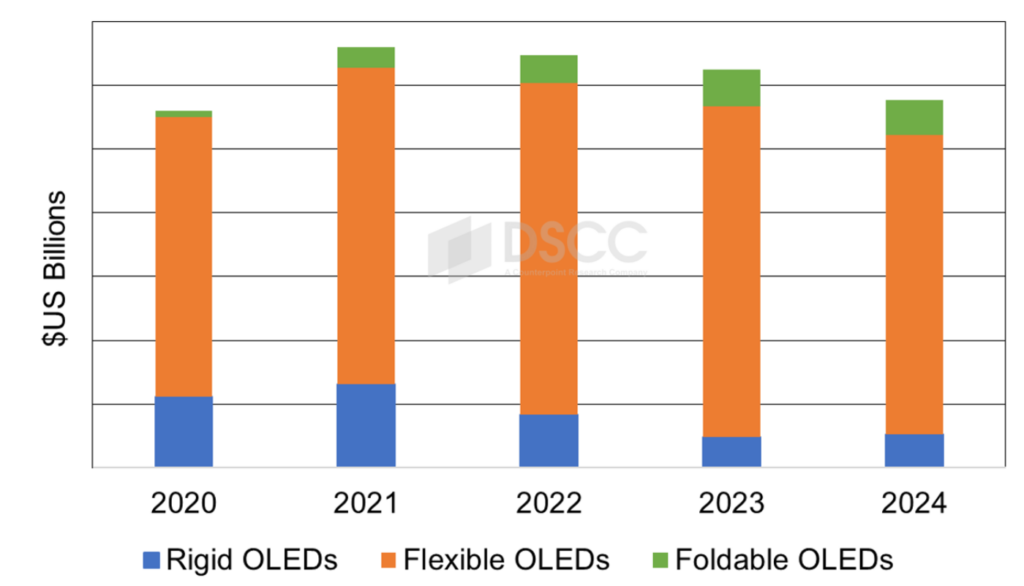

In the latter half of 2023, OLED smartphones showed a 41% increase, driving a 12% year-over-year growth in unit sales. This momentum is expected to continue into the next year, with an anticipated 11% rise in OLED smartphone shipments. The growth is forecasted across various types of OLED displays, with flexible OLEDs and foldable OLEDs both expected to see a 9% increase, while rigid OLEDs are projected to jump by 17%.

David Naranjo, Sr. Director, notes the competitive dynamics behind these numbers. “In 2024, we foresee reductions in OLED panel Average Selling Prices (ASPs) as brands pivot to more cost-effective suppliers,” he explains. “This strategic move aims to enhance unit sales and revenues, particularly within the flagship category.”

Apple, despite a slight dip in its dominance, remained at the forefront in 2023, commanding a 36% share in units and an impressive 56% in panel revenue. However, brands like Honor, Huawei, and Vivo made noticeable gains, too, with Huawei, in particular, increasing its market presence thanks to its Mate 60 and Nova 12 series. The chipset landscape also reflected these shifts. HiSilicon, the chip supplier for Huawei, saw an uptick in its market share, riding on the coattails of Huawei’s successful models.

Looking ahead to the first quarter of 2024, DSCC predicts that the top five smartphone models will include the Samsung A15, Apple iPhone 15, Samsung A35, iPhone 15 Pro Max, and the iPhone 14. These models are projected to capture a combined 28% of the market share, indicating a highly competitive season ahead for these tech giants.