Taiwan Semiconductor Manufacturing Co (TSMC), the primary chip manufacturer for Apple and Nvidia, has revised its revenue forecast for 2023, signaling ongoing challenges in the global electronics industry despite the surge in artificial intelligence (AI) development. The company now projects a 10% decline in sales this year, compared to its previous guidance of a single-digit decrease. Additionally, TSMC expects sales for the current quarter to be weaker than expected, ranging between $16.7 billion and $17.5 billion. TSMC has also reaffirmed its capital expenditure estimate for 2023, indicating that it will likely be towards the lower end of the previously forecast range of $32 billion to $36 billion.

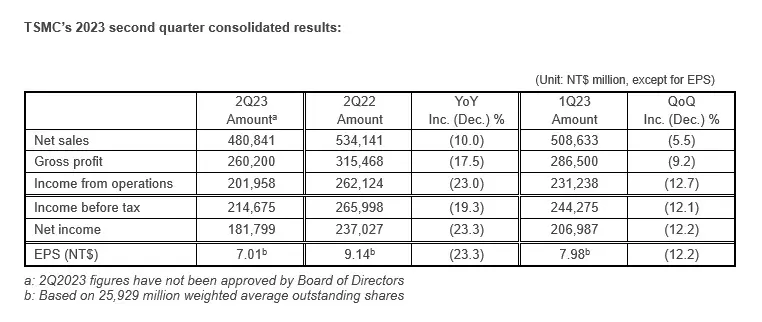

The revised outlook comes on the heels of TSMC’s first quarterly profit decline in four years, underscoring the global decline in smartphone and PC demand. The company reported a 23% decrease in net income, amounting to NT$181.8 billion ($5.85 billion). TSMC executives announced that the anticipated start of production at its new Arizona plant has been delayed to 2025, partially due to a shortage of skilled workers.

Despite the challenges, TSMC continues to be seen as a major player benefiting from international efforts to advance AI platforms. The company is renowned for producing Nvidia chips that are highly effective in AI training, such as those utilized by ChatGPT. Consequently, TSMC’s market value has increased by approximately 30% this year as investors seek opportunities in emerging AI technologies. However, TSMC is currently grappling with shrinking margins and growth in its smartphone and consumer-oriented business. This decline is attributed to the global economic downturn following the COVID-19 pandemic. In the second quarter, TSMC experienced a 10% decline in revenue, which was slightly better than anticipated.

The broader electronics industry also faces challenges, with Samsung recently reporting its worst quarterly revenue decline since at least 2009. This has raised uncertainties about when the year-long slump in electronics demand will end. Research firm Canalys estimates that global smartphone shipments have dropped by 11% in the April to June period, marking the sixth consecutive quarterly decline. Nevertheless, signs of recovery are emerging in the smartphone market as inventories of unsold phones begin to diminish.

To address customer concerns regarding geopolitical uncertainties around Taiwan, TSMC has been diversifying its manufacturing footprint over the past two years. The company has invested $40 billion to establish two fabs in Arizona (delayed though it may be) and is currently constructing an $8.6 billion facility in Japan with government financial support. TSMC is also engaged in discussions with Tokyo about potential subsidies for a second facility, which could be situated alongside its existing plant in Kumamoto.